What Happens with Loan Repayment Extensions and Penalties?

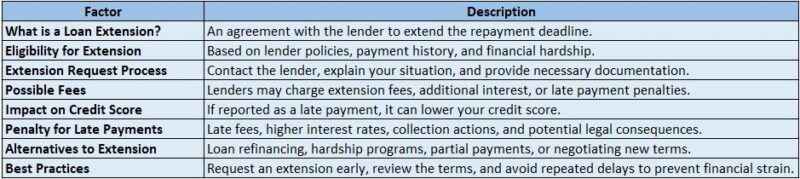

Facing unexpected financial challenges can make a loan repayment extension feel like a lifeline. This option allows borrowers to delay payments for a set period, providing some much-needed breathing room. However, it is essential to grasp the potential implications of extending your loan repayment. While it may seem beneficial initially, there are penalties and fees that could arise, particularly with payday loans. For example, extending your repayment period can lead to higher interest costs, ultimately increasing your total debt. Consider these important factors regarding loan repayment extensions and penalties:

- Increased Interest: An extended loan often results in accruing more interest, raising the total amount owed.

- Fees: Lenders may impose fees for extending repayment, further straining your finances.

- Credit Impact: Missing payments or neglecting to communicate with your lender can negatively affect your credit score, hindering future loan opportunities.

- Stress Relief: On the upside, a repayment extension can offer immediate relief, helping you manage your finances in the short term.

However, it is vital to balance the immediate benefits with the potential long-term consequences.

Fast Approval with ASAPPayday – Start Here!

How Loan Repayment Extensions Work

When unexpected expenses arise, you may consider a loan repayment extension. This option allows you to delay your payment due date, giving you extra time to gather the necessary funds. While this can be a lifesaver during temporary financial difficulties, it is essential to understand the implications, as extensions often come with penalties and additional interest charges. Here are some key points to keep in mind regarding loan repayment extensions:

- Increased Costs: Extensions can provide immediate relief but may lead to higher overall costs due to added interest and fees.

- Impact on Credit Score: The way your lender reports the extension can affect your credit score, so it is wise to check their policies.

- Alternatives Available: Before opting for an extension, consider other payday loan repayment options.

Some lenders may offer flexible repayment plans or hardship programs that could be more advantageous. For instance, if you have a payday loan due soon but face an unexpected car repair bill, requesting an extension could give you an extra two weeks to pay. However, be cautious, as this may incur fees and increase your total repayment amount. Weigh the pros and cons carefully, as extensions are not a long-term solution to financial challenges.

Common Reasons for Seeking Loan Repayment Extensions

Life can throw unexpected challenges our way, especially when it comes to finances. One common solution borrowers consider is seeking a loan repayment extension, which allows individuals to extend their repayment period for some much-needed relief. But what are the reasons behind these extensions, and what penalties might accompany them?

- Job Loss or Reduced Income: Losing a job or facing a pay cut can make it tough to meet monthly payments. An extension can provide temporary relief while you look for new employment.

- Unexpected Medical Expenses: Health issues can lead to unforeseen costs, making it difficult to keep up with loan obligations. An extension can help manage these expenses without falling behind.

- Major Life Changes: Events like divorce or relocation can disrupt financial stability. Extending your loan repayment can ease transitions and allow for regrouping financially. While loan repayment extensions can provide relief, they often come with penalties or additional interest.

It’s essential to understand the terms before proceeding. Key insights include:

- Increased Total Cost: Extending your loan may lead to higher overall costs due to added interest.

- Impact on Credit Score: Not communicating with your lender can negatively affect your credit score.

- Payday Loan Repayment Options: If you’re in a cycle of payday loans, discuss alternative repayment options with your lender to avoid further strain. Open communication is vital in navigating these challenges.

Personalized Loan Options at ASAPPayday! – Apply Now!

The Impact of Loan Repayment Extensions on Credit Scores

When facing financial difficulties, loan repayment extensions can appear to be a helpful solution. However, it is crucial to understand their potential impact on your credit score. While extending a loan may provide temporary relief from payments, it can also lead to penalties and additional interest charges. These factors can negatively affect your credit score, particularly if the lender reports the extension to credit bureaus.

For instance, if you have a payday loan that you cannot repay on time, opting for a repayment extension gives you extra time to gather funds. Yet, lenders often charge fees for this service, which can accumulate and increase your total debt. If not managed properly, this can harm your credit score. Here are some important insights regarding loan repayment extensions and penalties:

- Increased Debt: Extensions typically come with extra fees, raising your overall loan amount.

- Credit Score Impact: Extensions or late payments can be reported, resulting in a lower credit score.

- Future Borrowing: A diminished credit score can hinder your ability to secure loans later on.

- Consider Alternatives: Before choosing an extension, look into other payday loan repayment options that may be less harmful to your credit.

Exploring Loan Repayment Penalties and Fees

Managing loans effectively requires a clear understanding of repayment extensions and penalties. Borrowers often need extra time to make payments, and while extensions can offer temporary relief, they come with challenges. Extending your repayment period may lead to higher interest costs, ultimately making your loan more expensive. Therefore, it’s crucial to consider these factors before opting for an extension. In addition to potential interest increases, borrowers must be aware of penalties associated with late payments or missed deadlines. These penalties can vary by lender and loan type. Common consequences include:

- Late fees that increase your overall debt

- Negative impacts on your credit score

- Higher interest rates for future loans

- Difficulty securing future credit due to a poor repayment history.

Understanding these penalties is essential for making informed repayment decisions. If you’re struggling with payday loans, exploring repayment options is vital. Many lenders provide flexible repayment plans to ease financial burdens. Consider these strategies:

- Communicate with your lender about your situation; they may offer extensions or alternative plans.

- Prioritize payments to avoid penalties.

