Do Payday Loans Do Credit Checks? What You Should Know

When considering a payday loan, many people wonder, “Do payday loans do credit checks?” Understanding this aspect is crucial because it can affect your financial decisions. Payday loans are often seen as a quick fix for urgent cash needs, but knowing how they impact your credit is essential.

What You Should Know

Most payday lenders do not perform traditional credit checks. Instead, they may look at your income and bank account history. This means even if you have bad credit, you might still qualify for a payday loan. However, this can come with higher fees and interest rates.

Key Insights

- No Traditional Credit Checks: Many payday lenders skip the usual credit checks.

- Income Verification: They often check your income to ensure you can repay the loan.

- Higher Costs: Be prepared for potentially higher fees if you have poor credit.

- Short-Term Solution: Remember, payday loans are meant for quick cash needs, not long-term financial solutions.

Fast Approval with ASAPPayday – Start Here!

The Truth Behind Credit Checks and Payday Loans

When it comes to understanding payday loans, one of the most common questions is, “Do payday loans do credit checks?” This is important because many people rely on these loans during financial emergencies. Knowing how credit checks work can help you make informed decisions about borrowing money.

What You Need to Know

- No Credit Check: Many payday lenders do not perform traditional credit checks. Instead, they often look at your income and bank statements. This means that even if you have bad credit, you might still qualify for a loan.

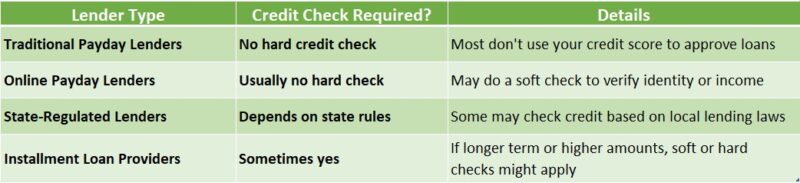

- Soft vs. Hard Checks: Some lenders might do a soft credit check, which doesn’t affect your credit score. However, a hard check can impact your score and is less common with payday loans.

Pros and Cons

- Quick Access: Since most payday loans don’t require credit checks, you can get cash quickly, often within a day.

- Higher Interest Rates: Keep in mind that because of the lack of credit checks, payday loans can come with high-interest rates. Always read the terms carefully before borrowing.

Personalized Loan Options at ASAPPayday! – Apply Now!

How Do Payday Loans Impact Your Credit Score?

When considering a payday loan, many people wonder, “Do payday loans do credit checks?” Understanding this is crucial because it can affect your financial future. Payday loans are often seen as a quick fix for cash shortages, but they come with important implications for your credit score.

The Basics of Credit Checks

Most payday lenders do not perform traditional credit checks. Instead, they may use alternative methods to assess your ability to repay the loan. This means that even if you have a low credit score, you might still qualify for a payday loan.

Potential Consequences

However, if you fail to repay the loan on time, it can lead to negative marks on your credit report. This is because lenders may report missed payments to credit bureaus. So, while you might not face a credit check initially, your actions can still impact your credit score significantly.

Also Read: Payday Loans Basics: What You Need to Know Before Borrowing

Are There Alternatives to Payday Loans Without Credit Checks?

When considering financial options, many people wonder, “Do payday loans do credit checks?” Understanding this is crucial, especially if you’re in a tight spot. Payday loans can seem tempting, but they often come with high fees and interest rates. So, what are the alternatives if you want to avoid these pitfalls?

If you’re looking for options that don’t involve credit checks, here are a few alternatives:

- Credit Unions: Many credit unions offer small personal loans with lower interest rates and no credit checks. They often have more flexible terms than payday lenders.

- Peer-to-Peer Lending: Platforms like LendingClub connect borrowers with individual investors. This can be a great way to secure funds without a traditional credit check.

- Payment Plans: Some retailers offer payment plans for larger purchases. This can help you avoid high-interest loans altogether.

What to Expect When Applying for a Payday Loan

When considering a payday loan, many people wonder, do payday loans do credit checks? Understanding this can help you make informed decisions. Payday loans can be a quick solution for financial emergencies, but knowing the basics is crucial before you apply.

Most payday lenders do not perform traditional credit checks. Instead, they often look at your income and bank statements. This means even if you have a low credit score, you might still qualify! However, it’s essential to remember that this convenience comes with higher fees and interest rates.

Key Points to Remember

- Quick Approval: Many lenders approve loans quickly, sometimes within hours.

- Income Verification: Be prepared to show proof of income.

