What Do I Need for a Payday Advance?

When unexpected expenses arise, understanding payday advances can be a lifesaver. You may wonder, what do I need for a payday advance? Knowing the essentials can help you navigate this financial option confidently.

Basic Requirements

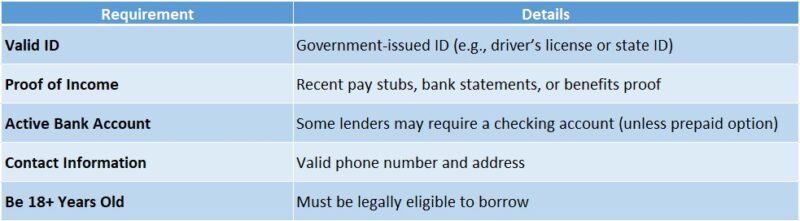

To obtain a payday advance, you typically need:

- Proof of Identity: A government-issued ID, like a driver’s license or passport.

- Proof of Income: Recent pay stubs or bank statements to demonstrate your ability to repay the loan.

- Active Bank Account: A checking account for fund deposits and loan repayments.

Why These Documents Matter

These documents are crucial for lenders to verify your identity and repayment capability. Without them, securing a payday loan can be difficult. Understanding payday loans basics means being prepared for your responsibilities as a borrower.

Additional Considerations

Consider these factors:

- Age Requirement: You must be at least 18 years old to apply.

- Residency: Many lenders require you to be a resident of the state where you apply.

- Credit Check: Some lenders may perform a credit check, but many do not.

Understanding the Costs

Payday advances can come with high fees. Always inquire about interest rates and repayment terms to avoid unexpected costs.

Fast Approval with ASAPPayday – Start Here!

Essential Documents for a Payday Advance: What to Prepare

When you’re in a financial pinch, knowing what do I need for a payday advance can make all the difference. Payday loans can provide quick cash to cover unexpected expenses, but you’ll need to gather some essential documents first. Let’s dive into what you should prepare to make the process smoother and faster.

Identification

First and foremost, you’ll need a valid form of identification. This could be a driver’s license, state ID, or even a passport. It proves who you are and helps lenders feel secure about giving you a loan.

Proof of Income

Next, you’ll need to show proof of income. This can be a recent pay stub, bank statement, or even a letter from your employer. Lenders want to see that you have a reliable source of income to repay the loan.

Bank Account Information

Lastly, don’t forget your bank account details. Most payday lenders require you to have an active checking account. This is where they’ll deposit your loan and withdraw repayments. Having these documents ready can help you understand payday loans basics and speed up the application process.

Personalized Loan Options at ASAPPayday! – Apply Now!

How to Qualify for a Payday Advance: Key Requirements

When you’re in a tight spot financially, understanding what do I need for a payday advance can make all the difference. These short-term loans can provide quick cash to help you cover unexpected expenses. But before you dive in, it’s essential to know the key requirements to qualify for a payday loan.

Basic Eligibility Criteria

To get a payday advance, you typically need to meet a few basic criteria:

- Age: You must be at least 18 years old.

- Income: A steady source of income is crucial. This can be from a job, government benefits, or other reliable sources.

- Bank Account: Most lenders require you to have an active checking account where they can deposit the funds and withdraw repayments.

Additional Considerations

While these are the basics, lenders may also look at your credit history. However, many payday loans focus more on your income than your credit score. Remember, understanding payday loans basics helps you navigate the process better, ensuring you make informed decisions.

Also Read: Payday Loans Basics: What You Need to Know Before Borrowing

The Application Process: What Do I Need for a Payday Advance?

When you’re facing financial difficulties, knowing the application process for a payday advance is essential. Understanding what do I need for a payday advance can transform your experience from stressful to manageable. Let’s simplify it so you feel ready and confident.

Basic Requirements

To apply for a payday loan, you generally need:

- Identification: A government-issued ID, like a driver’s license.

- Proof of Income: Recent pay stubs or bank statements.

- Bank Account: A checking account for fund deposits.

Additional Information

Some lenders may require extra details, such as:

- Social Security Number: For identity verification.

- Contact Information: A phone number and address.

Gathering these documents can expedite the process and enhance your understanding of Payday Loans Basics. Being prepared is crucial!

Understanding the Terms

Before applying, familiarize yourself with the loan terms, including interest rates and repayment schedules, to avoid surprises.

Choosing a Lender

Research various payday loan providers to find one that fits your needs. Check reviews and compare fees to make an informed choice.

Final Thoughts

In summary, knowing what do I need for a payday advance empowers you to navigate the process smoothly and make informed decisions.

