Payday Loans Wichita KS: Fast Approval Online

When unexpected expenses arise, many people in Wichita, KS, turn to payday loans for quick financial relief. Understanding payday loans in Wichita, KS, is crucial for making informed decisions. These loans offer fast approval online, making them a popular choice for those in need of immediate cash.

What Are Payday Loans?

Payday loans are short-term loans designed to cover urgent expenses until your next paycheck. They are typically small amounts, easy to apply for, and can be accessed quickly. However, it’s essential to understand the terms and conditions before applying.

Key Benefits of Payday Loans in Wichita KS:

- Fast Approval: Many lenders offer online applications with quick responses.

- Convenience: You can apply from the comfort of your home.

- Accessibility: Payday loans are available to those with varying credit histories.

While payday loans can provide immediate help, it’s important to borrow responsibly and consider your ability to repay the loan on time. Always compare options and read the fine print to avoid surprises.

Fast Approval with ASAPPayday – Start Here!

How to Get Fast Approval for Payday Loans in Wichita KS

When unexpected expenses hit, knowing how to get fast approval for payday loans in Wichita KS can be crucial. These loans offer quick cash to cover bills, medical emergencies, or urgent repairs, alleviating stress during tough times.

Steps to Get Fast Approval for Payday Loans in Wichita KS

- Research Lenders: Look for reputable lenders offering payday loans in Wichita KS. Check reviews and terms to find the best option.

- Gather Necessary Documents: Prepare proof of income, identification, and a bank account to expedite the process.

- Apply Online: Many lenders provide online applications for payday loans by state. Fill out the form accurately to avoid delays.

- Review Loan Terms: Carefully read the terms and conditions before accepting a loan to understand the repayment schedule and any fees involved.

Benefits of Fast Approval

- Quick Access to Cash: Receive funds almost instantly.

- Simple Process: The application is straightforward and can be completed in minutes.

- Flexible Use: Use the money for any urgent expense, providing peace of mind.

Personalized Loan Options at ASAPPayday! – Apply Now!

The Benefits of Choosing Online Payday Loans in Wichita KS

When unexpected expenses hit, many in Wichita, KS, rely on payday loans for quick financial relief. With payday loans Wichita KS: fast approval online, you can access funds without the hassles of traditional banking, making it ideal for urgent cash needs to cover bills or emergencies.

Quick and Easy Application Process

Applying for payday loans online is simple and can be done from home, saving you time. Many lenders provide instant approval, so you won’t wait long to see if you qualify.

Flexible Loan Amounts

Online payday loans allow you to choose your borrowing amount, giving you the flexibility to get just what you need. Whether it’s a small sum for a car repair or a larger amount for medical expenses, you have options.

Convenient Access to Funds

Once approved, funds are typically deposited directly into your bank account, allowing you to access money quickly, often within 24 hours. With payday loans by state, you can find lenders that meet your specific needs in Wichita, KS.

Also Read: Payday Loans by State: Online Options & Local Availability

Are Payday Loans in Wichita KS Right for You?

When unexpected expenses hit, finding quick financial help can feel overwhelming. That’s where payday loans Wichita KS come into play. With fast approval online, these loans offer a lifeline for those in need, allowing you to tackle urgent bills or emergencies without delay.

Are Payday Loans Right for You?

Before diving into payday loans, consider a few important factors:

- Quick Access to Cash: If you need money fast, payday loans can provide funds within hours.

- Short-Term Solution: These loans are designed for immediate needs, not long-term financial strategies.

- Repayment Terms: Be aware that payday loans typically require repayment by your next paycheck, which can be a challenge if not planned properly.

Weighing the Pros and Cons

While payday loans Wichita KS can be helpful, they also come with risks. Make sure to ask yourself:

- Can you repay the loan on time?

- Are there better alternatives available?

By understanding both the benefits and potential pitfalls, you can make an informed decision about whether payday loans are the right choice for you.

Key Requirements for Securing Payday Loans in Wichita KS

When unexpected expenses arise, knowing how to secure payday loans in Wichita KS can be a lifesaver. These loans offer quick access to cash, making them a popular choice for those in need of fast approval online. Understanding the key requirements can help you navigate the process smoothly.

To apply for payday loans in Wichita KS, you’ll need to meet a few basic requirements. Here’s what you should have ready:

- Proof of Identity: A valid ID, like a driver’s license or passport, is essential.

- Income Verification: Lenders want to see proof of your income, such as pay stubs or bank statements.

- Bank Account: A checking account is necessary for the loan deposit and repayment.

- Age Requirement: You must be at least 18 years old to apply for payday loans in Wichita KS.

By gathering these documents ahead of time, you can streamline your application process. Remember, payday loans by state may have different regulations, so it’s wise to check local laws. This preparation can lead to a faster approval and help you get the cash you need without unnecessary delays.

Exploring Alternatives to Payday Loans in Wichita KS

When facing unexpected expenses, many people in Wichita, KS, consider payday loans for quick cash. However, it’s essential to explore alternatives that can provide relief without the high costs associated with payday loans. Understanding these options can help you make informed financial decisions.

