Who Offers Instant Cash Advance Guaranteed Approval?

When unexpected expenses arise, many people ask, “Who offers instant cash advance guaranteed approval?” This question is vital because quick access to funds can significantly impact a financial emergency. Instant cash advances help cover urgent bills or unexpected costs, providing peace of mind when you need it most.

What Are Instant Cash Advances?

Instant cash advances are short-term loans that provide quick cash, often with guaranteed approval. They are designed for emergencies, making them a popular choice for those needing immediate funds.

Who Offers These Loans?

- Online Lenders: Many online platforms specialize in emergency & instant loans, offering fast approvals and easy applications.

- Credit Unions: Some local credit unions provide cash advances with favorable terms for their members.

- Banks: Traditional banks may also offer instant cash advances, but they often have stricter requirements.

Benefits of Instant Cash Advances

- Quick Access to Funds: You can receive money within hours or even minutes.

- Guaranteed Approval: Many lenders offer guaranteed approval, making it easier to get the help you need.

- Flexible Use: Funds can be used for any purpose, from medical bills to car repairs.

In summary, knowing who offers instant cash advance guaranteed approval can empower you during financial challenges, ensuring you have the resources to tackle emergencies head-on.

Fast Approval with ASAPPayday – Start Here!

Who Provides Instant Cash Advance Guaranteed Approval?

When unexpected expenses arise, knowing who offers instant cash advance guaranteed approval can be a lifesaver. These loans provide quick access to funds, helping you tackle emergencies without the stress of lengthy approval processes. Let’s explore who can help you when you need it most.

Online Lenders

Many online lenders specialize in emergency & instant loans. They often provide a simple application process, allowing you to receive funds within hours. Look for lenders that advertise instant cash advance guaranteed approval to ensure a smoother experience.

Credit Unions and Banks

Some credit unions and banks offer instant cash advances to their members. While they may have stricter requirements, they can provide competitive rates and terms. It’s worth checking with your local institutions to see what options are available.

Peer-to-Peer Lending Platforms

Peer-to-peer lending platforms connect borrowers with individual lenders. These platforms often have flexible approval criteria, making it easier to secure an instant cash advance guaranteed approval. Just be sure to read the terms carefully before committing.

Personalized Loan Options at ASAPPayday! – Apply Now!

The Benefits of Choosing Instant Cash Advances

When unexpected expenses arise, knowing who offers instant cash advance guaranteed approval can be a lifesaver. These loans provide quick access to funds, helping you tackle emergencies without the stress of long approval processes. But what are the real benefits of choosing instant cash advances?

Quick Access to Funds

- Speedy Approval: With instant cash advances, you can often get approved within minutes. This means you can handle urgent bills or unexpected costs right away.

- Guaranteed Approval: Many lenders offer instant cash advance guaranteed approval, ensuring you can access funds even with less-than-perfect credit.

Flexible Use of Funds

- Emergency & Instant Loans: These loans can be used for various purposes, from medical bills to car repairs. You decide how to use the money, giving you control in a pinch.

Simple Application Process

- Easy Online Applications: Most lenders allow you to apply online, making it convenient to get the help you need without leaving your home. Just fill out a simple form, and you’re on your way!

How to Qualify for Instant Cash Advance Guaranteed Approval

When unexpected expenses arise, knowing who offers instant cash advance guaranteed approval can be a lifesaver. These loans provide quick access to cash, helping you tackle emergencies without the stress of lengthy approval processes. But how do you qualify for these instant cash advances? Let’s break it down.

Basic Requirements

To qualify for an instant cash advance guaranteed approval, you typically need to meet a few basic requirements:

- Age: You must be at least 18 years old.

- Income: A steady source of income is essential, whether from a job or other means.

- Bank Account: Most lenders require a valid bank account for direct deposits.

Steps to Apply

Applying for an emergency & instant loan is usually straightforward. Here’s how you can get started:

- Research Lenders: Look for reputable lenders that offer instant cash advances.

- Gather Documents: Prepare necessary documents like ID and proof of income.

- Submit Application: Fill out the application online or in-person, depending on the lender.

- Receive Funds: If approved, funds are often deposited into your account quickly, sometimes within hours!

By understanding these steps, you can navigate the world of instant cash advances with confidence.

Common Misconceptions About Instant Cash Advances

When life throws unexpected expenses your way, knowing who offers instant cash advance guaranteed approval can be a lifesaver. Many people think these loans are a quick fix, but there are some common misconceptions that can lead to confusion. Let’s clear the air!

