How to Pay Off Payday Loans Faster?

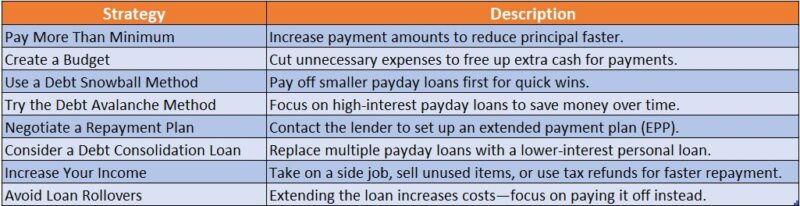

Understanding payday loans can be daunting, especially if you find yourself in a debt cycle. These short-term loans are meant to cover immediate expenses but often come with high interest rates that can lead to financial strain. For example, borrowing 500 dollars with a two-week repayment period might result in paying back 600 dollars or more. This situation can create a cycle where you need another loan to pay off the first, highlighting the importance of knowing how to pay off payday loans faster. To manage payday loans effectively, consider these repayment options:

- Negotiate with your lender: Many lenders are open to creating a payment plan that fits your budget.

- Prioritize your payments: Focus on paying off the loan with the highest interest rate first.

- Cut unnecessary expenses: Analyze your monthly budget to find savings.

- Seek financial counseling: Professionals can offer tailored strategies to help manage your debt. Implementing these strategies can help alleviate the burden of payday loans and restore financial control.

Real-world examples underscore the effectiveness of these strategies. For instance, Sarah, a single mother, was trapped in payday loan debt. By negotiating a payment plan and reducing her dining expenses, she paid off her loans in three months. This not only eased her financial stress but also equipped her with valuable budgeting skills. Understanding payday loans and their financial impact is crucial for a healthier financial future.

Fast Approval with ASAPPayday – Start Here!

Create a Budget to Manage Payday Loan Payments

Creating a budget is a powerful strategy for managing payday loan payments and paying them off faster. By outlining your income and expenses, you can pinpoint where your money goes and identify areas to cut back. This approach not only helps you allocate more funds towards loan repayment but also provides a clearer picture of your financial health. For example, if you notice high spending on dining out, consider cooking at home to free up cash for your payday loan. To create an effective budget, follow these steps:

- List Your Income: Include all income sources like salary and side gigs.

- Track Your Expenses: Document all monthly expenses, both fixed and variable.

- Identify Non-Essential Spending: Find areas to cut back, such as subscriptions or entertainment.

- Allocate Funds for Loan Payments: Set aside a specific amount each month for your payday loan.

- Review and Adjust: Regularly check your budget to stay on track and make necessary adjustments.

By adhering to your budget, you can manage payday loan payments more effectively and alleviate financial stress. The goal is to create a sustainable plan that allows you to pay off loans while enjoying life. With discipline and a clear budget, you can make significant progress in paying off payday loans faster, leading to a more secure financial future.

Explore Debt Consolidation Options for Payday Loans

Exploring debt consolidation options can be a game changer when tackling payday loans. This strategy allows you to combine multiple high-interest loans into a single, manageable payment, often securing a lower interest rate. As a result, more of your payment goes toward the principal balance rather than interest. Imagine simplifying your finances with just one monthly payment instead of juggling several, which can help you pay off payday loans faster. Here are some key benefits of debt consolidation for payday loans:

- Lower Interest Rates: Many consolidation loans offer lower rates than payday loans, saving you money over time.

- Single Payment: You’ll only have one payment to track instead of multiple due dates.

- Improved Credit Score: Paying off payday loans can enhance your credit score, especially with timely payments on your consolidation loan.

To get started with debt consolidation, follow these steps:

- Assess Your Debt: List all your payday loans and their interest rates.

- Research Options: Look for consolidation loans that meet your needs, as credit unions and online lenders often provide competitive rates.

- Apply for a Loan: Once you find a suitable option, apply and provide the necessary documentation.

- Pay Off Your Payday Loans: Use the funds from your consolidation loan to pay off your payday loans immediately, helping you avoid further interest accumulation.

