Payday Loan in NC: Instant Online Application

Payday loans in NC can be a quick solution for those facing unexpected expenses. With an instant online application, you can access funds without the hassle of traditional banking. Understanding how these loans work is essential for making informed financial decisions.

What is a Payday Loan?

A payday loan is a short-term borrowing option that helps you cover urgent costs until your next paycheck. These loans are typically small amounts, often ranging from $100 to $1,000. They are designed to be repaid quickly, usually within two weeks.

Why Choose Payday Loans in NC?

- Quick Access: The instant online application means you can get money fast.

- No Credit Check: Many lenders don’t require a credit check, making it easier for those with poor credit.

- Flexible Use: You can use the funds for anything, from medical bills to car repairs.

However, it’s important to remember that payday loans can come with high interest rates, so borrowing wisely is key. Always consider your ability to repay before applying for a payday loan in NC.

Final Thoughts

Payday loans by state can vary in terms of regulations and availability. In North Carolina, knowing the ins and outs of payday loans can empower you to make the best choice for your financial needs. Always read the terms carefully and ensure you understand the repayment process.

Fast Approval with ASAPPayday – Start Here!

How to Apply for a Payday Loan in NC Instantly Online

Applying for a payday loan in NC can be a quick and straightforward process, especially with the option for an instant online application. This method is convenient for those who need cash fast, allowing you to complete the application from the comfort of your home. Understanding how to navigate this process can make all the difference when you find yourself in a financial pinch.

Steps to Apply for a Payday Loan in NC Online

- Research Lenders: Start by looking for reputable lenders that offer payday loans in NC. Check their reviews and ensure they are licensed to operate in your state.

- Gather Necessary Information: You’ll typically need to provide personal details like your name, address, income, and bank account information.

- Complete the Application: Fill out the online application form. It’s usually straightforward and can be done in just a few minutes.

- Submit and Wait for Approval: After submitting, most lenders will review your application quickly. You may receive a decision within minutes!

Benefits of Online Applications

- Speed: Instant approval means you can get funds quickly.

- Convenience: Apply anytime, anywhere, without needing to visit a physical location.

- Easy Comparisons: You can easily compare different payday loans by state to find the best option for your needs.

Personalized Loan Options at ASAPPayday! – Apply Now!

The Benefits of Choosing an Online Payday Loan in NC

When unexpected expenses arise, many people in North Carolina turn to payday loans. With the option for an instant online application, getting the cash you need has never been easier. Understanding the benefits of a payday loan in NC can help you make informed decisions during financial emergencies.

Quick Access to Funds

One of the biggest advantages of payday loans is the speed at which you can access funds. With an online application, you can apply from the comfort of your home and often receive approval within minutes. This is especially helpful when bills are due or emergencies strike.

Convenience and Flexibility

Applying for a payday loan in NC online means you can do it anytime, anywhere. No need to visit a physical location or wait in long lines. Just fill out the application on your device, and you’re good to go!

Simple Application Process

The online application process is straightforward. You typically need to provide basic information like your income and bank details. This simplicity makes payday loans by state, including NC, a popular choice for many individuals seeking quick financial relief.

Also Read: Payday Loans by State: Online Options & Local Availability

Are Payday Loans in NC Right for You? Key Considerations

Payday loans in NC can be a quick solution for those facing unexpected expenses. With an instant online application, you can access funds when you need them most. But are these loans the right choice for you? Let’s explore some key considerations before you dive in.

Understanding Your Needs

Before applying for a payday loan in NC, think about your financial situation. Are you facing a temporary cash crunch? If so, these loans can provide immediate relief. However, it’s crucial to assess whether you can repay the loan on time to avoid additional fees.

Pros and Cons of Payday Loans

- Quick Access to Cash: You can get money fast, often within a day.

- Easy Application Process: The online application is simple and straightforward.

- Potential for High Fees: Be aware that payday loans can come with high interest rates.

- Short Repayment Terms: These loans typically require repayment by your next payday, which can be challenging for some borrowers.

In summary, payday loans in NC can be beneficial in certain situations, especially for urgent financial needs. However, always weigh the pros and cons carefully. Remember, understanding your options is key to making the best financial decision.

Exploring the Costs: What to Expect with a Payday Loan in NC

When considering a payday loan in NC, understanding the costs is crucial. With an instant online application, you can access funds quickly, but it’s important to know what that means for your finances. Let’s explore the expenses involved.

