Payday Loans in VA: What You Need to Know

Understanding payday loans in VA is crucial for anyone considering this financial option. These loans can provide quick cash in emergencies, but they come with important details you should know. Let’s dive into what makes payday loans in VA unique and how they work.

What Are Payday Loans?

Payday loans are short-term loans designed to help you cover expenses until your next paycheck. They are typically small amounts, usually ranging from $100 to $1,000. However, they can come with high-interest rates, so it’s essential to understand the terms before borrowing.

Key Features of Payday Loans in VA

- Quick Access to Cash: You can often get funds within a day.

- Easy Application Process: Many lenders allow you to apply online.

- Short Repayment Period: Most loans are due on your next payday, usually within two weeks.

- State Regulations: Virginia has specific laws governing payday loans, which can protect borrowers.

Before you decide, consider these factors carefully. While payday loans in VA can be helpful, they can also lead to a cycle of debt if not managed wisely. Always read the fine print and ensure you can repay the loan on time.

Fast Approval with ASAPPayday – Start Here!

What Are the Eligibility Requirements for Payday Loans in VA?

Understanding the eligibility requirements for payday loans in VA is essential for anyone considering this financial option. These loans can provide quick cash in emergencies, but knowing if you qualify is the first step. Let’s explore what you need to know!

Basic Requirements for Payday Loans in VA

To apply for payday loans in VA, you typically need to meet a few basic criteria:

- Age: At least 18 years old.

- Residency: Must be a resident of Virginia.

- Income: A steady source of income is essential, whether from a job or benefits.

These requirements help lenders ensure that you can repay the loan on time.

Additional Considerations

In addition to the basics, keep these points in mind:

- Bank Account: Most lenders require an active checking account.

- Identification: Valid ID is necessary to verify your identity.

Loan Amounts and Limits

In Virginia, payday loans typically range from $100 to $500, depending on your income and the lender’s policies. It’s crucial to borrow only what you can afford to repay.

Repayment Terms

Payday loans in VA usually have a repayment term of two weeks. Plan how you’ll repay the loan quickly to avoid extra fees.

Fees and Interest Rates

Payday loans can come with high fees and interest rates, with a maximum fee of $15 per $100 borrowed in Virginia. Understanding these costs helps you make informed financial choices.

Personalized Loan Options at ASAPPayday! – Apply Now!

The Pros and Cons of Choosing Payday Loans in VA

When considering financial options, understanding the pros and cons of payday loans in VA is crucial. These loans can be a quick solution for urgent cash needs, but they come with their own set of challenges. Knowing what to expect can help you make informed decisions.

The Pros of Payday Loans in VA

- Quick Access to Cash: Payday loans are designed for emergencies, providing fast cash when you need it most.

- Minimal Requirements: Unlike traditional loans, payday loans often require less documentation, making them accessible to many.

- No Credit Check: Many lenders don’t check your credit score, which can be beneficial if you have a poor credit history.

The Cons of Payday Loans in VA

- High Interest Rates: One of the biggest downsides is the high interest rates, which can lead to debt if not managed properly.

- Short Repayment Terms: These loans typically require repayment within a few weeks, which can be challenging for some borrowers.

- Potential for Debt Cycle: If you can’t repay on time, you might end up borrowing again, creating a cycle of debt that’s hard to escape.

Also Read: Payday Loans by State: Online Options & Local Availability

How to Apply for Payday Loans in VA: A Step-by-Step Guide

Applying for payday loans in VA may seem intimidating, but it can be straightforward with the right knowledge. This guide simplifies the process, especially useful during financial emergencies.

Step 1: Check Your Eligibility

Ensure you meet the basic requirements: be at least 18 years old, a Virginia resident, and have a steady income. This helps you avoid unapproved applications.

Step 2: Gather Necessary Documents

Prepare essential documents, including:

- A valid ID (like a driver’s license)

- Proof of income (like pay stubs)

- Bank account information

Having these ready can streamline your application process!

Step 3: Choose a Lender

Research various lenders offering payday loans in VA. Compare interest rates and read reviews. Finding the right lender can save you money in the long run.

Step 4: Complete the Application

After selecting a lender, fill out their application form, often available online for convenience. Be truthful with your information to avoid future issues. You’ll typically receive a quick decision!

Step 5: Review the Terms

If approved, carefully read the loan terms, including repayment schedules and fees. Understanding these details is crucial to avoid surprises later.

Step 6: Receive Your Funds

Once you agree to the terms, the lender will deposit the funds into your bank account, often on the same day, providing immediate cash access when needed.

Are Payday Loans in VA Right for You? Key Considerations

Understanding payday loans in VA is essential when exploring financial options. These loans can provide quick cash during emergencies, but they come with significant considerations. Knowing the details can help you make informed decisions about your financial situation.

Understand the Costs

Payday loans typically have high interest rates. It’s important to calculate how much you’ll owe after the loan term to avoid unexpected surprises.

Evaluate Your Needs

Before opting for a payday loan, assess whether you truly need one. Consider alternatives like borrowing from friends or family or looking into other financial assistance programs, which may save you money and stress.

