Payday Loan in Virginia: Fast Approval Online

When unexpected expenses arise, many people in Virginia turn to payday loans for quick financial relief. Understanding how a payday loan in Virginia works can help you make informed decisions. With fast approval online options, you can access funds quickly, making it easier to manage your finances during tough times.

What is a Payday Loan?

A payday loan is a short-term borrowing option designed to cover urgent expenses until your next paycheck. It’s important to know that these loans typically come with high-interest rates, so they should be used wisely.

Key Features of Payday Loans in Virginia

- Fast Approval: Many lenders offer online applications that can be completed in minutes.

- Quick Access to Cash: Once approved, funds can be deposited into your bank account as soon as the next business day.

- Flexible Amounts: You can borrow a small amount, usually between $100 and $500, depending on your needs and state regulations.

Considerations Before Applying

Before applying for a payday loan in Virginia, consider the following:

- Repayment Terms: Understand when and how you will repay the loan.

- Interest Rates: Be aware of the high-interest rates associated with payday loans.

- Alternatives: Explore other options like personal loans or credit cards that may offer better terms.

By knowing these details, you can navigate the world of payday loans more effectively and make choices that align with your financial goals. Remember, while payday loans can provide quick cash, they should be approached with caution.

Fast Approval with ASAPPayday – Start Here!

How to Secure Fast Approval for a Payday Loan in Virginia

When unexpected expenses arise, a payday loan in Virginia can provide a quick financial solution. With fast online approval, you can access cash when you need it most, making it a popular choice. Here’s how to secure this loan effectively.

Know Your Options

- Research various lenders offering payday loans by state.

- Compare interest rates and terms to find the best fit for your needs.

Gather Necessary Documents

Before applying, ensure you have:

- A valid ID

- Proof of income

- A bank account statement

Apply Online

Applying online is straightforward. Just follow these steps:

- Complete the application form on the lender’s website.

- Submit your documents electronically.

- Wait for approval, which usually takes just minutes!

By following these steps, you can secure a payday loan in Virginia quickly. However, it’s essential to borrow responsibly and read the terms to avoid surprises later.

Understand the Costs

Understanding the costs associated with a payday loan in Virginia is crucial. These loans often come with high-interest rates, so calculate the total repayment amount to avoid financial pitfalls.

Repayment Plans

Lenders will outline repayment plans clearly. Know when payments are due and how much you’ll need to pay back. Setting reminders can help you stay on track and avoid late fees.

Seek Help if Needed

If you struggle to repay, reach out for help. Many organizations offer financial counseling to assist you in managing your debts effectively. Remember, you’re not alone!

Personalized Loan Options at ASAPPayday! – Apply Now!

The Benefits of Choosing Online Payday Loans in Virginia

When unexpected expenses arise, finding quick financial help can be a challenge. That’s where a payday loan in Virginia comes into play. With fast approval online, you can get the cash you need without the long wait times of traditional banks. This convenience is crucial for many Virginians facing urgent bills or emergencies.

Quick and Easy Application Process

Applying for a payday loan in Virginia online is straightforward. You can fill out an application from the comfort of your home, often in just a few minutes. No more long lines or complicated paperwork!

Fast Approval Times

One of the biggest advantages of online payday loans is the speed of approval. Many lenders provide instant decisions, allowing you to access funds quickly. This is especially helpful when you need money for urgent expenses, like car repairs or medical bills.

Flexible Loan Amounts

Online payday loans offer flexibility in how much you can borrow. Depending on your needs, you can choose a loan amount that fits your situation. This adaptability makes it easier to manage your finances without overextending yourself.

Also Read: Payday Loans by State: Online Options & Local Availability

What Are the Eligibility Requirements for a Payday Loan in Virginia?

Understanding the eligibility requirements for a payday loan in Virginia is crucial for anyone seeking fast financial help. These loans can provide quick cash for emergencies, but knowing if you qualify can save you time and stress. Let’s break down what you need to know!

Basic Eligibility Criteria

To apply for a payday loan in Virginia, you generally need to meet a few basic requirements:

- Age: You must be at least 18 years old.

- Residency: You need to be a resident of Virginia.

- Income: Proof of a steady income is essential, whether from a job or other sources.

- Bank Account: A valid checking account is required for loan disbursement and repayment.

Additional Considerations

While the above points cover the basics, there are a few more things to keep in mind:

- Credit History: Your credit score may not be a major factor, but lenders will check it.

- Debt-to-Income Ratio: Lenders may look at how much debt you currently have compared to your income.

- Loan Limits: Virginia has specific limits on how much you can borrow, usually up to $500.

By understanding these eligibility requirements, you can confidently apply for a payday loan in Virginia and get the fast approval you need online. Remember, payday loans by state can vary, so always check local regulations!

