Payday Loan Kansas Online: Same-Day Funding

Payday loans can be a lifesaver for unexpected expenses, especially in Kansas where many seek payday loan Kansas online options for quick cash. With same-day funding, you can address urgent bills promptly. But what are payday loans? Let’s explore.

What Are Payday Loans?

Payday loans are short-term loans meant to help during financial crunches, typically due on your next payday. Key points include:

- Quick Access: Apply online and often receive funds the same day.

- Easy Application: The process is simple, requiring minimal paperwork.

- State Regulations: Kansas has specific rules governing these loans.

Why Choose Online Options?

Opting for payday loans by state online has several advantages:

- Convenience: Apply from home.

- Speed: Quick approval and funding for urgent needs.

- Flexibility: Various loan amounts are available to fit your situation.

Understanding these elements can help you make informed choices when seeking financial help.

Fast Approval with ASAPPayday – Start Here!

How to Apply for a Payday Loan Kansas Online: Step-by-Step Guide

Unexpected expenses can arise at any time, making quick financial help essential. A payday loan Kansas online offers same-day funding to assist with urgent bills. Knowing how to apply can simplify the process significantly.

Step 1: Research Lenders

Begin by searching for reputable lenders that provide payday loans by state. Check their reviews and confirm they are licensed in Kansas to ensure reliability.

Step 2: Gather Your Information

Collect necessary documents such as your ID, proof of income, and bank details before applying. This preparation speeds up the application process.

Step 3: Complete the Application

Go to the lender’s website and fill out the online application form accurately. Most lenders review applications quickly, often within minutes!

Step 4: Review Loan Terms

If you’re approved, read the loan terms carefully. Understanding the interest rates and repayment schedule is crucial for making an informed decision.

Personalized Loan Options at ASAPPayday! – Apply Now!

What Makes Same-Day Funding Possible with Online Payday Loans?

When unexpected expenses arise, having access to quick cash can be a lifesaver. That’s where payday loans come in, especially the payday loan Kansas online options that offer same-day funding. This means you can get the money you need almost instantly, helping you tackle those urgent bills without delay.

What Makes Same-Day Funding Possible?

Several factors contribute to the speed of online payday loans. First, the application process is simple and can be completed from the comfort of your home. You just fill out a form online, and within minutes, you can receive approval. Here’s how it works:

- Instant Approval: Many lenders provide quick decisions, often within minutes.

- Electronic Transfers: Once approved, funds are transferred directly to your bank account, usually on the same day.

- Minimal Documentation: Online payday loans require less paperwork, speeding up the process even more.

Also Read: Payday Loans by State: Online Options & Local Availability

Are Online Payday Loans in Kansas Safe and Secure?

When life throws unexpected expenses your way, a payday loan Kansas online can be a quick solution. With same-day funding options, you can access cash when you need it most. But, is it safe? Let’s dive into the security of these loans.

Many people wonder about the safety of payday loans. Here are some key points to consider:

- Regulated Lenders: In Kansas, payday lenders must follow state regulations, ensuring they operate fairly.

- Secure Websites: Reputable lenders use encryption technology to protect your personal information.

- Transparent Terms: Trustworthy lenders provide clear terms, so you know what you’re getting into.

In summary, while payday loans can be a helpful resource, it’s essential to choose a reputable lender. Always read the fine print and ensure you understand the terms before proceeding. This way, you can enjoy the benefits of payday loans by state without unnecessary worries.

The Pros and Cons of Choosing Payday Loans Kansas Online

When unexpected expenses arise, many people in Kansas seek payday loans for quick cash. These loans are available online, offering same-day funding, which can be crucial during financial emergencies. However, it’s important to consider both the advantages and disadvantages before making a decision.

The Pros of Payday Loans Kansas Online

- Quick Access to Funds: You can apply online and receive money in your account the same day.

- Easy Application Process: The application is simple and requires minimal paperwork.

- No Credit Check: Many lenders do not perform credit checks, making these loans accessible to those with poor credit.

The Cons of Payday Loans Kansas Online

- High-Interest Rates: These loans often come with high-interest rates, which can lead to a cycle of debt.

- Short Repayment Terms: Repayment is typically required within a few weeks, which can be difficult if you’re already struggling financially.

- Potential for Over-Borrowing: The ease of access may encourage some to borrow more than they can afford to repay.

How Much Can You Borrow with a Payday Loan in Kansas?

