Online Payday Loans in Ohio: Quick & Easy

If you’ve ever found yourself in a pinch and needed cash fast, you might have considered online payday loans in Ohio. These loans are designed to help people cover unexpected expenses without the hassle of traditional bank loans. With a simple application process, they offer a quick solution when time is of the essence.

Why Choose Online Payday Loans in Ohio?

- Convenience: You can apply from the comfort of your home.

- Speed: Get approved and receive funds quickly.

- Accessibility: Available to those with less-than-perfect credit.

Applying for payday loans by state, especially in Ohio, is straightforward. You just need to fill out an online form, and in most cases, you’ll know if you’re approved within minutes. This makes it a great option for emergencies when you can’t wait for a traditional loan.

Things to Keep in Mind

- Interest Rates: Payday loans often have higher interest rates.

- Repayment Terms: Usually due by your next payday.

In summary, online payday loans in Ohio offer a no-hassle application process that can be a lifesaver in urgent situations. Just remember to read the terms carefully and ensure you can repay the loan on time to avoid extra fees.

Fast Approval with ASAPPayday – Start Here!

How to Apply for Online Payday Loans in Ohio Without the Hassle

Applying for online payday loans in Ohio can be a breeze if you know the right steps. These loans are a quick solution when you need cash fast, and the process is designed to be simple and straightforward. Let’s explore how you can apply without any hassle.

Step-by-Step Guide to a Smooth Application

- Research Lenders: Start by searching for reputable lenders offering online payday loans in Ohio. Look for reviews and ratings to ensure they are trustworthy.

- Check Eligibility: Most lenders require you to be at least 18 years old, have a steady income, and a valid bank account.

- Gather Documents: Prepare necessary documents like your ID, proof of income, and bank details. Having these ready speeds up the process.

- Fill Out the Application: Complete the online form with accurate information. Double-check for errors to avoid delays.

- Submit and Wait: Once submitted, lenders typically respond quickly, often within a few hours.

Benefits of Online Payday Loans by State

- Convenience: Apply from anywhere in Ohio, anytime.

- Speed: Quick approval and fast access to funds.

- Flexibility: Use the loan for any immediate financial need.

By following these steps, you can secure online payday loans in Ohio without the usual stress, ensuring you get the funds you need swiftly and efficiently.

Personalized Loan Options at ASAPPayday! – Apply Now!

Are Online Payday Loans in Ohio Right for You? Evaluating Your Options

When unexpected expenses arise, online payday loans in Ohio can provide a quick financial solution. These loans feature a straightforward application process, allowing you to access funds without the hassle of traditional lending. However, it’s essential to determine if they suit your needs.

Understanding Online Payday Loans

These short-term loans are designed to bridge financial gaps until your next paycheck. They offer fast approval, easy access from home, and no credit check, making them ideal for those with less-than-perfect credit.

Evaluating Your Needs

Consider your financial situation before applying:

- Is the money needed urgently?

- Can you repay the loan by your next payday?

- Are there better alternatives available?

Comparing Payday Loans by State

Regulations and interest rates for payday loans differ by state. In Ohio, consumer protection caps exist, but it’s still vital to compare options and understand the terms.

By assessing your needs and understanding the loan terms, you can decide if online payday loans in Ohio are the right choice for your financial situation.

Also Read: Payday Loans by State: Online Options & Local Availability

The Benefits of Choosing Online Payday Loans in Ohio

When unexpected expenses pop up, finding a quick and easy solution is crucial. That’s where online payday loans in Ohio come in handy. These loans offer a no-hassle application process, making it simple for anyone in need of fast cash. Whether it’s a car repair or a medical bill, payday loans by state can be a lifesaver.

Quick and Convenient Application

Applying for online payday loans in Ohio is as easy as pie. You can complete the entire process from the comfort of your home. No need to visit a bank or fill out endless paperwork. Just a few clicks, and you’re done!

Fast Approval and Access to Funds

One of the best things about these loans is the speedy approval. Once you apply, you often get a decision within minutes. If approved, the money is deposited directly into your bank account, usually by the next business day.

Flexible Use of Funds

With payday loans by state, you have the freedom to use the money however you need. Whether it’s paying bills, buying groceries, or handling emergencies, the choice is yours. This flexibility makes them a popular choice for many Ohio residents.

Navigating the Legal Landscape of Online Payday Loans in Ohio

Online payday loans in Ohio offer a quick and easy solution for those unexpected expenses that pop up. But, understanding the legal landscape is crucial to ensure a smooth borrowing experience. Ohio has specific laws that regulate payday loans, making it essential to know your rights and responsibilities.