How ASAPPayday.com Can Simplify Your Payday Loan Application Process

When unexpected expenses arise, many people in Virginia turn to payday loans for quick financial relief. Understanding how to navigate the application process can make all the difference. That’s where ASAPPayday.com comes in, making it easier than ever to secure a payday loan in Virginia with fast approval online.

Applying for a payday loan can feel overwhelming, but it doesn’t have to be. Here’s how ASAPPayday.com streamlines the process:

Easy Online Application

- User-Friendly Interface: Our website is designed for simplicity, guiding you step-by-step through the application.

- Fast Processing: Submit your application in minutes and receive quick feedback on your approval status.

Secure and Confidential

- Safety First: Your personal information is protected, ensuring a safe borrowing experience.

- Transparent Terms: We provide clear information about fees and repayment terms, so you know exactly what to expect.

With ASAPPayday.com, getting a payday loan in Virginia is straightforward and stress-free. You can focus on what matters most—getting the funds you need when you need them. Plus, our service is tailored to meet the unique needs of borrowers across the state, making us a trusted choice for payday loans by state.

Common Misconceptions About Payday Loans in Virginia

When it comes to financial emergencies, many people in Virginia turn to payday loans for quick cash. However, there are several misconceptions surrounding these loans that can lead to confusion. Understanding the truth about payday loans in Virginia is essential for making informed decisions, especially when you need fast approval online.

1. They’re Only for Desperate Situations

Many believe that payday loans are only for those in dire financial straits. While they can help in emergencies, they can also be a useful tool for managing cash flow between paychecks. It’s all about how you use them responsibly!

2. They Have Hidden Fees

Another common myth is that payday loans in Virginia come with hidden fees. In reality, lenders are required to disclose all fees upfront. Always read the terms carefully to avoid surprises!

3. They’re Illegal in Virginia

Some people think payday loans are illegal in Virginia. This is not true! Payday loans are regulated and legal, but they do have specific rules. Always check the latest regulations to stay informed. By debunking these misconceptions, you can better understand payday loans by state and make choices that suit your financial needs. Remember, knowledge is power when it comes to borrowing money!

Tips for Responsible Borrowing: Managing Your Payday Loan in Virginia

When you find yourself in a financial pinch, a payday loan in Virginia can be a quick solution. With fast approval online, it’s tempting to rush into borrowing. However, responsible borrowing is crucial to avoid falling into a cycle of debt. Let’s explore some tips to manage your payday loan wisely.

Understand Your Loan Terms

Before signing any agreement, take the time to read the terms of your payday loan in Virginia. Know the interest rates, repayment schedule, and any fees involved. Understanding these details helps you plan your budget and avoid surprises later on.

Create a Repayment Plan

Having a solid repayment plan is essential. Here’s how to do it:

- Budget Wisely: Allocate funds for your loan repayment in your monthly budget.

- Set Reminders: Use your phone or calendar to remind you of due dates.

- Prioritize Payments: Make your payday loan a priority to avoid late fees and penalties.

Seek Help if Needed

If you find yourself struggling to repay your payday loan, don’t hesitate to seek help. Consider talking to a financial advisor or exploring options like consolidating your debt. Remember, payday loans by state can vary, so understanding your local laws can also provide additional support.

FAQs

💵 Are payday loans legal in Virginia?

Yes, payday loans are legal in Virginia. However, they are subject to strict regulations under the Virginia Fairness in Lending Act to protect consumers from predatory lending practices.

📋 What are the requirements to qualify for a payday loan in Virginia?

To qualify, you must be at least 18 years old, have a valid government-issued ID, provide proof of income, and possess an active checking account.

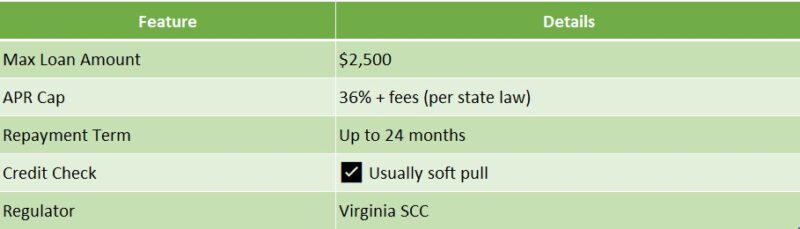

💰 What are the loan limits and terms for payday loans in Virginia?

The maximum loan amount is $2,500. Loan terms must be between 4 and 24 months, unless the monthly payment is less than 5% of your gross monthly income or 6% of your net monthly income.

💸 What fees and interest rates apply to payday loans in Virginia?

Lenders can charge a simple annual interest rate up to 36%. A monthly maintenance fee may apply, but total fees and charges are capped at 50% of the loan amount for loans up to $1,500, and 60% for loans over $1,500.

🔁 Can I have more than one payday loan at a time in Virginia?

No, Virginia law prohibits borrowers from having more than one payday loan or motor vehicle title loan outstanding at the same time.

Quick Cash Before You Go with ASAPPayday!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.

Find a Payday Loan!

"*" indicates required fields