Check Your Eligibility

Eligibility for payday loans in VA varies. Lenders usually require proof of income and a bank account, so ensure you meet these criteria before applying to avoid wasting time.

Know the Risks

These loans can lead to a cycle of debt if not managed properly. If you can’t repay on time, you may need to take out another loan, incurring additional fees. Make sure you can afford repayment before borrowing.

Research Lenders

Not all lenders offer the same terms. Research and compare rates to find a trustworthy lender and avoid scams.

Consider Your Financial Future

Reflect on how a payday loan will impact your long-term finances. Will it help you stabilize your situation, or could it lead to further financial issues? Make a plan to stay on track.

Exploring Alternatives to Payday Loans in VA: What Are Your Options?

When facing unexpected expenses, many people consider payday loans in VA. However, these loans can come with high fees and interest rates. It’s essential to explore alternatives that can help you manage your finances without falling into a debt trap. Let’s dive into some options that might work better for you.

Credit Unions and Community Banks

Credit unions and community banks often offer small personal loans with lower interest rates than payday loans. They are more flexible and can work with you to create a repayment plan that fits your budget. Plus, being a member of a credit union can come with additional benefits!

Payment Plans with Service Providers

If you’re struggling to pay a bill, consider reaching out to your service providers. Many companies offer payment plans or extensions, allowing you to pay off your balance over time without incurring extra fees. This can be a lifesaver when cash is tight!

Borrowing from Friends or Family

Sometimes, the best option is to ask friends or family for help. They may be willing to lend you money without charging interest. Just be sure to communicate clearly about repayment to avoid any misunderstandings. Remember, maintaining relationships is important!

Budgeting and Financial Counseling

Lastly, consider speaking with a financial counselor. They can help you create a budget and find ways to save money. This proactive approach can prevent the need for payday loans in VA in the future. It’s all about planning ahead!

How ASAPPayday.com Can Help You Navigate Payday Loans in VA

Navigating payday loans in VA can be daunting, especially during financial hardships. Understanding how these loans function and the available options is essential. That’s where ASAPPayday.com steps in, offering valuable insights to help you make informed choices.

At ASAPPayday.com, we streamline the process of finding payday loans in VA, aiming to empower you with the necessary knowledge and resources. Here’s how we assist you:

Key Insights on Payday Loans in VA

- Clear Information: We simplify the terms and conditions of payday loans for easy understanding.

- Comparison Tools: Our platform enables you to compare various lenders and their rates, helping you secure the best deal.

- Expert Advice: Our team is available to answer your questions and guide you through the application process.

With ASAPPayday.com, you’re not alone. We’re committed to helping you navigate payday loans by state, ensuring you find the right financial solution.

Understanding the Risks

- High Interest Rates: Be aware that payday loans often carry steep interest rates.

- Short Repayment Terms: These loans typically require repayment within weeks, which can be challenging.

Finding the Right Lender

- Research Options: Look for lenders with good reviews and transparent practices.

- Check Licensing: Ensure your lender is licensed in Virginia to avoid scams.

Making Informed Decisions

- Budget Wisely: Assess your budget before taking a payday loan.

- Explore Alternatives: Consider other options like personal loans or credit unions for potentially better terms.

FAQs

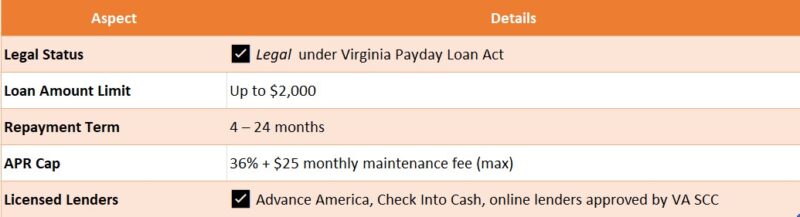

📜 Are payday loans legal in Virginia?

Yes, payday loans are legal in Virginia. However, they are now regulated under the Virginia Fairness in Lending Act, which limits interest rates and fees to protect borrowers from predatory lending.

💰 What are the loan limits for payday loans in VA?

Under current law, you can borrow up to $2,500 with loan terms ranging from 4 to 24 months. The annual interest rate is capped at 36%, plus a monthly maintenance fee not exceeding $25.

🌐 Can I get an online payday loan in Virginia?

Yes, but only from licensed lenders. Virginia law requires all payday lenders—online and in-person—to be licensed and follow the same consumer protection rules.

🛡️ What protections do Virginia payday loan laws offer?

Borrowers are protected by:

-

Rate caps and fee limits

-

A ban on multiple simultaneous payday loans

-

A required 45-day waiting period after 5 loans in 180 days

-

Military borrower protections

⏳ What happens if I can’t repay my payday loan on time?

If you miss a payment, lenders may charge late fees, report the default to credit bureaus, or send the account to collections. However, they must follow Virginia’s laws and cannot pursue illegal collection practices.

Quick Cash Before You Go with ASAPPayday!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.

Find a Payday Loan!

"*" indicates required fields