Where Can I Find Emergency Loans in Massachusetts?

When unexpected expenses arise, knowing where to find emergency loans in Massachusetts can be a lifesaver. Whether it’s a medical bill, car repair, or urgent home repair, having quick access to funds can help you navigate tough times without added stress.

Emergency loans in Massachusetts are designed to provide fast cash when you need it most. Here are some options to consider:

Local Credit Unions and Banks

- Many local credit unions offer emergency & instant loans with competitive rates. They often have more flexible terms than larger banks.

Online Lenders

- Online platforms can provide quick access to emergency loans Massachusetts residents can apply for from the comfort of their homes. Just ensure they are reputable and licensed.

Peer-to-Peer Lending

- Consider peer-to-peer lending as an alternative. These platforms connect borrowers with individual lenders, often with lower interest rates than traditional loans. In conclusion, finding emergency loans in Massachusetts doesn’t have to be overwhelming. By exploring local banks, online lenders, and peer-to-peer options, you can secure the funds you need quickly and efficiently.

Fast Approval with ASAPPayday – Start Here!

What Types of Emergency Loans Are Available?

When life throws unexpected challenges your way, knowing where to find emergency loans in Massachusetts can be a lifesaver. Whether it’s a medical bill, car repair, or urgent home repair, having quick access to funds can ease your stress and help you get back on track. Let’s explore the types of emergency loans available to you.

Personal Loans

Personal loans are a popular choice for emergency situations. They are typically unsecured, meaning you don’t need to put up collateral. You can borrow a set amount of money and pay it back over time. Many lenders in Massachusetts offer quick approval for these loans, making them a great option for urgent needs.

Payday Loans

Payday loans are short-term loans designed to cover immediate expenses until your next paycheck. While they can be helpful, be cautious of high-interest rates. Always read the fine print before committing to ensure you understand the terms.

Credit Union Loans

If you’re a member of a credit union, you might have access to emergency loans with lower interest rates. Credit unions often provide more personalized service and flexible repayment options, making them a great alternative for emergency & instant loans.

Personalized Loan Options at ASAPPayday! – Apply Now!

How to Qualify for Emergency Loans in Massachusetts

Finding emergency loans in Massachusetts can be a lifesaver when unexpected expenses arise. Whether it’s a medical bill, car repair, or urgent home repair, knowing where to look for help is crucial. Let’s explore how you can qualify for these emergency & instant loans and get the support you need.

Understanding Your Options

To qualify for emergency loans in Massachusetts, you first need to understand the types of loans available. Many lenders offer quick cash options, which can be processed in as little as one business day. Look for lenders that specialize in emergency loans Massachusetts to find the best fit for your situation.

Key Qualifications

Here are some common requirements to keep in mind:

- Age: You must be at least 18 years old.

- Income: Proof of steady income is often required.

- Credit Score: While some lenders may check your credit score, others may offer loans with flexible terms.

- Identification: A valid ID or Social Security number is typically needed.

By meeting these qualifications, you can increase your chances of securing the funds you need quickly. Remember, understanding the process can help ease your financial stress!

Where to Apply for Emergency Loans in Massachusetts?

Finding emergency loans in Massachusetts can be a lifesaver when unexpected expenses pop up. Whether it’s a medical bill or car repair, knowing where to look for emergency & instant loans is crucial. Let’s explore some reliable options that can help you get the funds you need quickly.

Local Credit Unions and Banks

Many local banks and credit unions offer emergency loans Massachusetts residents can access. These institutions often provide lower interest rates and flexible terms. It’s a good idea to check with your current bank first, as they may have special programs for existing customers.

Online Lenders

Another great option is online lenders. They usually have a quick application process and can provide funds within a day or two. Just make sure to read the terms carefully. Some popular online platforms include:

- LendingClub

- Upstart

- Avant

These lenders specialize in emergency loans and can help you get cash fast!

Peer-to-Peer Lending

Consider peer-to-peer lending platforms as well. These connect borrowers directly with individual lenders. It’s a unique way to secure emergency funds without going through traditional banks. Just remember to check the fees and interest rates before committing.

Are There Online Options for Emergency Loans in Massachusetts?

Finding emergency loans in Massachusetts can feel overwhelming, especially when unexpected expenses arise. Whether it’s a medical bill or car repair, knowing where to turn for help is crucial. Luckily, there are options available, including online resources that can provide quick solutions.

Many people wonder if they can find emergency loans Massachusetts residents can access online. The good news is that there are several reputable lenders offering Emergency & Instant Loans through their websites. This means you can apply from the comfort of your home, often with a simple application process.

Benefits of Online Emergency Loans

- Quick Access: Many online lenders provide fast approval, sometimes within minutes.

- Convenience: You can apply anytime, anywhere, without needing to visit a physical location.

- Variety of Options: Online platforms often feature multiple lenders, allowing you to compare rates and terms easily.

