How Do Online Loan Payment Portals Work?

Understanding how online loan payment portals work is essential for anyone looking to manage their loans effectively. These platforms simplify the repayment process, making it easier for borrowers to stay on top of their payments. Let’s dive into the details!

What Are Online Loan Payment Portals?

Online loan payment portals are digital platforms that allow borrowers to make payments on their loans conveniently. They provide a user-friendly interface where you can view your loan details, payment history, and upcoming due dates. This means no more mailing checks or worrying about late fees!

Benefits of Using Online Loan Payment Portals

- Convenience: Pay anytime, anywhere!

- Instant Access: View your loan balance and payment history at a glance.

- Payment Reminders: Get notifications to help you remember due dates.

- Multiple Payment Options: Choose from various payday loan repayment options to suit your needs.

By using these portals, you can manage your loans more efficiently and avoid unnecessary stress.

Fast Approval with ASAPPayday – Start Here!

How Do Online Loan Payment Portals Simplify Your Payment Process?

Managing loans can be stressful, but online loan payment portals are here to help! These platforms make it easy to keep track of your payments and ensure you never miss a due date. Understanding how they work can save you time and hassle, especially when it comes to payday loan repayment options.

What Are Online Loan Payment Portals?

Online loan payment portals are secure websites or apps that allow you to manage your loan payments from anywhere. You can log in, view your balance, and make payments with just a few clicks. This convenience means you can pay your loans anytime, whether you’re at home or on the go!

Benefits of Using Online Loan Payment Portals

- Easy Access: You can access your account 24/7, making it simple to check your payment status.

- Automatic Payments: Set up automatic payments to avoid late fees.

- Payment History: Keep track of your past payments, which is helpful for budgeting.

- Multiple Payment Options: Choose from various payday loan repayment options, like credit cards or bank transfers.

Personalized Loan Options at ASAPPayday! – Apply Now!

The Technology Behind Online Loan Payment Portals: What You Need to Know

Understanding how online loan payment portals work is crucial for anyone looking to manage their loans effectively. These platforms simplify the repayment process, making it easier to stay on top of your finances. With the rise of digital banking, knowing how to navigate these portals can save you time and stress.

The Basics of Online Loan Payment Portals

Online loan payment portals are secure websites or apps that allow borrowers to manage their loans. They provide a user-friendly interface where you can view your loan balance, payment history, and upcoming due dates. Most importantly, they enable you to make payments quickly and easily, often with just a few clicks!

Key Features of Online Loan Payment Portals

- Convenience: Pay anytime, anywhere, using your computer or smartphone.

- Payment Tracking: Keep an eye on your repayment progress and history.

- Multiple Payment Options: Choose from various payday loan repayment options, including automatic withdrawals or one-time payments.

By utilizing these features, you can ensure that your loan payments are made on time, helping you avoid late fees and maintain a good credit score.

Are Online Loan Payment Portals Secure? Exploring Safety Measures

Managing loans effectively requires understanding how online loan payment portals function. These platforms make it easier to handle payments, particularly for payday loan repayment options. However, with this convenience comes the important question of security. Let’s delve into how these portals protect your information.

Encryption Technology

Most online loan payment portals utilize encryption technology to safeguard your data. This process scrambles your personal information, making it unreadable to unauthorized users, ensuring your details remain secure during transactions.

Secure Payment Methods

These portals typically provide secure payment methods, such as credit cards or bank transfers, adding an extra layer of protection for your transactions. Always opt for well-known and trusted payment options.

Regular Security Updates

Reputable online loan payment portals regularly update their security measures to defend against emerging threats. This continuous vigilance is akin to having a dedicated security team on duty. In summary, while online loan payment portals offer convenience, it’s vital to confirm they implement robust security measures. Understanding their workings and safety features empowers you to make informed decisions regarding your loan repayments.

Step-by-Step Guide: How to Use an Online Loan Payment Portal Effectively

Managing your loans is easier with online loan payment portals, which allow you to pay from home, saving time and hassle. Understanding how these platforms work is key to maximizing your payday loan repayment options.

1. Create Your Account

Start by visiting your lender’s website to create an account. You’ll need to provide personal information, such as your name and loan details, to access your loan information securely.

2. Log In and Navigate

After setting up your account, log in with your credentials. The dashboard displays your loan balance, payment due dates, and other important details. Familiarize yourself with the layout for quick navigation.