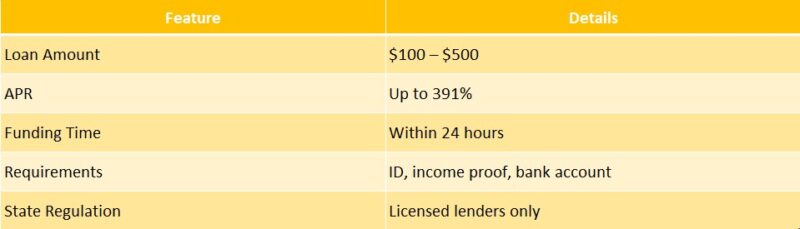

When unexpected expenses arise, knowing how much you can borrow with a payday loan in Kansas can be crucial. Payday Loan Kansas Online: Same-Day Funding allows you to access cash quickly, helping you manage bills or emergencies without delay. But what can you actually borrow?

Loan Amounts Available

In Kansas, payday loans typically range from $100 to $1,500. The amount you can borrow depends on your income and the lender’s policies. Key considerations include:

- Income Verification: Lenders assess your income to set your borrowing limit.

- State Regulations: Kansas has specific laws affecting loan amounts and terms, so it’s vital to understand these before applying.

Why It Matters

Knowing your borrowing limit is essential for effective financial planning and avoiding excessive debt. Payday loans provide quick access to funds, making them a popular choice for those facing urgent financial needs. If you find yourself in a tough spot, payday loans can be a valuable resource.

What to Expect During the Approval Process for Online Payday Loans

When facing a financial crunch, knowing the approval process for a payday loan Kansas online is crucial. Same-day funding allows you to access cash quickly, and understanding the steps can alleviate stress during this time.

Simple Application Steps

- Fill Out the Application: Provide basic details like your name, address, and income online in just a few minutes.

- Submit Your Documents: Upload necessary documents such as your ID and proof of income for quick verification by lenders.

- Receive Approval: Most lenders review applications within hours, notifying you of your loan amount and terms if approved.

Quick Funding

- Same-Day Funding: Upon approval, many lenders can deposit funds into your account the same day, which is ideal for urgent needs.

- Payday Loans by State: Be aware that regulations vary by state, so understanding Kansas laws is essential for making informed decisions about your loan options.

Tips for Responsible Borrowing: Managing Your Payday Loan Kansas Online

When facing financial difficulties, a payday loan Kansas online can provide quick cash with same-day funding. However, it’s essential to borrow responsibly to prevent falling into debt. Here are some tips for effective management of your payday loan.

Understand Your Needs

Before applying, consider if a payday loan is necessary. Explore other options like budgeting or asking friends for help. Understanding your needs ensures you borrow wisely.

Create a Repayment Plan

After securing your payday loan, develop a repayment strategy. Allocate a portion of your income for this purpose to avoid surprises on the due date. Remember, payday loans are short-term solutions, so plan accordingly!

Avoid Borrowing More Than You Can Handle

It’s easy to be tempted to borrow more than needed, but this can lead to financial trouble. Stick to the amount that addresses your immediate expenses to keep repayments manageable and stay on track.

How ASAPPayday.com Can Help You Find the Right Payday Loan

When unexpected expenses arise, having quick access to cash can be a lifesaver. That’s where payday loans come into play. With payday loan Kansas online options, you can secure same-day funding to tackle those urgent bills or emergencies without the long wait. But how do you find the right loan for your needs?

At ASAPPayday.com, we understand that navigating the world of payday loans can be overwhelming. Our platform simplifies the process, making it easier for you to find payday loans by state, including Kansas. Here’s how we can assist you:

Key Benefits of Using ASAPPayday.com

- Easy Comparisons: Quickly compare different payday loan options available in Kansas.

- User-Friendly Interface: Our website is designed for everyone, ensuring you can find what you need without hassle.

- Same-Day Funding: We connect you with lenders who offer fast funding, so you won’t have to wait long for your cash.

Frequently Asked Questions About Payday Loans in Kansas Online

💰 What is the maximum amount I can borrow with a payday loan in Kansas?

Kansas law limits payday loans to a maximum of $500 per loan. However, a lender may have up to two loans outstanding to the same borrower at any one time, allowing for a total of up to $1,000 in payday loan debt per lender.

📅 What are the loan term limits for payday loans in Kansas?

The minimum loan term is 7 days, and the maximum term is 30 days.

💸 What are the finance charges for payday loans in Kansas?

For loans equal to or less than $500, lenders may charge a finance fee not exceeding 15% of the amount advanced.

🔄 Are rollovers or renewals allowed for payday loans in Kansas?

No, rollovers are not permitted. However, borrowers may elect once every 12 months to repay a payday loan through an extended payment plan.

🏦 Are there alternatives to payday loans available online in Kansas?

Yes, some lenders offer online lines of credit ranging from $200 to $3,000 as an alternative to traditional payday loans.

Quick Cash Before You Go with ASAPPayday!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.

Find a Payday Loan!

"*" indicates required fields