- Repayment Terms: Understand when and how you need to repay the loan.

In summary, while payday loans may not require credit checks, they can still impact your finances. Always read the fine print and consider your options carefully before borrowing.

The Role of Credit History in Payday Loan Approval

When considering a payday loan, many people wonder, “Do payday loans do credit checks?” Understanding this is crucial because it can affect your chances of approval. Payday loans are often seen as a quick fix for financial emergencies, but knowing how your credit history plays a role is essential.

Do Payday Loans Do Credit Checks?

Most payday lenders do not perform traditional credit checks. Instead, they may look at your income and bank statements. This means that even if you have a poor credit score, you might still qualify for a loan. However, some lenders might check your credit history to assess risk, so it’s good to be aware of this possibility.

Key Insights About Payday Loans

- Quick Approval: Many payday loans can be approved within hours.

- No Extensive Checks: Most lenders focus on your income rather than your credit score.

- Higher Interest Rates: Be cautious, as payday loans often come with high interest rates, which can lead to more debt if not managed properly.

In summary, while payday loans may not always require credit checks, understanding the basics can help you make informed decisions.

Can You Get a Payday Loan with Bad Credit?

When facing financial difficulties, you may ask, “Can you get a payday loan with bad credit?” This is an important question, especially when unexpected expenses arise. Knowing if payday loans do credit checks can guide your choices.

What You Should Know

Most payday lenders do not conduct traditional credit checks. Instead, they assess your income and repayment ability. This means that even with a low credit score, you might still qualify for a payday loan. However, be cautious as higher interest rates often apply, so borrowing wisely is crucial.

Key Insights:

- Quick Access: Payday loans can provide cash quickly, often within a day.

- No Traditional Checks: Many lenders focus on income rather than credit scores.

- Higher Costs: Be aware of potentially high fees and interest rates.

- Repayment Risks: Ensure you can repay the loan on time to avoid additional financial strain.

In conclusion, payday loans may be available for those with bad credit, but understanding the terms and risks is essential before proceeding.

How ASAPPayday.com Can Help You Navigate Payday Loan Options

Understanding whether do payday loans do credit checks is essential for anyone considering this option. Many seek payday loans for quick cash, but knowing how they work and their impact on your credit is vital. Let’s explore the basics and see how ASAPPayday.com can assist you in navigating payday loan options.

When applying for a payday loan, lenders typically check your credit history. However, some may use alternative methods instead of traditional credit checks. This can be beneficial for those with poor credit, but understanding the implications is crucial.

Key Insights on Payday Loans Basics

- Quick Access to Cash: Payday loans can provide fast funds, usually within a day.

- Credit Check Variability: Not all payday loans require a credit check, so it’s important to inquire.

- Potential Risks: High interest rates can lead to debt if not managed properly.

By grasping these basics, you can make informed decisions about payday loans and find the best options for your needs. ASAPPayday.com is here to guide you through the process, ensuring you have all the necessary information.

Key Takeaways: Do Payday Loans Do Credit Checks?

When considering a payday loan, many people wonder, “Do payday loans do credit checks?” This question is crucial because it can affect your financial decisions. Understanding how payday loans work can help you make informed choices, especially if you’re in a tight spot and need quick cash.

Key Takeaways: Do Payday Loans Do Credit Checks?

- No Credit Check Required: Most payday lenders do not perform traditional credit checks. Instead, they focus on your income and ability to repay the loan. This can be a relief for those with poor credit histories.

- Higher Interest Rates: Since payday loans often skip credit checks, they come with higher interest rates. This means you might pay back much more than you borrowed, so be cautious!

- Short-Term Solution: Remember, payday loans are meant for short-term financial needs. They should not be your go-to solution for long-term financial problems. Always consider other options before applying.

FAQs

🔍 Do all payday lenders perform credit checks?

Not all do—many payday lenders skip traditional credit checks and focus on your income instead.

💳 Will a payday loan affect my credit score?

Usually no, unless the lender reports missed payments to credit bureaus or the debt goes to collections.

🚫 Can I get a payday loan with bad credit?

Yes, many payday lenders approve borrowers with poor or no credit history.

📁 What information do payday lenders check instead of credit?

They typically review your employment status, income, and bank account activity.

🧾 Will a soft credit check happen during application?

Some lenders may do a soft pull to verify identity, but it won’t impact your credit score.

Quick Cash Before You Go with ASAPPayday!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation

Find a Payday Loan!

"*" indicates required fields