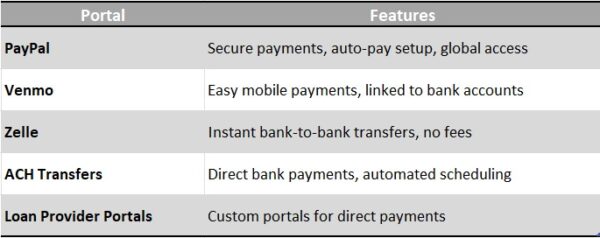

3. Choose Your Payment Method

Most portals offer various payment methods, including bank transfers and credit card payments. Choose the option that suits you best, ensuring you have sufficient funds available.

4. Confirm Your Payment

Once you enter your payment details, double-check everything. Confirm the amount and payment date to avoid mistakes that could result in late fees.

What Features Should You Look for in an Online Loan Payment Portal?

Understanding how online loan payment portals work is essential for anyone looking to manage their loans efficiently. These platforms simplify the process of making payments, tracking balances, and exploring payday loan repayment options. But what features should you look for in an online loan payment portal?

User-Friendly Interface

A good online loan payment portal should be easy to navigate. Look for a clean design that allows you to find what you need quickly. This makes managing your payments less stressful and more efficient.

Security Features

Security is crucial when dealing with financial information. Ensure the portal uses encryption and secure login methods to protect your data. This way, you can make payments confidently, knowing your information is safe.

Payment Flexibility

Different lenders offer various payday loan repayment options. Choose a portal that allows you to set up automatic payments, make one-time payments, or even pay extra when you can. Flexibility can help you manage your loans better and avoid late fees.

The Benefits of Using Online Loan Payment Portals for Borrowers

In today’s fast-paced world, managing finances can be a challenge, especially when it comes to repaying loans. Understanding how online loan payment portals work is crucial for borrowers. These platforms simplify the repayment process, making it easier to stay on top of your financial commitments.

Convenience at Your Fingertips

Online loan payment portals offer a user-friendly experience. With just a few clicks, you can make payments anytime, anywhere. This convenience is especially helpful for those exploring payday loan repayment options, allowing you to avoid late fees and keep your credit score intact.

Secure Transactions

Security is a top priority for online loan payment portals. They use encryption technology to protect your personal information. This means you can make payments confidently, knowing your data is safe from prying eyes. Plus, many portals offer reminders for upcoming payments, helping you stay organized.

How ‘ASAPPayday.com’ Enhances Your Experience with Online Loan Payment Portals

Managing loans effectively requires understanding how online loan payment portals function. These platforms simplify tracking payments and help borrowers avoid late fees. As digital banking grows, knowing how to navigate these portals can greatly enhance your financial experience.

At ‘ASAPPayday.com’, we focus on your convenience. Our user-friendly online loan payment portals allow you to access your account anytime, anywhere. Here’s how we ensure a seamless experience:

- Easy Navigation: Our straightforward interface helps you find what you need quickly.

- Multiple Payment Options: Select from various payday loan repayment options tailored to your financial needs.

- Real-Time Updates: Receive instant notifications about your payment status to manage your budget effectively.

Additionally, our portals feature enhanced security measures to protect your personal information. With 24/7 access, you can make payments at your convenience, ensuring you never miss a due date. This flexibility is what sets ‘ASAPPayday.com’ apart in online loan management.

Common Issues with Online Loan Payment Portals and How to Resolve Them

Online loan payment portals have become a popular way for borrowers to manage their loans conveniently. Understanding how these platforms work is essential, especially when issues arise. Knowing how to navigate these challenges can save you time and stress, ensuring your payday loan repayment options are handled smoothly.

Technical Glitches

Sometimes, online loan payment portals can experience technical glitches. This might mean you can’t log in or your payment doesn’t go through. If this happens, try refreshing the page or clearing your browser’s cache. If problems persist, contact customer support for help.

Payment Processing Delays

Another common issue is payment processing delays. You might think your payment is made, but it hasn’t been processed yet. Always check your account balance and transaction history. If you notice a delay, reach out to your lender to confirm the status of your payment. They can provide clarity and assistance.

FAQs

⭐ What is an online loan payment portal?

An online loan payment portal is a secure digital platform that allows borrowers to make payments on their loans electronically.

⭐ How do I access my lender’s online payment portal?

You can typically access it through the lender’s website or mobile app using your login credentials.

⭐ What payment methods are accepted on loan payment portals?

Most portals accept bank transfers, debit/credit cards, and ACH payments for loan repayment.

⭐ Are online loan payment portals secure?

Yes, reputable portals use encryption and authentication to protect your financial information.

⭐ Can I set up automatic payments through an online portal?

Yes, many lenders allow borrowers to schedule automatic payments to avoid missing due dates.

Quick Cash Before You Go with ASAPPayday!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.

Find a Payday Loan!

"*" indicates required fields