Common Misconceptions About Payday Advances: What You Should Know

When considering a payday advance, many people wonder, “What do I need for a payday advance?” Understanding this is crucial because it helps you prepare and avoid common pitfalls. Payday loans can be a quick solution for urgent cash needs, but misconceptions often cloud their benefits.

You Need Perfect Credit

One big myth is that you need perfect credit to qualify for payday loans. In reality, payday loans basics show that lenders often focus more on your income than your credit score. This means even if your credit isn’t great, you might still get approved!

A Long Application Process

Another misconception is that applying for a payday advance takes forever. Most lenders offer quick online applications, allowing you to get cash in hand within a day. This speed can be a lifesaver when unexpected expenses arise!

Hidden Fees Galore

Lastly, many believe payday loans come with hidden fees. While there are fees, being informed about what to expect can help you avoid surprises. Always read the terms carefully before signing anything. This way, you can make a smart decision that fits your needs.

How Much Can I Borrow? Understanding Limits on Payday Advances

When you’re facing financial challenges, knowing what do I need for a payday advance is vital. Understanding how much you can borrow allows you to make informed decisions and reduces stress. Let’s explore the limits of payday advances!

Payday loans are short-term loans designed to cover urgent expenses until your next paycheck. The amount you can borrow varies based on several factors:

Factors Affecting Your Loan Amount

- Income Level: Lenders assess your monthly income to determine your borrowing capacity. Generally, a higher income allows for a larger loan.

- State Regulations: Laws differ by state, impacting the maximum loan amount available to you.

- Lender Policies: Each lender has unique rules, so it’s wise to compare offers before choosing.

Typical Loan Amounts

Most payday advances range from $100 to $1,000, but the specific amount depends on your income and state laws. Always verify limits with your lender.

Repayment Considerations

Payday loans are typically due within two weeks. Ensure you can manage the repayment to avoid debt cycles.

Final Thoughts

Knowing how much you can borrow is crucial for making smart financial choices. Always read the fine print before signing any agreement.

Where to Find Reliable Payday Advance Services: Tips and Resources

When you’re in a financial pinch, understanding what do I need for a payday advance can make all the difference. It’s essential to know how to find reliable payday advance services that won’t leave you in a worse situation. Let’s explore some tips and resources to help you navigate this process smoothly.

Research Online Reviews

Look for payday loan companies with positive reviews. Websites like Trustpilot or the Better Business Bureau can provide insights into customer experiences. This way, you can avoid scams and find trustworthy lenders.

Check for Licensing

Ensure the payday advance service is licensed in your state. Each state has its own regulations, and licensed lenders follow the law, protecting you from unfair practices. This is a crucial step in understanding Payday Loans Basics.

Compare Rates and Terms

Don’t settle for the first offer. Compare interest rates and repayment terms from different lenders. This will help you find the best deal and understand what you’re getting into. Remember, a little research can save you a lot of money!

How ASAPPayday.com Can Help You Secure a Payday Advance

When you’re in a tight spot financially, knowing what you need for a payday advance can make all the difference. Understanding the basics of payday loans helps you navigate the process smoothly and ensures you’re prepared for what’s ahead. Let’s explore how ASAPPayday.com can assist you in securing that much-needed cash.

At ASAPPayday.com, we simplify the payday loan process. Here’s what you typically need for a payday advance:

- Proof of Income: This can be a paycheck stub or bank statement. It shows lenders that you can repay the loan.

- Identification: A valid ID, like a driver’s license or passport, is essential to verify your identity.

- Bank Account Information: Lenders need your bank details to deposit the funds directly into your account.

By gathering these documents, you’ll be ready to apply for a payday advance with confidence. Plus, our user-friendly platform guides you through each step, making it easier than ever to understand payday loans basics.

FAQs

💡 What basic requirements do I need for a payday advance?

You usually need to be at least 18 years old, have a steady income, and possess a valid government-issued ID.

📄 Do I need a bank account to get a payday advance?

Yes, most lenders require an active checking account to deposit funds and withdraw repayments.

📱 Can I apply for a payday advance online?

Absolutely. Many lenders offer fast online applications with instant decisions and same-day funding.

📆 How recent does my income proof need to be?

Lenders typically ask for recent pay stubs or bank statements from the last 30 days to verify your income.

🔐 Is a credit check required for a payday advance?

Not always. Many payday lenders approve loans without a traditional credit check, focusing more on your income.

Quick Cash Before You Go with ASAPPayday!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.

Find a Payday Loan!

"*" indicates required fields