What to Know About Payday Loan Amounts & Offers

When it comes to managing finances, understanding payday loan amounts & offers is crucial. These loans can provide quick cash for emergencies, but knowing how much you can borrow and the terms involved can save you from future headaches. Let’s dive into what you need to know!

What Are Payday Loan Amounts?

Payday loan amounts vary based on your income and the lender’s policies. Typically, you can borrow anywhere from $100 to $1,000. However, it’s essential to check your state’s regulations, as they can affect how much you can borrow.

Key Factors Influencing Offers

- Income Level: Lenders often look at your monthly income to determine how much you can borrow.

- Repayment Terms: Understand how long you have to repay the loan, as this affects the total cost.

- Fees and Interest Rates: Always ask about any additional fees or interest rates that might apply.

By knowing these factors, you can make informed decisions about payday loan amounts and offers, ensuring you choose the best option for your needs.

Fast Approval with ASAPPayday – Start Here!

How Are Payday Loan Offers Determined?

Understanding payday loan amounts and offers is essential for anyone considering this financial option. These loans can provide quick cash, but knowing how offers are determined helps you make informed choices. Let’s explore the key factors that influence payday loan amounts and offers.

Factors Influencing Payday Loan Offers

Several elements play a role in determining payday loan amounts and offers:

- Income Level: Lenders assess your income to decide how much you can borrow; higher income typically means a larger loan.

- Credit History: While payday loans are accessible to those with poor credit, a better credit history can lead to more favorable offers.

- State Regulations: Different states have unique laws regarding payday loans, affecting the amounts and terms available.

Understanding Loan Terms

When you receive a payday loan offer, reading the terms carefully is crucial. Pay attention to:

- Interest Rates: These can vary widely, impacting your total repayment amount.

- Repayment Period: Be aware of when the loan is due and any penalties for late payments.

By grasping these factors, you can navigate payday loan amounts and offers more effectively, ensuring you select the best option for your needs.

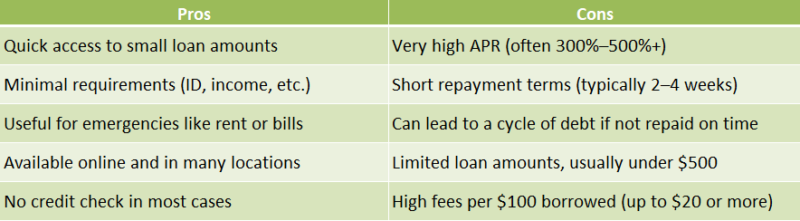

The Pros and Cons of Different Payday Loan Amounts

Understanding payday loans and their amounts is essential for making informed financial decisions. These loans can be lifesavers in emergencies, but they come with pros and cons that you should consider.

Pros of Higher Loan Amounts

- Quick Access: Larger loans can cover significant expenses like car repairs or medical bills.

- Less Frequent Borrowing: Receiving a larger sum means you may not need to borrow again soon.

Cons of Higher Loan Amounts

- Higher Fees: Bigger loans typically incur higher fees, increasing overall costs.

- Debt Risk: If repayment is difficult, you could fall into a cycle of debt that’s hard to escape.

Pros of Lower Loan Amounts

- Manageable Payments: Smaller loans lead to smaller, more manageable payments.

- Lower Fees: They usually come with lower fees, making them less expensive overall.

Cons of Lower Loan Amounts

- Limited Coverage: Smaller amounts may not suffice for larger emergencies, necessitating additional borrowing.

- Frequent Borrowing: This could lead to taking out multiple loans, which can accumulate quickly.

Personalized Loan Options at ASAPPayday! – Apply Now!

What Factors Influence Your Payday Loan Offer?

When considering a payday loan, understanding the factors that influence your payday loan amounts & offers is crucial. This knowledge can help you make informed decisions and avoid potential pitfalls. After all, no one wants to be caught off guard by unexpected terms or fees!

Your Income Level

Your income plays a significant role in determining your payday loan offer. Lenders want to ensure you can repay the loan, so higher incomes often lead to larger loan amounts.

Credit History

While payday loans typically have less stringent credit requirements, your credit history can still impact your offer. A better credit score may result in more favorable terms, while a poor score might limit your options.

Loan Repayment History

If you’ve taken out payday loans before, your repayment history will be considered. Consistent, on-time payments can lead to better offers in the future.

State Regulations

Lastly, remember that state laws affect payday loan amounts & offers. Some states have caps on how much you can borrow, which can influence the lender’s offer. Understanding these factors can empower you to navigate the payday loan landscape confidently.

Can You Negotiate Your Payday Loan Amount?

When considering payday loans, understanding the amounts and offers available is crucial. Many people find themselves in a tight spot financially, and payday loans can seem like a quick fix. However, knowing whether you can negotiate your payday loan amount can make a significant difference in your financial journey.

While payday loans often come with fixed amounts, there are situations where negotiation is possible. Here are some key points to consider:

Key Insights:

- Lender Flexibility: Some lenders may be open to adjusting the loan amount based on your financial situation.