Understanding the Costs of a Payday Loan in NC

Payday loans are convenient but often come with high fees. Key points include:

- Interest Rates: Generally higher than traditional loans.

- Loan Amounts: You can borrow between $100 and $500 in NC.

- Repayment Terms: Loans are typically due on your next payday, which can lead to debt cycles if not managed well.

Key Takeaways

Before applying, consider these insights:

- Budget Wisely: Ensure you can repay on time to avoid extra fees.

- Research Options: Compare payday loans by state for better rates.

- Read the Fine Print: Understand the total cost before signing any agreement.

Alternatives to Consider

If payday loans seem too costly, consider alternatives like:

- Credit Unions: Often offer lower interest rates.

- Personal Loans: More affordable in the long run.

- Payment Plans: Flexible repayment options may be available.

In conclusion, while payday loans can provide quick cash, understanding the costs is vital. Always weigh your options and choose what’s best for your financial health.

How ASAPPayday.com Simplifies Your Payday Loan Application Process

When unexpected expenses arise, a payday loan in NC can be a quick and effective solution. With online applications, accessing funds has never been easier. At ASAPPayday.com, we simplify this process to make it more user-friendly and efficient.

We know that applying for a payday loan can be daunting. That’s why we’ve streamlined our application process:

Easy Online Application

- Quick Form: Complete a simple online form in minutes—no complicated paperwork!

- Instant Approval: Receive a decision almost immediately, allowing you to plan your next steps without delay.

- Secure Process: Your information is safeguarded with top-notch security measures, ensuring peace of mind.

Helpful Support

Our dedicated customer support team is always available to assist you with any questions about payday loans in NC or the application process.

Flexible Loan Options

We offer a variety of payday loans by state, so you can find the right fit for your needs—whether it’s a small amount for a quick fix or a larger sum for bigger expenses.

Fast Funding

Once approved, funds can be deposited directly into your bank account as soon as the next business day, allowing you to address your financial challenges promptly.

Transparent Terms

We prioritize clear communication, providing straightforward terms with no hidden fees. You’ll know exactly what to expect, making your payday loan experience stress-free.

Alternatives to Payday Loans in NC: What Are Your Options?

When facing unexpected expenses, many people in North Carolina consider a payday loan in NC: Instant Online Application. However, it’s essential to explore alternatives that might be more beneficial in the long run. Understanding your options can help you make informed financial decisions and avoid high-interest debt.

Credit Unions and Community Banks

Credit unions and local banks often offer small personal loans with lower interest rates than payday loans. They may also provide flexible repayment terms, making it easier to manage your finances. Plus, becoming a member of a credit union can lead to more financial benefits down the road.

Installment Loans

Another option is an installment loan. Unlike payday loans, which require full repayment by your next paycheck, installment loans allow you to pay back the amount over several months. This can ease the financial burden and help you budget better.

Borrowing from Friends or Family

Sometimes, the best solution is to ask friends or family for help. They may be willing to lend you money without charging interest, making it a more affordable option. Just be sure to communicate clearly about repayment to avoid misunderstandings.

FAQs

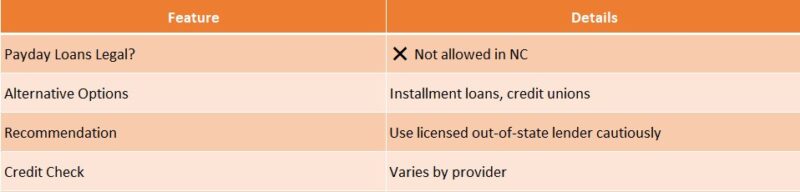

🚫 Are payday loans legal in North Carolina?

No, payday loans are illegal in North Carolina. The state has banned them due to their high interest rates and potential for consumer harm.

🏛️ Why were payday loans banned in NC?

Payday loans were banned to protect consumers from predatory lending practices and high fees that often led to cycles of debt.

💡 What alternatives to payday loans are available in NC?

North Carolina residents can consider credit union personal loans, salary advance programs from employers, or short-term installment loans from licensed lenders.

🔍 Can I still get a payday loan online if I live in NC?

Even though some online lenders offer payday loans, they must follow North Carolina laws. If they’re unlicensed, the loans are considered illegal and unenforceable.

📞 Where can I report illegal payday lending activity in NC?

You can report suspicious or illegal lending to the North Carolina Department of Justice or the Consumer Protection Division.

Quick Cash Before You Go with ASAPPayday!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.

Find a Payday Loan!

"*" indicates required fields