Online Payday Loans MN: Quick Approval Process

Online payday loans MN have become a popular choice for many residents seeking quick financial relief. Understanding the quick approval process is essential, especially when unexpected expenses arise. These loans can help bridge the gap until your next paycheck, making them a valuable resource in times of need.

What Are Online Payday Loans MN?

Online payday loans MN are short-term loans designed to provide fast cash to borrowers. They are typically easy to apply for and can be approved within minutes. This quick turnaround is crucial for those who need money urgently, whether it’s for medical bills, car repairs, or other unexpected costs.

Benefits of Quick Approval

- Speedy Access to Funds: You can receive money in your account as soon as the next business day.

- Simple Application Process: Most lenders offer online applications that are straightforward and user-friendly.

- Flexible Loan Amounts: You can borrow what you need, often ranging from $100 to $1,000, depending on your state regulations.

- No Collateral Required: Unlike traditional loans, you don’t need to put up any assets to secure your payday loan.

In conclusion, understanding online payday loans MN and their quick approval process can empower you to make informed financial decisions. Remember, while these loans can provide immediate relief, it’s essential to borrow responsibly and consider your ability to repay.

Fast Approval with ASAPPayday – Start Here!

How to Get Quick Approval for Online Payday Loans MN

When unexpected expenses arise, Online Payday Loans MN can be a lifesaver. Navigating the quick approval process is essential to secure the funds you need without the hassle of traditional loans.

Gather Your Information

Start by preparing necessary documents, including:

- Proof of income

- A valid ID

- Bank account details

Having these ready speeds up the application process significantly!

Apply Online

Visit a reputable lender’s website for online payday loans MN. Fill out the application form accurately. Many lenders offer user-friendly interfaces, allowing you to receive a decision within minutes!

Review and Accept the Terms

Once approved, carefully review the loan terms, including the repayment schedule and any fees. If everything looks good, accept the offer and wait for the funds to be deposited into your account. It’s that simple!

Stay Informed

Remember that payday loans by state can vary. Familiarize yourself with Minnesota’s specific regulations to avoid surprises and make informed decisions.

Use a Reliable Lender

Choose a lender with positive reviews and transparent practices. A trustworthy lender will guide you through the process, reducing stress during your financial journey.

Plan for Repayment

Create a repayment plan before taking out a loan. Knowing how and when you’ll pay it back helps avoid a cycle of debt. Always borrow what you can comfortably repay!

Seek Alternatives

If payday loans aren’t the best fit, consider local credit unions or community programs for assistance with lower interest rates. Exploring all options can lead to better financial health.

Personalized Loan Options at ASAPPayday! – Apply Now!

The Benefits of Choosing Online Payday Loans MN

When unexpected expenses arise, having quick access to cash can be a lifesaver. That’s where Online Payday Loans MN come into play. With a quick approval process, these loans can help you bridge the gap between paychecks, making them a popular choice for many Minnesotans.

Fast and Easy Application

Applying for online payday loans MN is simple. You can fill out an application from the comfort of your home, often in just a few minutes. No long lines or complicated paperwork!

Quick Approval Times

Once you submit your application, you can receive approval in as little as a few hours. This quick turnaround means you can get the funds you need without waiting days or weeks, which is crucial during emergencies.

Flexible Loan Amounts

Online payday loans MN offer various amounts to suit your needs. Whether you need a small amount for a minor expense or a larger sum for something more significant, you can find a loan that fits your situation.

Accessible Anytime

With online payday loans, you can apply anytime, day or night. This flexibility is especially helpful for those with busy schedules or those who work irregular hours. You can get the help you need when it’s convenient for you.

Also Read: Payday Loans by State: Online Options & Local Availability

Are Online Payday Loans MN Right for You?

When unexpected expenses arise, many people in Minnesota find themselves considering online payday loans. These loans can provide quick cash, especially when you need it the most. But are online payday loans MN the right choice for you? Let’s explore this together!

Before diving in, it’s important to understand what online payday loans MN offer. They typically feature a quick approval process, allowing you to access funds within hours. This can be a lifesaver during emergencies, like car repairs or medical bills. However, there are a few things to consider:

Key Considerations:

- Interest Rates: Online payday loans often come with higher interest rates compared to traditional loans. Make sure you can manage the repayment.

- Loan Amounts: These loans usually range from $100 to $1,000. Think about how much you really need.

- Repayment Terms: Understand when and how you will repay the loan. Missing payments can lead to additional fees.

In summary, online payday loans MN can be a quick solution for urgent financial needs. However, it’s essential to weigh the pros and cons carefully. If you decide to proceed, ensure you borrow responsibly and understand the terms. This way, you can make the best choice for your financial situation!

Step-by-Step Guide to Applying for Online Payday Loans MN

When unexpected expenses arise, Online Payday Loans MN can be a lifesaver. They offer a quick approval process that helps you get cash in hand when you need it most. Understanding how to apply can make the experience smoother and less stressful.