- Think about consolidating loans to simplify repayment.

By taking proactive steps, you can navigate loan repayment complexities and avoid penalties and fees.

How to Avoid Penalties During Loan Repayment Extensions

Facing unexpected financial challenges can make a loan repayment extension seem like a lifeline. However, it is vital to grasp the implications of extending your repayment period. While it may offer temporary relief, it can also lead to penalties if not handled properly. Some lenders might impose additional fees or raise your interest rate, making your loan more costly over time. Therefore, navigating these situations is crucial for your financial well-being. To avoid penalties during loan repayment extensions, consider these steps:

- Communicate with your lender: Keeping an open line of communication is essential. Lenders value honesty and may provide more flexible options if they understand your circumstances.

- Review your loan agreement: Familiarize yourself with the terms regarding extensions to identify potential penalties upfront.

- Explore payday loan repayment options: If considering a payday loan, research various repayment plans that may offer better terms, helping you avoid hefty penalties.

Real-world examples illustrate effective management of loan repayment extensions. For instance, a borrower who communicated early with their lender about financial issues successfully negotiated a lower interest rate on their extended repayment plan. Conversely, another borrower who delayed communication faced significant penalties, increasing their total repayment amount. These examples underscore the importance of proactive engagement and understanding your loan terms to prevent unnecessary costs.

The Benefits of Requesting a Loan Repayment Extension

When unexpected financial challenges arise, a loan repayment extension can be a crucial option for borrowers. This allows them to postpone payments, providing the necessary time to regain stability. However, it is essential to note that while extensions offer immediate relief, they may also incur penalties or additional interest. Despite these potential drawbacks, the benefits often outweigh them, especially during temporary hardships. Here are some key benefits of requesting a loan repayment extension:

- Reduced Financial Stress: Extending your repayment period can lower monthly payments, making budgeting easier.

- Avoiding Default: An extension can prevent defaulting on your loan, which can have severe long-term effects.

- Improved Credit Score: Staying on track with payments, even with an extension, can help maintain or enhance your credit score over time.

- Flexibility: Many lenders provide various repayment options, including payday loan repayment options, tailored to fit individual financial situations.

To request a loan repayment extension, follow these steps:

- Contact Your Lender: Reach out as soon as you need help; lenders are often willing to work with you.

- Explain Your Situation: Be honest about your financial difficulties, as transparency can lead to better terms.

- Review the Terms: Carefully examine any penalties or additional interest before agreeing to ensure you are comfortable with the new terms.

What to Expect After a Loan Repayment Extension

When facing financial difficulties, a loan repayment extension can appear to be a helpful solution. This extension allows you to postpone your payment due date, providing extra time to secure the necessary funds. However, it is vital to recognize the implications for your financial health. While it offers immediate relief, potential penalties and interest may accumulate during this period, leading to increased costs. Many lenders impose additional fees or raise interest rates, making your loan more expensive over time. Here are some important considerations when thinking about a loan repayment extension:

- Increased Costs: Be aware of possible penalties that can raise your total loan amount.

- Impact on Credit Score: Extensions can negatively affect your credit score if not handled correctly.

- Communication is Key: Always consult with your lender to fully understand the extension terms.

- Explore Alternatives: Investigate payday loan repayment options that may provide better terms than a simple extension. Borrowers who choose repayment extensions often find themselves trapped in a cycle of debt.

For example, extending a payday loan can lead to higher fees, forcing the borrower to take out another loan just to cover the previous one. To avoid this situation, it is essential to carefully weigh the pros and cons and determine if an extension is truly the best choice for your financial circumstances. Staying informed and proactive is crucial for effectively managing loan repayment extensions and penalties.

Tips for Managing Loans with Repayment Extensions and Penalties

Managing loans can be overwhelming, particularly regarding repayment extensions and penalties. If you find yourself unable to meet your loan obligations, understanding the implications of extending your repayment period is crucial. While it may offer temporary relief, it can lead to increased interest costs and potential penalties. For example, opting for an extension on a payday loan might result in paying more in fees than you initially borrowed. Therefore, weighing your options carefully is essential before making a decision. Here are some tips to navigate loans with repayment extensions and penalties:

- Communicate with your lender: Contact your lender as soon as you anticipate needing an extension. They may provide flexible repayment options or alternative solutions.

- Understand the terms: Ensure you fully comprehend the new terms before agreeing to an extension, including any additional fees or interest rates.

- Consider your budget: Evaluate your financial situation to determine if you can manage the extended payments without incurring further debt.

- Explore other options: Investigate other payday loan repayment options, such as consolidating loans or seeking help from financial counseling services.

Ultimately, managing loans with repayment extensions and penalties requires proactive communication and careful planning. Staying informed and making strategic decisions can help you navigate loan repayment complexities while minimizing financial strain. Seeking help early is always better than waiting until the situation becomes unmanageable, as this approach can help you avoid penalties and lead you toward financial stability.

FAQs

-

Can I extend my loan repayment period?

Many lenders allow repayment extensions, but approval depends on loan terms, financial hardship, and lender policies. -

Will I have to pay extra fees for a loan extension?

Some lenders charge extension fees or additional interest, while others may offer hardship extensions at no extra cost. -

How does a loan extension affect my credit score?

If your lender approves the extension and you follow the new terms, it won’t harm your credit. However, late or missed payments before approval can hurt your score. -

What happens if I don’t get a loan extension?

Without an extension, you may face late fees, higher interest rates, debt collection, and credit damage if you miss payments. -

Are there alternatives to loan repayment extensions?

You can consider loan refinancing, debt consolidation, negotiating new repayment terms, or seeking assistance from nonprofit financial organizations.

Quick Cash Before You Go with ASAPPayday!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.

Find a Payday Loan!

"*" indicates required fields