Understanding Ohio’s Payday Loan Laws

Ohio has set clear rules to protect borrowers. The state limits the amount you can borrow and caps interest rates to prevent excessive fees. This means you can get the cash you need without falling into a debt trap. Always check the lender’s compliance with Ohio’s regulations before applying.

Benefits of Payday Loans by State

- Quick Access: Get funds fast without lengthy paperwork.

- Convenience: Apply online from the comfort of your home.

- Regulated Environment: Ohio’s laws ensure fair lending practices.

Steps to a Hassle-Free Application

- Research Lenders: Choose a reputable lender that follows Ohio’s laws.

- Gather Information: Have your ID, bank details, and income proof ready.

- Apply Online: Fill out the application form and submit.

By understanding the legal framework and following these steps, you can confidently navigate the world of online payday loans in Ohio.

Avoiding Common Pitfalls with Online Payday Loans in Ohio

Online payday loans in Ohio can be a convenient solution when you’re in a financial bind. They’re fast, simple, and accessible from home. However, it’s crucial to be aware of potential pitfalls to make informed decisions.

Watch Out for High Fees

- Understand the Costs: Payday loans often carry high fees. Ensure you know the total cost before committing.

- Compare Options: Different lenders offer varying rates. Shop around to find the best deal.

Read the Fine Print

- Know the Terms: Carefully read the terms and conditions to avoid unexpected surprises.

- Ask Questions: If anything is unclear, seek clarification from the lender.

Plan for Repayment

- Budget Wisely: Have a repayment plan to avoid late fees.

- Consider Alternatives: If repayment is uncertain, consider other options like borrowing from friends or family.

By following these tips, you can confidently navigate payday loans by state. Staying informed is your best defense against common pitfalls, ensuring you make smart financial choices.

How ASAPPayday.com Simplifies Your Online Payday Loan Experience in Ohio

At ASAPPayday.com, we understand that when you need cash quickly, the last thing you want is a complicated process. That’s why we’ve made applying for online payday loans in Ohio as easy as possible. Whether you’re dealing with an unexpected expense or just need a little extra to tide you over, our streamlined application process is designed to get you the funds you need without the hassle.

Easy Application Process

- Quick Start: Start your application with just a few clicks.

- Simple Requirements: All you need is a steady income and a bank account.

- Fast Approval: Get approved in minutes, not days.

Why Choose Payday Loans by State?

By choosing payday loans by state, you’re working with a lender who understands your local needs. At ASAPPayday.com, we offer services tailored to Ohio residents, ensuring you receive the best terms and conditions. Our team is always ready to assist, making the process even smoother.

Benefits of Using ASAPPayday.com

- No Hidden Fees: What you see is what you get.

- Secure Transactions: Your information is safe with us.

- 24/7 Support: We’re here to help whenever you need us.

With ASAPPayday.com, obtaining an online payday loan in Ohio is straightforward and stress-free. Apply today and see the difference!

Frequently Asked Questions About Online Payday Loans in Ohio

💻 Are online payday loans legal in Ohio?

Yes, online payday loans are legal in Ohio, but they are regulated under the Ohio Fairness in Lending Act to protect consumers from excessive fees and interest rates.

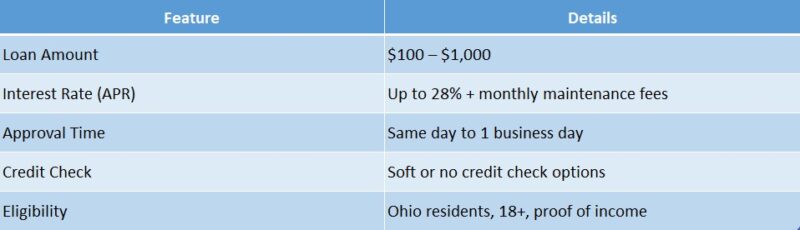

💵 How much can I borrow with a payday loan in Ohio?

You can typically borrow between $100 and $1,000, but the total amount of payday loans outstanding cannot exceed $2,500 at any one time.

🧾 What are the repayment terms for payday loans in Ohio?

The minimum term is 91 days unless the loan amount is under 6% of your gross monthly income or 7% of your net income, which allows for shorter terms.

🏦 Do I need good credit to get a payday loan in Ohio?

No, most online payday lenders in Ohio do not require good credit and may approve loans based on income and employment status instead.

⚠️ What protections do Ohio borrowers have from predatory lending?

Ohio law caps APR at 28%, limits total loan costs, and prohibits criminal action for non-payment, offering strong protections against abusive lending practices.

Quick Cash Before You Go with ASAPPayday!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.

Find a Payday Loan!

"*" indicates required fields