Payday Loans in DC: Rules & Online Options

Payday loans in DC offer a quick solution for unexpected expenses, but understanding the rules and online options is essential for informed decisions. These loans can help bridge the gap until your next paycheck, yet they come with specific regulations that borrowers must follow.

Key Rules to Remember

- Loan Amounts: You can borrow up to $1,000 in DC.

- Repayment Terms: Loans must be repaid within 14 days.

- Fees: Be cautious of fees that can accumulate quickly.

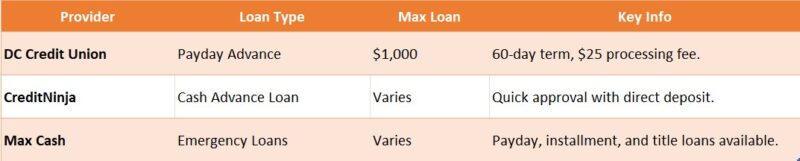

Online Options

Many lenders provide payday loans online, making applications more convenient. Benefits include:

- Convenience: Apply anytime, anywhere.

- Quick Approval: Receive funds faster than traditional methods.

- Easy Comparison: Easily compare lenders for the best rates.

Before opting for payday loans in DC, weigh your options carefully. While they offer immediate cash relief, high-interest rates can lead to a debt cycle if not managed wisely. Always read the fine print to understand the terms before borrowing, and remember that payday loans by state can differ significantly.

Fast Approval with ASAPPayday – Start Here!

Are Payday Loans in DC Right for You? Pros and Cons

When unexpected expenses arise, many people consider payday loans in DC as a quick solution. Understanding the rules and online options available can help you make an informed decision. But are these loans right for you? Let’s explore the pros and cons together!

Pros of Payday Loans in DC

- Quick Access to Cash: Payday loans provide fast funding, often within a day.

- Easy Application Process: Most lenders have simple online applications that can be completed in minutes.

- No Credit Check: Many payday lenders do not require a credit check, making it accessible for those with poor credit.

Cons of Payday Loans in DC

- High Interest Rates: These loans often come with steep fees and interest rates, making repayment challenging.

- Short Repayment Terms: Borrowers usually have to repay the loan by their next payday, which can lead to a cycle of debt.

- Potential for Over-Borrowing: The ease of obtaining these loans can tempt borrowers to take out more than they can afford.

In conclusion, while payday loans in DC can be a quick fix, it’s essential to weigh these pros and cons carefully before deciding.

Personalized Loan Options at ASAPPayday! – Apply Now!

The Legal Landscape: Regulations Governing Payday Loans in DC

Understanding the rules around payday loans in DC is crucial for anyone considering this financial option. These loans can provide quick cash, but they come with specific regulations that protect borrowers. Knowing these rules can help you make informed decisions and avoid pitfalls.

Key Regulations to Know

- Loan Amounts: In DC, payday loans can range from $100 to $1,000.

- Repayment Terms: Borrowers typically have 14 days to repay the loan, aligning with their next paycheck.

- Interest Rates: The maximum interest rate is capped at 24% for payday loans, ensuring they remain affordable.

Online Options for Payday Loans

Many lenders offer payday loans online, making it easier to access funds. Here are some benefits of online payday loans in DC:

- Convenience: Apply from home, anytime.

- Quick Approval: Get funds in as little as one business day.

- Comparison Shopping: Easily compare rates and terms from different lenders.

By understanding the legal landscape and exploring online options, you can navigate payday loans in DC more effectively.

Also Read: Payday Loans by State: Online Options & Local Availability

How to Apply for Payday Loans in DC: A Step-by-Step Guide

When unexpected expenses pop up, payday loans in DC can be a quick solution. Understanding the rules and online options available is crucial for making informed decisions. This guide will walk you through the application process, ensuring you know what to expect.

- Check Eligibility: Ensure you meet the basic requirements, like being at least 18 years old and having a steady income.

- Research Lenders: Look for reputable lenders that offer payday loans in DC. Compare interest rates and terms to find the best fit.

- Gather Documents: Prepare necessary documents, such as proof of income, identification, and bank account details.

- Complete the Application: Fill out the online application form on the lender’s website. Make sure to provide accurate information to avoid delays.

- Review Terms: Carefully read the loan terms before signing. Understand the repayment schedule and any fees involved.

Applying for payday loans in DC can be straightforward if you follow these steps. Remember, these loans should be used wisely, as they come with high interest rates. Always consider your ability to repay before taking one on.

Exploring Online Options for Payday Loans in DC: Convenience at Your Fingertips

When unexpected expenses arise, many people in Washington, DC, turn to payday loans for quick cash. Understanding the rules and online options for payday loans in DC is crucial. It helps you make informed decisions and avoid pitfalls that can lead to financial stress.

Why Choose Online Payday Loans?

- Speed: Online applications are quick, often processed within minutes.

- Accessibility: You can apply anytime, anywhere, right from your phone or computer.

- Comparison: Easily compare different lenders to find the best rates and terms.

