Online Payday Loans in Illinois: How to Apply

Online payday loans in Illinois offer a quick cash solution for urgent expenses. However, understanding how they work and the application process is crucial to making informed decisions.

What Are Online Payday Loans?

These are short-term loans due on your next payday, ideal for covering unexpected bills. Keep in mind that they come with high interest rates, so borrowing wisely is essential.

How to Apply for a Payday Loan

Applying for payday loans by state, such as Illinois, is simple. Follow these steps:

- Research Lenders: Find reputable online lenders in Illinois.

- Gather Documents: Prepare proof of income, identification, and a bank account.

- Fill Out the Application: Complete the online form with your information.

- Review Terms: Read the loan terms carefully before signing.

- Receive Funds: If approved, funds can be quickly deposited into your account.

While online payday loans can be beneficial, use them responsibly to avoid falling into a debt cycle.

Fast Approval with ASAPPayday – Start Here!

Who Can Apply for Online Payday Loans in Illinois?

When unexpected expenses arise, many people in Illinois turn to online payday loans for quick financial relief. Understanding who can apply for these loans is crucial, as it helps you navigate the process smoothly. Let’s dive into the eligibility criteria for online payday loans in Illinois.

Who Can Apply?

To qualify for online payday loans in Illinois, applicants generally need to meet the following criteria:

- Age: You must be at least 18 years old.

- Residency: You need to be a resident of Illinois.

- Income: A steady source of income is essential, whether from a job, benefits, or other means.

- Bank Account: Having an active checking account is necessary for loan disbursement.

These requirements ensure that lenders can provide loans responsibly and that borrowers can repay them without falling into a cycle of debt. If you meet these criteria, applying for online payday loans in Illinois can be a straightforward process, helping you tackle those urgent financial needs.

Personalized Loan Options at ASAPPayday! – Apply Now!

The Application Process: Step-by-Step Guide to Online Payday Loans

Applying for online payday loans in Illinois is a straightforward process if you know the steps involved. Many people need quick cash for unexpected expenses, and understanding how to apply can make a big difference. Here’s a simple guide to help you navigate the process.

Step 1: Research Lenders

Start by researching lenders that offer online payday loans in Illinois. Look for reviews and compare interest rates to find a reputable lender that meets your needs.

Step 2: Gather Your Information

Next, collect the necessary documents, including:

- A valid ID

- Proof of income

- Bank account details

Having these ready will speed up your application.

Step 3: Complete the Application

Choose a lender and fill out their application form on their website. This usually takes just a few minutes, so ensure your information is accurate to avoid delays.

Step 4: Review and Submit

After completing the form, review your details carefully before submitting. Most lenders provide a decision quickly, often within the same day!

Step 5: Receive Your Funds

If approved, funds will be deposited directly into your bank account, sometimes as soon as the next business day, making online payday loans a convenient option for urgent financial needs.

What Documents Are Required for Online Payday Loans in Illinois?

When you’re in a tight spot financially, knowing how to apply for online payday loans in Illinois can be a lifesaver. These loans can provide quick cash to help you cover unexpected expenses. But before you dive in, it’s essential to understand what documents you’ll need to make the process smooth and hassle-free.

What Documents Are Required?

To apply for online payday loans in Illinois, you’ll typically need a few key documents. Here’s a quick list to help you prepare:

- Identification: A government-issued ID, like a driver’s license or passport, to prove your identity.

- Proof of Income: Recent pay stubs or bank statements to show you have a steady income.

- Bank Account Information: Your bank account details for direct deposit of the loan funds.

Having these documents ready can speed up your application process. Remember, each lender may have slightly different requirements, so it’s a good idea to check their specific guidelines. By gathering these documents beforehand, you can focus on finding the best online payday loans in Illinois without unnecessary delays. This way, you can get the help you need when you need it most.

How to Choose the Right Lender for Your Online Payday Loan

Choosing the right lender for your online payday loan in Illinois is crucial. With so many options available, it can feel overwhelming. However, making the right choice can save you money and stress in the long run. Let’s explore how to find the best lender for your needs.

Research Lenders Thoroughly

Start by looking for lenders that specialize in online payday loans in Illinois. Check their reputation by reading reviews and ratings. A trustworthy lender will have positive feedback from previous customers, which can give you confidence in your choice.

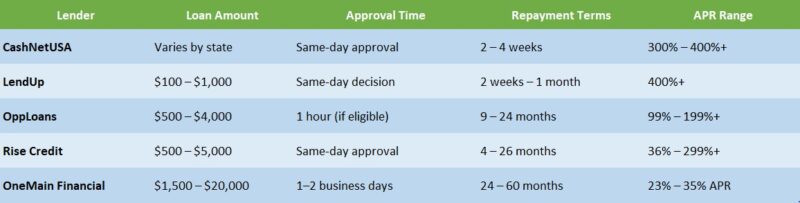

Compare Interest Rates and Fees

Not all payday loans are created equal. Compare interest rates and fees from different lenders. Some may offer lower rates or fewer fees, making them a better option. Remember, even a small difference can save you a lot of money over time!