- Creditworthiness: If you have a good credit score, you might have more leverage to negotiate better terms.

- Loan Purpose: Clearly explaining why you need the loan can help lenders understand your situation and possibly offer a better deal.

In conclusion, while payday loan amounts and offers can seem rigid, there is often room for negotiation. Always communicate openly with your lender to explore your options.

Exploring State Regulations on Payday Loan Amounts

When considering payday loans, understanding the amounts and offers available is crucial. These loans can be a quick fix for financial emergencies, but they come with specific rules that vary by state. Knowing these regulations helps you make informed decisions and avoid pitfalls.

What Are Payday Loan Amounts?

Payday loan amounts can differ significantly from one state to another. Some states allow larger loans, while others cap the amount to protect consumers. This means you might find offers ranging from $100 to $1,500, depending on where you live.

Key Factors to Consider

- State Limits: Each state has its own maximum loan amount.

- Interest Rates: Rates can vary, affecting how much you repay.

- Loan Terms: Understand the repayment period, which can influence your financial planning.

By knowing these details, you can better navigate payday loan amounts and offers, ensuring you choose the right option for your needs.

How to Choose the Right Payday Loan Offer for Your Needs

Choosing the right payday loan offer can feel overwhelming, especially when you see so many payday loan amounts & offers available. Understanding what to look for is crucial, as it can help you avoid financial pitfalls and find a loan that truly meets your needs. Let’s break it down!

Know Your Needs

Before diving into payday loan amounts & offers, take a moment to assess your financial situation. Ask yourself:

- How much money do I need?

- When can I repay it?

- What fees are involved?

Knowing these details will guide you in selecting the right loan.

Compare Offers

Not all payday loans are created equal. When comparing offers, consider the following:

- Interest Rates: Lower rates mean less money paid back.

- Repayment Terms: Ensure you can meet the repayment schedule.

- Lender Reputation: Research reviews to find trustworthy lenders.

Taking the time to compare can save you money and stress!

The Role of Credit Scores in Payday Loan Amounts & Offers

When considering payday loan amounts and offers, understanding the role of credit scores is crucial. Your credit score is like a report card for your financial behavior. It tells lenders how reliable you are when it comes to borrowing money. So, why does this matter?

How Credit Scores Affect Loan Offers

A higher credit score can open doors to better payday loan amounts and offers. Lenders see you as a lower risk, which means they might offer you more money or lower fees. On the flip side, a lower score can limit your options. You might get offered less money or face higher interest rates.

Key Points to Remember

- Higher Scores = Better Offers: A good credit score often leads to more favorable payday loan amounts and offers.

- Lower Scores = Limited Options: If your score is low, expect fewer choices and possibly higher costs.

- Check Your Score: Always know your credit score before applying for a payday loan. It can help you negotiate better terms.

How ASAPPayDay.com Can Help You Navigate Payday Loan Options

When facing financial challenges, understanding payday loan amounts and offers is essential. These loans can provide quick cash, but knowing what to expect is crucial. That’s where ASAPPayDay.com helps you make informed decisions.

Understanding Loan Amounts

Payday loans usually range from $100 to $1,000. Choosing an amount you can comfortably repay is vital. At ASAPPayDay.com, we guide you through available options to find a suitable loan without straining your finances.

Comparing Offers

Not all payday loan offers are created equal. Some may come with higher fees or shorter repayment terms. With ASAPPayDay.com, you can compare offers side by side, helping you find the best deal and avoid costly mistakes.

Tips for Choosing the Right Loan

When selecting a payday loan, consider these tips:

- Assess Your Needs: Know how much you need.

- Check the Terms: Look for clear repayment terms.

- Read Reviews: Research lender reputations.

The Importance of Responsible Borrowing

Borrow responsibly by only taking what you can repay on time. ASAPPayDay.com emphasizes financial health to help you avoid debt cycles.

FAQs

💰 How much can I borrow with a payday loan?

Payday loan amounts typically range from $100 to $1,000, depending on your state laws, income, and the lender. Some states set strict caps on the maximum loan amount allowed.

📋 What affects the amount I’m offered?

Lenders consider your monthly income, employment status, and sometimes your banking history. Most will offer up to 30% of your monthly income.

🎁 Do payday lenders offer special promotions or discounts?

Some lenders offer first-time borrower discounts, referral bonuses, or fee waivers. These vary by lender and may require specific terms like early repayment or auto-debit enrollment.

🔁 Can I get more money if I repay on time?

Yes, many payday lenders may increase your loan limit over time if you build a good repayment history with them. This can lead to larger loans or better terms on future applications.

⚠️ Are there limits on payday loan offers by state?

Yes. Each state has its own rules on loan caps, fees, and rollover policies. For example, California caps payday loans at $300, while Texas allows higher amounts with fewer restrictions.

Quick Cash Before You Go with ASAPPayday!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.

Find a Payday Loan!

"*" indicates required fields