Important Rules to Remember

- Loan Limits: In DC, payday loans are capped at $1,000.

- Repayment Terms: Borrowers typically have 14 days to repay the loan.

- Fees: Be aware of the fees involved, as they can add up quickly.

By knowing these rules and utilizing online options, you can navigate payday loans in DC with confidence and ease.

What to Watch Out For: Common Pitfalls of Payday Loans in DC

Payday loans in DC can be a quick fix for financial emergencies, but they come with their own set of challenges. Understanding the rules and online options is crucial to avoid falling into a debt trap. Let’s explore some common pitfalls that borrowers should watch out for.

Hidden Fees and High Interest Rates

Many payday loans in DC come with hidden fees that can surprise you. Always read the fine print! The interest rates can also skyrocket, making it hard to pay back the loan on time.

Loan Terms and Repayment

Payday loans typically have short repayment terms, often due on your next payday. This can lead to a cycle of borrowing if you can’t pay it back right away. Be sure to plan how you’ll repay the loan before you take it out.

Alternatives to Consider

Instead of rushing into payday loans, consider other options. Local credit unions or community programs might offer better rates. Always weigh your choices to find the best solution for your financial needs.

How ASAPPayday.com Can Help You Navigate Payday Loans in DC

Navigating the world of payday loans in DC can feel overwhelming, especially with all the rules and options available online. Understanding these loans is crucial for anyone considering them, as they can provide quick cash in emergencies but come with responsibilities. That’s where ASAPPayday.com comes in to help you make sense of it all.

Understanding the Rules

Payday loans in DC have specific regulations to protect borrowers. For instance, the maximum loan amount is $2,000, and you can only have one outstanding loan at a time. Knowing these rules can save you from costly mistakes, and ASAPPayday.com provides clear, easy-to-understand information on them.

Exploring Online Options

Finding payday loans online can be a breeze with the right guidance. Here are some benefits of using ASAPPayday.com:

- Comparison Tools: Easily compare different lenders.

- User Reviews: Read experiences from other borrowers.

- Application Assistance: Get help with the application process.

With these resources, you can confidently choose the best payday loan option for your needs.

Alternatives to Payday Loans in DC: Exploring Other Financial Solutions

When facing unexpected expenses, many people consider payday loans in DC. However, understanding the rules and exploring other financial options can help you make better choices. Let’s dive into some alternatives that might suit your needs without the high costs associated with payday loans.

Credit Unions and Community Banks

Credit unions and community banks often offer small personal loans with lower interest rates than payday loans. They focus on helping their members, making them a great option for those in need. Plus, they usually have more flexible repayment terms!

Payment Plans

Many businesses offer payment plans for larger purchases. Instead of taking out payday loans in DC, consider asking if you can pay in installments. This way, you can manage your budget without the burden of high-interest loans.

Borrowing from Friends or Family

Sometimes, the best help comes from those closest to us. If you can, ask friends or family for a small loan. Just remember to agree on repayment terms to avoid misunderstandings. It’s a simple way to get the cash you need without the stress of payday loans by state.

Tips for Responsible Borrowing: Making the Most of Payday Loans in DC

When considering payday loans in DC, it’s essential to understand the rules and options available to you. These loans can provide quick cash in emergencies, but they come with responsibilities. Knowing how to borrow wisely can make a significant difference in your financial health.

Tips for Responsible Borrowing

- Understand the Terms: Before taking out payday loans in DC, read the fine print. Know the interest rates, repayment terms, and any fees involved. This knowledge helps you avoid surprises later on.

- Borrow Only What You Need: It’s tempting to take out more money than necessary, but this can lead to trouble. Only borrow what you can comfortably repay by your next payday.

- Plan Your Repayment: Create a budget that includes your loan repayment. This way, you won’t find yourself in a cycle of debt. Remember, payday loans by state can vary, so be aware of local regulations that may affect your repayment options.

- Seek Alternatives: If possible, explore other options before opting for payday loans. Credit unions, personal loans, or even asking friends or family might be better choices.

FAQs

❌ Are payday loans allowed in Washington, D.C.?

No, payday loans are not allowed in Washington, D.C. The law caps interest rates at 24%, which makes the typical payday loan business model unprofitable.

⚖️ Why did Washington, D.C. ban payday loans?

Payday loans were banned to protect consumers from high interest rates and fees that often led to long-term debt cycles and financial harm.

💳 What are the alternatives to payday loans in D.C.?

Residents can explore credit union payday alternative loans, small personal loans from banks, or emergency assistance programs offered by nonprofit organizations.

🌐 Can I still get a payday loan online if I live in D.C.?

Even online lenders must follow D.C. laws. If they offer payday loans that violate the local interest cap, they may be operating illegally.

📞 What should I do if I’m offered a payday loan in D.C.?

If you’re approached by a lender offering a payday loan in D.C., it’s best to avoid it and report the activity to local financial regulators, as it may be unlawful.

Quick Cash Before You Go with ASAPPayday!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.

Find a Payday Loan!

"*" indicates required fields