Personalized Loan Options at ASAPPayday! – Apply Now!

Negotiate with Lenders for Better Repayment Terms

To pay off payday loans faster, negotiating with your lenders for better repayment terms is a highly effective strategy. Many borrowers hesitate to take this step, thinking it may not yield results. However, lenders are often willing to work with you, especially if you present a clear plan and a positive attitude. They want to recover their money just as much as you want to pay off your debt. Begin by contacting your lender and explaining your financial situation. Honesty is key, so express your desire to repay the loan. Here are some negotiation tips to consider:

- Be polite and respectful: A friendly demeanor can make a significant difference.

- Prepare your case: Know what you want—be it a lower interest rate, an extended repayment period, or a temporary payment pause.

- Show your commitment: Indicate that you are serious about repayment and seeking a mutually beneficial solution.

Real-world examples highlight the effectiveness of negotiation. One borrower successfully reduced their interest rate from 400 percent to 200 percent by simply asking for a reconsideration. Another extended their repayment period, lowering monthly payments and easing their budget.

By negotiating, you can secure more manageable repayment options and take a proactive step toward financial stability. Every little bit helps when figuring out how to pay off payday loans faster.

Utilize Extra Income to Pay Off Payday Loans Faster

Utilizing extra income can be a game changer when tackling payday loans. Whether through a side gig, freelance work, or selling items you no longer need, every bit helps. By directing this additional cash towards your payday loan, you can significantly reduce both the principal and the interest that accrues. This approach not only speeds up repayment but also alleviates the stress of looming deadlines. Here are some effective ways to generate extra income:

- Freelancing: Leverage your skills in writing, graphic design, or programming on platforms like Upwork or Fiverr.

- Part-time jobs: Consider flexible part-time roles in retail or hospitality that fit around your main job.

- Selling unused items: Use eBay or Facebook Marketplace to sell items you no longer use.

- Gig economy: Join services like Uber, DoorDash, or TaskRabbit to earn money on your own schedule.

By dedicating this extra income to your payday loans, you can create a snowball effect that accelerates debt repayment and builds financial confidence. Additionally, adjusting your budget to prioritize loan repayment is crucial. This may involve cutting back on non-essential expenses or finding savings on monthly bills. Every dollar saved can be redirected towards your payday loan, making a significant impact over time. By taking these proactive steps, you can regain control over your finances and work towards a debt-free future.

Consider Alternative Loan Options to Avoid Payday Loans

Being trapped in payday loans can be daunting, but a great way to pay them off faster is by exploring alternative loan options. These alternatives can help you dodge the high interest rates and fees that come with payday loans, making your financial situation much more manageable. For example, personal loans from credit unions typically offer lower interest rates and more flexible repayment terms, allowing you to tackle your debt without the pressure of tight deadlines. Consider these alternative loan options:

- Credit Union Loans: Often feature lower interest rates and more lenient repayment schedules. If you’re a member, check what they offer.

- Personal Loans: Many banks and online lenders provide personal loans that can help pay off payday loans. Look for competitive rates and favorable terms.

- Peer-to-Peer Lending: Platforms like LendingClub connect you with individual investors, potentially offering better rates than traditional lenders.

- Payment Plans: Some payday lenders may allow you to pay off your loan in installments, easing the financial burden. Just ensure you read the fine print.

By considering these options, you can not only pay off payday loans faster but also pave the way for a healthier financial future. The key is to find a solution that suits your needs and helps you escape the payday loan cycle.

Establish an Emergency Fund to Prevent Future Loans

Establishing an emergency fund is essential for effective financial management and can significantly aid in paying off payday loans faster. When unexpected expenses arise, having a financial cushion prevents the need for high-interest loans. Think of it as your safety net, allowing you to handle emergencies without falling back into the payday loan trap. By saving even a small amount each month, you can create a fund that offers peace of mind and stability. To kickstart your emergency fund, consider these practical steps:

- Set a Savings Goal: Aim for three to six months’ worth of living expenses.