1. Gather Your Information

Before you start, make sure you have all the necessary documents. This usually includes:

- A valid ID

- Proof of income

- Bank account details

2. Choose a Lender

Look for reputable lenders that offer online payday loans MN. Check their reviews and ensure they are licensed to operate in your state. This step is crucial to avoid scams and ensure a safe borrowing experience.

3. Fill Out the Application

Once you’ve chosen a lender, fill out their online application form. It’s typically straightforward and asks for your personal information, income details, and how much you want to borrow. Make sure to double-check your entries for accuracy.

4. Submit and Wait for Approval

After submitting your application, you’ll usually receive a decision quickly. Many lenders provide instant approval, so you won’t be left waiting for long. If approved, you’ll get the loan terms to review before accepting.

5. Receive Your Funds

Once you accept the terms, the funds are often deposited directly into your bank account within one business day. This quick process makes payday loans by state a convenient option for urgent financial needs.

How ASAPPayday.com Simplifies Your Online Payday Loan Experience

When unexpected expenses arise, knowing how to access quick funds can be a lifesaver. Online payday loans MN offer a fast and convenient solution for those in need of immediate cash. With a simple application process, you can get the help you need without the hassle of traditional banking.

Easy Application Process

Applying for online payday loans MN through ASAPPayday.com is straightforward. You fill out a short form, and within minutes, you can receive approval. This means you can focus on what matters most—solving your financial issues quickly.

Fast Approval Times

Once you submit your application, ASAPPayday.com works hard to ensure you get a response fast. Many applicants receive approval on the same day, allowing you to access funds when you need them most. No more waiting in long lines or dealing with complicated paperwork!

Flexible Loan Options

ASAPPayday.com understands that everyone’s financial situation is unique. That’s why they offer various payday loans by state, ensuring you find the right fit for your needs. Whether you need a small amount or a larger sum, there’s a solution for you.

In summary, ASAPPayday.com makes the process of obtaining online payday loans MN simple and efficient. With quick approvals and flexible options, you can tackle your financial challenges head-on.

Common Misconceptions About Online Payday Loans MN

When it comes to Online Payday Loans MN, many people have misconceptions that can lead to confusion. Understanding the quick approval process is essential for anyone considering these loans. They can be a helpful financial tool when used wisely, but myths often cloud their true benefits.

Misconception 1: They’re Always High-Interest

Many believe that all online payday loans MN come with sky-high interest rates. While some lenders do charge higher fees, not every loan is the same. It’s crucial to shop around and compare rates, just like you would with any other loan.

Misconception 2: Approval Takes Forever

Another common myth is that the approval process for payday loans takes days or even weeks. In reality, many lenders offer quick approvals, sometimes within minutes! This speed can be a lifesaver in emergencies, allowing you to access funds when you need them most.

Misconception 3: You Need Perfect Credit

Some think that only those with perfect credit can qualify for online payday loans MN. However, many lenders consider other factors beyond credit scores. This means that even if your credit isn’t great, you might still find a loan that works for you.

FAQs

💰 Are online payday loans legal in Minnesota?

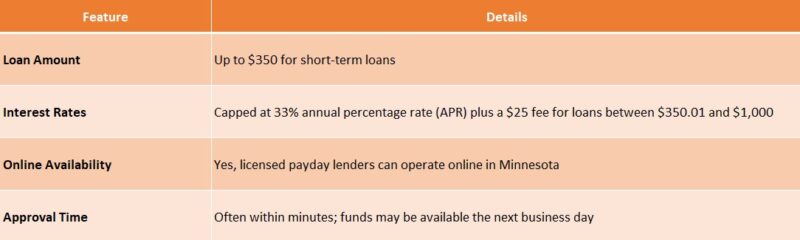

Yes, online payday loans are legal in Minnesota but are strictly regulated. Lenders must be licensed by the state and follow specific rules on loan amounts, fees, and terms.

⚖️ What are the borrowing limits and terms for payday loans in Minnesota?

Payday loans in Minnesota are typically capped at $350 for short-term loans up to 30 days. Loans above $350 must follow additional interest rate limits and cannot be renewed or extended.

🛡️ How can I verify if an online payday lender is licensed in Minnesota?

You can verify a lender’s license through Minnesota’s official state resources. Working with a licensed lender helps ensure fair treatment and legal protection.

🔍 What risks are associated with unlicensed online payday lenders?

Unlicensed lenders may charge excessive fees, withdraw money without permission, or use illegal collection tactics. They can put you at risk of identity theft or financial abuse.

🚫 Are there alternatives to payday loans in Minnesota?

Yes, consider credit union loans, installment loans with longer repayment terms, or help from local assistance programs. These options are often more affordable and safer.

Quick Cash Before You Go with ASAPPayday!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.

Find a Payday Loan!

"*" indicates required fields