Misconception 1: Everyone Qualifies for Instant Cash Advances

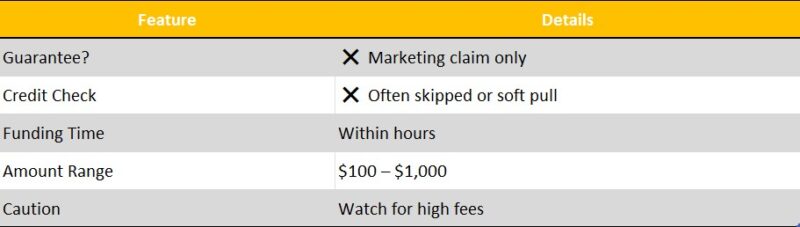

While the term ‘guaranteed approval’ sounds appealing, it doesn’t mean everyone will qualify. Lenders often have specific criteria, such as income level and credit history, that must be met. It’s essential to read the fine print before applying.

Misconception 2: Instant Cash Advances Are Always Expensive

Many believe that emergency & instant loans come with sky-high interest rates. However, some lenders offer competitive rates, especially for those with good credit. Always compare options to find the best deal for your situation.

Misconception 3: They Are Only for Emergencies

Although these loans are often marketed for emergencies, they can also be used for planned expenses. Whether it’s a car repair or a medical bill, understanding your needs can help you make the best choice.

Exploring Alternatives to Instant Cash Advances

When unexpected expenses arise, many people wonder, “Who offers instant cash advance guaranteed approval?” This question is crucial because it can help you find quick financial relief without the hassle of lengthy applications or credit checks. Understanding your options can empower you to make informed decisions during emergencies.

What Are Your Options?

Instead of relying solely on instant cash advances, consider these alternatives:

- Emergency & Instant Loans: These loans often come with flexible terms and quicker approval processes.

- Credit Unions: They may offer lower interest rates and personalized service.

- Peer-to-Peer Lending: This option connects you with individuals willing to lend money, often with better terms than traditional banks.

Benefits of Exploring Alternatives

Choosing alternatives to instant cash advances can lead to better financial health. Here are some benefits:

- Lower Interest Rates: Many alternatives offer more competitive rates.

- Flexible Repayment Plans: You can often negotiate terms that suit your budget.

- Improved Credit Score: Responsible borrowing can help enhance your credit profile.

By exploring these options, you can find a solution that meets your needs without the stress of guaranteed approval loans.

How ASAPPayday.com Can Help You Secure Instant Cash Advances

When unexpected expenses arise, knowing who offers instant cash advance guaranteed approval can be a lifesaver. Whether it’s a medical bill or a car repair, having quick access to funds can ease your stress. That’s where ASAPPayday.com comes in, providing a reliable solution for your financial emergencies.

At ASAPPayday.com, we understand that life can throw curveballs. Our platform specializes in Emergency & Instant Loans, making it easier for you to get the cash you need without the hassle. Here’s how we can help:

Quick Application Process

- Simple Forms: Fill out a short application in minutes.

- Fast Approval: Get a decision quickly, often within hours.

Flexible Options

- Variety of Loans: Choose from different loan amounts and terms.

- Guaranteed Approval: We work with multiple lenders to ensure you find a suitable option.

With ASAPPayday.com, securing an instant cash advance is straightforward and stress-free. We’re here to support you through your financial journey, ensuring you have access to the funds you need when you need them most.

Tips for Managing Your Finances After an Instant Cash Advance

When you find yourself in a tight spot financially, knowing who offers instant cash advance guaranteed approval can be a lifesaver. These loans can help you cover unexpected expenses, but it’s crucial to manage your finances wisely afterward. Let’s explore some tips to keep your budget on track after securing an emergency loan.

Create a Budget

After receiving your instant cash advance, take a moment to create a budget. List your income and expenses to see where your money goes. This will help you allocate funds for repaying your loan while still covering your daily needs.

Prioritize Repayment

Make it a priority to repay your emergency & instant loans on time. Late payments can lead to extra fees and damage your credit score. Set reminders or automate payments to ensure you never miss a due date.

Build an Emergency Fund

Once you’ve managed your immediate expenses, consider setting aside a small amount each month for an emergency fund. This can prevent you from needing another instant cash advance in the future. Even a little savings can make a big difference!

FAQs

What is an instant cash advance with guaranteed approval?

It’s a fast loan option with a high chance of approval for basic eligibility.

Can I get an instant cash advance without a credit check?

Yes, some lenders offer them based on income instead of credit history.

How fast can I get the money?

You may receive funds the same day or by the next business day.

What do I need to qualify?

You need ID, proof of income, and an active bank account.

Are there risks with instant cash advances?

Yes, they often come with high fees and short repayment terms.

Quick Cash Before You Go with ASAPPayday!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.

Find a Payday Loan!

"*" indicates required fields