How to Use a Loan Repayment Due Date Tracker?

Managing multiple loan due dates can be challenging, but a Loan Repayment Due Date Tracker can simplify this task. This tool not only reminds you of upcoming payments but also aids in strategic financial planning. It acts as a personal financial assistant, helping you avoid late fees and maintain a good credit score by keeping track of your repayment schedule.

The benefits of using a tracker include:

- Timely Reminders: Alerts you before due dates, allowing time to arrange funds.

- Financial Planning: Helps budget around loan repayments, ensuring coverage for other expenses.

- Stress Reduction: Removes the anxiety of missed payments and their consequences.

Take Sarah, for example, a young professional managing student loans and a payday loan. By using a Loan Repayment Due Date Tracker, she aligned her payday loan repayment options with her salary schedule, avoiding defaults and enhancing her creditworthiness.

To start using a Loan Repayment Due Date Tracker, follow these steps:

- Choose a Tracker: Find a tool that fits your lifestyle, like a mobile app or desktop application.

- Input Loan Details: Enter all necessary information, such as loan amounts and due dates.

- Set Alerts: Customize notifications for upcoming repayment dates.

- Review Regularly: Adjust your tracker as your financial situation changes.

Incorporating this tool into your routine can significantly impact your financial management, providing peace of mind and empowering you to control your financial future.

Fast Approval with ASAPPayday – Start Here!

How to Set Up Your Loan Repayment Due Date Tracker Efficiently

Creating a Loan Repayment Due Date Tracker can significantly enhance your financial management, especially if you’re handling multiple loans. This system helps you stay ahead of payment schedules, preventing late fees and safeguarding your credit score. Here’s how to set it up effectively.

Start by collecting all pertinent loan details, such as the loan amount, interest rate, and due dates. This information is crucial for a smooth setup. Next, select a tracking method that aligns with your lifestyle, whether it’s a digital app or a simple spreadsheet. Consistency is key.

Steps to Get Started:

- Choose a Tracking Tool: Consider apps like Mint, Google Calendar, or a specialized loan management app.

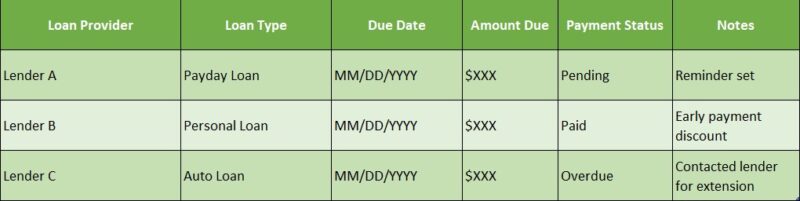

- Enter Loan Details: Record each loan’s due date, amount, and any specific notes.

- Set Reminders: Schedule alerts a few days before each due date to ensure timely payments.

For payday loans, understanding your repayment options is essential. These loans often offer flexibility but require careful tracking to avoid issues. By incorporating them into your tracker, you can manage them alongside other loans efficiently.

Regularly updating your tracker is vital as financial situations change. This ensures your tracker remains a dependable tool in managing your finances, giving you peace of mind and control over your financial future.

Personalized Loan Options at ASAPPayday! – Apply Now!

Key Features to Look for in a Loan Repayment Due Date Tracker

Managing loans can be challenging, especially with multiple repayment schedules. A Loan Repayment Due Date Tracker can be invaluable in efficiently handling these commitments. But what features should you prioritize in a tracker?

User-friendliness is essential. The tracker should have an intuitive interface for easy input and access to loan details, whether dealing with student loans or payday loan repayment options. A complex tool can add unnecessary stress.

Look for a tracker with customizable alerts and reminders to ensure you never miss a due date, helping you avoid late fees and maintain a good credit score. Imagine receiving a reminder a few days before your payment is due—it’s like having a personal assistant.

- Integration with Calendars: Syncing with your digital calendar helps visualize your repayment schedule alongside other commitments.

- Multi-Loan Management: A tracker that consolidates all repayment dates in one place saves time and hassle.

- Payment History Tracking: This feature allows monitoring past payments, providing insights into repayment progress and aiding future planning.

Finally, ensure the tracker offers secure data storage to protect your sensitive financial information. This security allows you to focus on managing loans without worrying about data breaches. Incorporating these features can transform your financial management, making the repayment process smoother and less stressful, whether handling a single loan or multiple payday loan repayment options.

Step-by-Step Guide to Using a Loan Repayment Due Date Tracker

Managing multiple loan repayments can be challenging, but a Loan Repayment Due Date Tracker can help you stay organized and avoid late fees. Here’s a concise guide to using one effectively.

1. Choose the Right Tracker

Select a tool that suits your needs, whether it’s a mobile app, spreadsheet, or online service. Look for features like reminders, customization options, and calendar integration. Some apps even sync with your bank account for real-time updates on payday loan repayment options.

2. Input Your Loan Details

Enter all relevant loan information into your tracker, including:

- Loan Amount: Helps in budgeting.

- Interest Rate: Motivates timely payments by showing interest costs.

- Due Dates: Ensures you never miss a payment.

3. Set Up Reminders

Utilize the tracker’s reminder feature to alert you a few days before each due date, preventing last-minute scrambles and late fees.

4. Monitor and Adjust

Regularly review your tracker to monitor progress. Adjust your repayment plan if your financial situation changes. For instance, use a work bonus to pay off part of your loan early, reducing interest over time.

By following these steps, you can simplify loan management and take control of your financial future with a Loan Repayment Due Date Tracker.