- Automate Your Savings: Set up automatic transfers to your savings account to avoid spending temptations.

- Cut Unnecessary Expenses: Review your budget and redirect savings into your fund.

- Use Windfalls Wisely: Allocate bonuses or tax refunds directly to your emergency fund.

By following these steps, you can build a financial buffer that helps you avoid future payday loans and tackle unexpected expenses confidently. An emergency fund not only helps you avoid payday loans but also enhances your financial health. Benefits include:

- Reduced Financial Stress: Savings alleviate anxiety during tough times.

- Improved Credit Score: Avoiding payday loans maintains a healthier credit profile.

- Greater Financial Freedom: An emergency fund allows you to make choices based on needs rather than desperation.

In summary, building an emergency fund is a proactive strategy that can help you pay off payday loans faster and prevent future financial pitfalls. Start today and take control of your financial future!

Seek Financial Counseling for Personalized Strategies

Seeking financial counseling can be a game changer when tackling payday loans. These professionals offer personalized strategies tailored to your financial situation, helping you navigate the stress of debt. They can provide a clear path forward, enabling you to pay off your loans faster and avoid future pitfalls.

Here are some benefits of working with a financial counselor:

- Customized Plans: They assess your income, expenses, and debts to create a repayment plan that suits you.

- Negotiation Skills: Counselors often negotiate with lenders for better repayment terms.

- Budgeting Assistance: They help develop a budget that prioritizes loan repayment while covering essential expenses.

- Emotional Support: Having someone to talk to can alleviate the overwhelming stress of debt.

To get started, consider these steps:

- Research Local Services: Look for non-profit organizations offering financial counseling.

- Schedule an Appointment: Many counselors provide free initial consultations.

- Prepare Your Financial Information: Bring details about your income, expenses, and debts to maximize your session.

- Follow Through: Implement the strategies discussed to see real progress in paying off your payday loans faster.

By taking this proactive approach, you can regain control of your finances and work towards a debt-free future.

Stay Informed About Your Rights as a Borrower

To pay off payday loans faster, it’s essential to stay informed about your rights as a borrower. Many individuals are unaware of the laws that protect them from predatory lending practices. Understanding these rights can empower you to negotiate better repayment terms and avoid falling into a debt cycle. For instance, in some states, lenders must provide clear information about the total cost of the loan and any associated fees, allowing you to make informed repayment decisions. Here are some key rights to remember:

- Right to clear information: Lenders must disclose all terms and conditions before you sign.

- Right to fair treatment: You cannot be harassed or threatened by lenders if you cannot pay on time.

- Right to repayment options: Many lenders offer flexible repayment plans, so don’t hesitate to inquire about them.

Being aware of these rights can boost your confidence in discussions with lenders and lead to better outcomes when paying off payday loans. Additionally, explore various repayment options. Some lenders may allow you to extend your loan term or set up a budget-friendly payment plan. Consolidating your payday loans into a single loan with a lower interest rate can also simplify payments and save you money. By staying informed and proactive, you can take control of your financial situation and work towards efficient loan repayment.

FAQs

-

What are the best strategies to pay off payday loans quickly?

Focus on making extra payments, prioritizing high-interest loans, cutting unnecessary expenses, and using windfalls like tax refunds to reduce debt faster. -

Can I consolidate my payday loans to pay them off faster?

Yes, you can combine multiple payday loans into a personal loan or debt consolidation loan with a lower interest rate and more manageable payments. -

Do payday lenders allow early repayment without penalties?

Many payday lenders allow early payments without fees, but it’s best to check your loan agreement to confirm any prepayment terms. -

Is negotiating with my payday lender an option for faster repayment?

Yes, some lenders may offer payment extensions, reduced interest rates, or settlement options to help you pay off the loan faster. -

Should I seek professional help to get rid of payday loan debt?

If you’re struggling, consider credit counseling services, debt relief programs, or financial advisors to create a repayment strategy that works for you.

Quick Cash Before You Go with ASAPPayday!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.

Find a Payday Loan!

"*" indicates required fields