Personal Loans

Personal loans can be a great alternative. Unlike payday loans Wichita KS, these loans often come with lower interest rates and longer repayment terms. You can borrow a larger amount and pay it back over time, making it easier to manage your finances.

Credit Unions

Consider reaching out to local credit unions. They typically offer small loans with favorable terms. Plus, being a member might give you access to financial education resources, helping you avoid future financial pitfalls.

Budgeting Assistance

Sometimes, the best solution is to adjust your budget. Look for ways to cut unnecessary expenses. This can free up cash for emergencies, reducing the need for payday loans by state.

By exploring these alternatives, you can find a more sustainable way to handle financial challenges.

How ASAPPayday.com Simplifies Your Payday Loan Experience

When unexpected expenses arise, knowing where to turn for help is crucial. Payday loans Wichita KS offer fast approval online, allowing you to access funds quickly and tackle urgent bills without stress.

Easy Application Process

Applying for payday loans by state can feel overwhelming, but ASAPPayday.com simplifies this with a user-friendly online application. Just fill out a few forms, and you’re on your way to getting the cash you need.

Quick Approval Times

One standout feature of ASAPPayday.com is its fast approval times. Many applicants receive decisions within minutes, ensuring you won’t be left waiting when you need money urgently.

Flexible Loan Amounts

ASAPPayday.com offers various loan amounts tailored to your needs. Whether you need a small sum for a quick fix or a larger amount for bigger expenses, you can find the right fit easily.

Transparent Terms and Conditions

Understanding your payday loan terms is vital. ASAPPayday.com provides clear information about interest rates and repayment schedules, ensuring no hidden fees.

Customer Support

If you have questions, ASAPPayday.com has your back. Their friendly customer support team is available to assist you, ensuring you feel confident throughout the process.

Common Myths About Payday Loans in Wichita KS Debunked

When it comes to managing finances, many people in Wichita, KS, turn to payday loans for quick cash solutions. However, there are several myths surrounding payday loans that can create confusion. Understanding these misconceptions is essential for making informed decisions about payday loans Wichita KS: Fast Approval Online. Let’s debunk some of these myths!

Myth 1: Payday Loans Are Always High-Interest

Many believe that all payday loans come with exorbitant interest rates. While it’s true that some lenders charge higher fees, not all payday loans are created equal. Researching different options can help you find more affordable rates.

Myth 2: You Need Perfect Credit to Qualify

Another common myth is that only those with perfect credit can get payday loans. In reality, payday loans are often accessible to individuals with various credit scores. Lenders typically focus more on your income and ability to repay than your credit history.

Myth 3: Payday Loans Lead to Debt Traps

Some people think that payday loans always lead to a cycle of debt. While this can happen if loans are not managed wisely, responsible borrowing and timely repayment can prevent this issue. Always borrow what you can afford to pay back!

Tips for Responsible Borrowing: Making the Most of Your Payday Loan

When unexpected expenses arise, payday loans Wichita KS can provide a quick financial solution. With fast approval online, these loans can help you bridge the gap until your next paycheck. However, it’s essential to borrow responsibly to avoid falling into a cycle of debt.

Tips for Responsible Borrowing

- Understand Your Needs: Before applying, ask yourself how much you really need. Borrowing only what you can repay will help you manage your finances better.

- Read the Terms: Always read the loan agreement carefully. Knowing the interest rates and repayment terms can save you from surprises later.

- Plan Your Repayment: Create a budget that includes your loan repayment. This way, you can ensure you have enough funds to cover your expenses without stress.

By following these tips, you can make the most of your payday loans by state, ensuring they serve as a helpful tool rather than a burden. Remember, responsible borrowing is key to financial health.

FAQs

💰 How much can I borrow with a payday loan in Wichita, KS?

In Wichita and across Kansas, the maximum payday loan amount is $500 per loan.

📅 What is the repayment period for payday loans in Wichita?

Kansas law requires payday loans to be repaid within a term of 7 to 30 days, usually aligned with your next payday.

💸 What fees are allowed on payday loans in Kansas?

Lenders can charge a finance fee of up to 15% of the loan amount. For example, borrowing $300 may result in a $45 fee.

🔁 Can I roll over or renew a payday loan in Wichita?

No, rollovers are not allowed. You must repay the loan in full by the due date without extending the term.

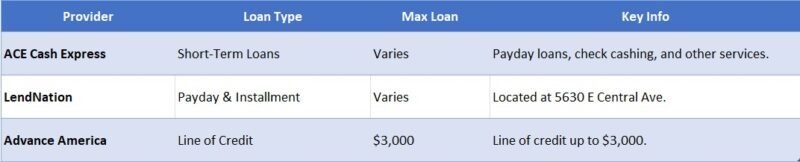

🏦 Where can I get a payday loan in Wichita, KS?

You can apply through licensed storefront lenders or online providers that are authorized to operate in Kansas.

Quick Cash Before You Go with ASAPPayday!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.

Find a Payday Loan!

"*" indicates required fields