- Flexible Amounts: You can request different loan amounts based on your needs, making it easier to find the right fit.

In summary, if you’re in Massachusetts and need emergency funds, exploring online options for emergency loans can be a smart move. Just remember to read the terms carefully and choose a lender that suits your situation.

What to Consider Before Taking an Emergency Loan?

Finding emergency loans in Massachusetts can be a lifesaver when unexpected expenses arise. Whether it’s a medical bill or a car repair, knowing where to turn for help is crucial. But before diving into the world of emergency loans, it’s important to consider a few key factors.

- Interest Rates: Always check the interest rates on emergency loans in Massachusetts. High rates can lead to bigger problems down the road.

- Repayment Terms: Understand how long you have to pay back the loan. Shorter terms might mean higher payments, while longer terms can lead to more interest.

- Lender Reputation: Research the lender offering emergency & instant loans. Look for reviews and ratings to ensure they are trustworthy.

- Your Financial Situation: Assess your ability to repay the loan. Taking on more debt can be risky, especially if your financial situation is already tight.

Additional Tips for Finding Emergency Loans

- Compare Options: Don’t settle for the first loan you find. Compare different lenders to find the best terms and rates.

- Check for Hidden Fees: Some loans come with extra costs. Make sure to read the fine print to avoid surprises.

- Ask for Help: If you’re unsure, consider talking to a financial advisor. They can guide you through your options.

How Can ASAPPayday.com Help You Find Emergency Loans?

Finding emergency loans in Massachusetts can feel overwhelming, especially when unexpected expenses arise. Whether it’s a medical bill or a car repair, knowing where to turn for help is crucial. That’s where ASAPPayday.com comes in, guiding you through the process of securing emergency & instant loans tailored to your needs.

At ASAPPayday.com, we simplify your search for emergency loans Massachusetts residents can rely on. Here’s how we can assist you:

Easy Comparisons

- Compare Options: We provide a list of lenders, allowing you to compare interest rates and terms easily.

- User-Friendly Tools: Our calculators help you understand potential repayments, making it easier to choose the right loan.

Expert Guidance

- Personalized Advice: Our team offers insights based on your financial situation, ensuring you find the best fit.

- Quick Access: We connect you with lenders who can provide funds quickly, so you won’t have to wait long in times of need.

With ASAPPayday.com, finding the right emergency loan is just a few clicks away, making your financial journey smoother and less stressful.

Tips for Managing Emergency Loans Effectively

When life throws unexpected expenses your way, knowing where to find emergency loans in Massachusetts can be a lifesaver. These loans can help you cover urgent bills, medical expenses, or car repairs, ensuring you stay afloat during tough times. But how do you manage these loans effectively once you have them?

Understand the Terms

Before signing any agreement, read the terms carefully. Emergency & instant loans often come with high-interest rates. Make sure you know how much you’ll owe and when payments are due. This knowledge helps you avoid surprises later on.

Create a Repayment Plan

Once you secure emergency loans Massachusetts, create a repayment plan. List your monthly income and expenses to see how much you can allocate towards loan payments. Sticking to this plan will help you pay off the loan without falling behind.

Communicate with Lenders

If you find yourself struggling to make payments, don’t hesitate to reach out to your lender. Many companies offer flexible repayment options or may work with you to adjust your payment schedule. Open communication can ease your financial stress.

FAQs

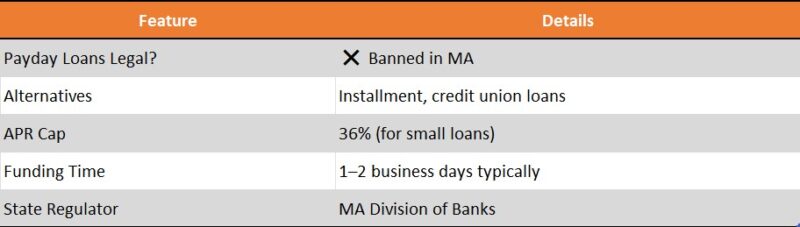

💵 Are payday or emergency loans legal in Massachusetts?

Payday loans are effectively banned in Massachusetts due to strict interest rate caps, but other emergency loan options like personal loans from licensed lenders and credit unions are available.

🏦 What types of emergency loans are available in Massachusetts?

You can apply for personal installment loans, credit union emergency loans, cash advance apps, or hardship assistance through community programs.

📋 What do I need to qualify for an emergency loan in Massachusetts?

You typically need to be at least 18, have proof of income, a valid photo ID, an active checking account, and proof of residence.

⏱️ How fast can I get an emergency loan in Massachusetts?

If approved, some lenders and apps can deposit funds the same day or by the next business day.

⚠️ What should I watch out for when applying for emergency loans?

Avoid unlicensed online lenders, check the APR and fees carefully, and borrow only what you can realistically repay to avoid further financial stress.

Quick Cash Before You Go with ASAPPayday!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.

Find a Payday Loan!

"*" indicates required fields