Benefits of Using a Loan Repayment Due Date Tracker for Financial Management

Managing multiple loans can be daunting, but a Loan Repayment Due Date Tracker serves as a crucial tool to keep your finances in order. By tracking your loan repayment schedules, you can avoid late fees and maintain a healthy credit score.

Why use a Loan Repayment Due Date Tracker?

- Avoid Late Fees: Receive timely reminders to prevent missed payments and unnecessary penalties.

- Improve Credit Score: On-time payments positively impact your credit report.

- Simplify Financial Management: Centralize all due dates to reduce financial stress.

Consider the scenario of managing multiple payday loans with different repayment options. A Loan Repayment Due Date Tracker can efficiently organize these payments. For example, if one payday loan is due on the 15th and another on the 30th, the tracker provides advance reminders, helping you budget effectively.

Using a tracker is simple: list all your loans, their due dates, and repayment amounts, then set reminders a few days before each due date. This proactive strategy not only aids in managing payday loan repayment options but also ensures you have sufficient funds ready, minimizing financial anxiety.

Incorporating a Loan Repayment Due Date Tracker into your routine can revolutionize debt management, acting like a personal assistant to keep your financial life on track and ensuring you never miss a payment.

Common Mistakes to Avoid When Using a Loan Repayment Due Date Tracker

Using a Loan Repayment Due Date Tracker can simplify managing your loan repayments, but it’s essential to avoid common pitfalls to maximize its benefits. One frequent mistake is failing to set reminders. While the tracker keeps you informed, setting up alerts or notifications is crucial. This proactive step ensures you’re reminded of due dates well in advance, allowing you to organize your finances effectively. Syncing your tracker with a calendar app can enhance this process.

Another oversight is neglecting payday loan repayment options. Many borrowers miss out on the flexibility offered by payday loan providers, such as extended payment plans or early repayment discounts. Exploring these options can lead to significant savings and reduced financial stress.

To make the most of your tracker, consider these insights:

- Regularly update your tracker: Keep all loan details current, including any changes in interest rates or repayment terms.

- Review your tracker monthly: A monthly review helps identify discrepancies early, allowing you to adjust your budget as needed.

- Communicate with your lender: If repayment issues arise, contact your lender promptly. They may offer solutions to prevent penalties.

By avoiding these mistakes, you can fully leverage your Loan Repayment Due Date Tracker, ensuring a smoother financial journey. Staying proactive and informed is key to effective loan management.

How a Loan Repayment Due Date Tracker Can Improve Your Credit Score

Managing finances can often feel overwhelming, especially when juggling multiple loan repayments. However, a Loan Repayment Due Date Tracker can simplify this process and even enhance your credit score. This tool, whether a digital app or a traditional calendar, helps you stay on top of your payments by reminding you of upcoming due dates.

Timely Payments are crucial for maintaining a healthy credit score. By using a due date tracker, you ensure that you never miss a payment, thus avoiding late fees and negative impacts on your credit report. Additionally, having a clear view of all your loan repayment dates aids in Financial Planning. This foresight allows you to allocate funds appropriately, ensuring you have enough to cover each payment.

Moreover, knowing exactly when each payment is due can significantly reduce stress and anxiety, leading to better financial decisions overall. Take Jane, for example, who struggled with managing her payday loan repayment options. After adopting a Loan Repayment Due Date Tracker, she not only avoided late fees but also saw a noticeable improvement in her credit score.

To start benefiting from this tool, choose a tracking method that fits your lifestyle and set reminders a few days before each due date. Consistency is key to achieving a healthier credit score and a more organized financial life.

Top Loan Repayment Due Date Tracker Apps to Consider in 2023

Managing loans can be challenging, especially with multiple due dates. Fortunately, loan repayment due date tracker apps are here to help. These tools not only remind you of upcoming payments but also streamline your financial management. Let’s look at some top apps for 2023.

Mint is a leading app that offers comprehensive financial management, tracking spending, budgets, and loan repayments. It allows you to set alerts for loan repayment due dates, ensuring timely payments. This app is particularly beneficial for those handling various payday loan repayment options, as it consolidates all financial data in one place.

Another great option is Prism, known for its user-friendly interface and support for numerous billers. Prism automatically tracks bills and sends reminders before due dates, making it ideal for busy individuals who need a simple way to manage financial obligations.

Benefits of Using Loan Repayment Due Date Tracker Apps:

- Timely Reminders: Notifications before due dates help avoid late fees.

- Financial Overview: Provides a clear view of financial commitments for better planning.

- Stress Reduction: Automates financial tracking, freeing mental space.

To start, download these apps from your app store, set up your account, and input loan details. Most apps offer customization, allowing you to tailor notifications and schedules to your needs. By using a loan repayment due date tracker, you can confidently manage your finances.

FAQs

⭐ What is a loan repayment due date tracker?

A loan repayment due date tracker is a tool or system that helps borrowers monitor and manage their loan payments by providing reminders and alerts to avoid missed payments.

⭐ How can I track my loan repayment due dates?

You can track due dates using mobile apps, online banking alerts, calendars, or spreadsheets. Many lenders also offer automatic payment reminders via email or SMS.

⭐ What happens if I miss a loan repayment due date?

Missing a payment can result in late fees, penalty interest rates, and a negative impact on your credit score. If the loan remains unpaid, it may be sent to collections.

⭐ Can I change my loan repayment due date?

Some lenders allow due date adjustments if you request it in advance, but policies vary. Contact your lender to see if you qualify for a change.

⭐ How do automatic payment reminders work?

Automatic reminders can be set through banking apps, loan provider portals, or personal finance apps. They notify you via text, email, or push notification before your payment is due.

Quick Cash Before You Go with ASAPPayday!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.

Find a Payday Loan!

"*" indicates required fields