Look for Transparency

A good lender will be transparent about their terms. They should clearly explain the repayment schedule and any potential penalties. If you feel confused or pressured, it might be best to look elsewhere. Always choose a lender who values your understanding and comfort.

What Are the Costs Associated with Online Payday Loans in Illinois?

When considering online payday loans in Illinois, it’s essential to understand the costs involved. These loans can be a quick solution for financial emergencies, but they come with specific fees and interest rates that can add up quickly. Knowing what to expect can help you make informed decisions and avoid surprises.

Understanding the Costs of Online Payday Loans in Illinois

The costs associated with online payday loans in Illinois typically include:

- Interest Rates: These can be quite high, often exceeding 400% APR.

- Fees: Lenders may charge additional fees for processing your loan.

- Repayment Terms: Most loans are due on your next payday, which can lead to a cycle of debt if not managed carefully.

Key Takeaways

- Short-Term Solution: Online payday loans in Illinois can provide quick cash, but they are not a long-term fix.

- Budget Wisely: Always consider how the repayment will fit into your budget.

- Research Lenders: Compare different lenders to find the best rates and terms.

Understanding these costs is crucial when navigating payday loans by state, ensuring you choose wisely.

The Pros and Cons of Online Payday Loans in Illinois

When considering financial options, understanding the pros and cons of online payday loans in Illinois is crucial. These loans can be a quick fix for urgent cash needs, but they come with their own set of challenges. Knowing how to apply and what to expect can help you make informed decisions.

Pros of Online Payday Loans in Illinois

- Quick Access to Cash: Online payday loans provide fast funding, often within a day.

- Convenience: You can apply from the comfort of your home, avoiding long lines at banks.

- Flexible Requirements: Many lenders have less stringent credit requirements, making it easier for individuals to qualify.

Cons of Online Payday Loans in Illinois

- High Interest Rates: These loans often come with steep fees and interest, which can lead to debt cycles.

- Short Repayment Terms: Borrowers usually have to repay the loan quickly, often within two weeks, which can be challenging.

- Potential for Scams: The online nature of these loans can expose borrowers to predatory lenders.

How ASAPPayday.com Can Simplify Your Online Payday Loan Experience

Applying for online payday loans in Illinois can seem daunting, but it doesn’t have to be. Understanding the process is crucial, especially when unexpected expenses arise. With the right guidance, you can navigate this financial option smoothly and efficiently. That’s where ASAPPayday.com comes in to simplify your experience!

Easy Application Process

- User-Friendly Interface: Our website is designed for simplicity, making it easy for anyone to apply for online payday loans in Illinois.

- Quick Approval: We prioritize your time, ensuring that your application is reviewed swiftly so you can get the funds you need without delay.

Helpful Resources

- Informative Guides: We provide clear information about payday loans by state, helping you understand the specific regulations in Illinois.

- Customer Support: Our team is always ready to assist you with any questions, ensuring you feel confident throughout the process.

With ASAPPayday.com, applying for an online payday loan becomes a breeze, allowing you to focus on what truly matters—getting back on track financially.

Frequently Asked Questions About Online Payday Loans in Illinois

💳 Are online payday loans legal in Illinois?

Yes, online payday loans are legal in Illinois but are subject to strict regulations under the Predatory Loan Prevention Act (PLPA). The PLPA caps the interest rate at an annual percentage rate (APR) of 36%, making any loan with an APR higher than 36% void and unenforceable.

📆 What are the terms for payday loans in Illinois?

In Illinois, payday loans must have a minimum term of 13 days and a maximum term of 45 days. Borrowers cannot be indebted to payday lenders for more than 45 consecutive days. If a borrower has loans outstanding for 45 days, they must wait at least 7 calendar days after paying off the balance before obtaining another payday loan.

💰 What is the maximum loan amount for payday loans in Illinois?

The maximum payday loan amount in Illinois is $1,000 or 25% of the borrower’s gross monthly income, whichever is less.

🔄 Are payday loan rollovers allowed in Illinois?

No, payday loan rollovers are prohibited in Illinois. Lenders cannot extend, renew, or refinance payday loans. If a borrower is unable to repay the loan, they may be eligible to enter into an interest-free repayment plan with the lender.

🛡️ How can I ensure I’m dealing with a licensed payday lender in Illinois?

To verify if a payday lender is licensed in Illinois, you can check the Illinois Department of Financial and Professional Regulation (IDFPR) website. All payday lenders operating in Illinois must be licensed by the IDFPR.

Quick Cash Before You Go with ASAPPayday!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.

Find a Payday Loan!

"*" indicates required fields