Can I Get Instant Cash Advance on Disability Online?

When unexpected expenses arise, many people wonder, “Can I get an instant cash advance on disability payments online?” This question is crucial for those relying on disability payments. Understanding your options can help you navigate financial challenges more smoothly.

What Are Instant Cash Advances?

Instant cash advances are quick loans that provide immediate funds, often without the need for extensive paperwork. They can be a lifesaver during emergencies, especially for individuals on disability payments who may face unexpected costs.

Benefits of Emergency & Instant Loans

- Quick Access: Get funds in your account within hours.

- Minimal Requirements: Often, you only need proof of income.

- Flexibility: Use the money for any urgent need, from medical bills to home repairs.

In summary, if you’re on disability and facing a financial crunch, exploring instant cash advances online can be a viable solution. Just remember to read the terms carefully and ensure you can manage the repayment.

Fast Approval with ASAPPayday – Start Here!

Are Instant Cash Advances on Disability Payments Right for You?

Are you wondering if you can get an instant cash advance on disability payments online? This question is important for many people who rely on disability benefits. Sometimes, unexpected expenses pop up, and having quick access to cash can make a big difference in managing those financial surprises.

Understanding Instant Cash Advances on Disability Payments

Instant cash advances on disability payments online can provide a lifeline during tough times. They are designed to help you cover urgent costs, like medical bills or car repairs, without the long wait typical of traditional loans. However, it’s essential to know if this option is right for you.

Key Considerations

- Eligibility: Most lenders require proof of your disability income.

- Interest Rates: Be aware that these loans can have higher interest rates.

- Repayment Terms: Understand how and when you’ll need to repay the loan.

If you find yourself in a financial pinch, Emergency & Instant Loans can be a quick solution. Just remember to weigh the pros and cons before making a decision!

Personalized Loan Options at ASAPPayday! – Apply Now!

The Process of Getting an Instant Cash Advance Online

Getting an instant cash advance on disability payments online can be a lifesaver for many facing unexpected bills or sudden expenses. This process helps individuals relying on disability payments manage their finances effectively.

Understanding Your Options

When you need money fast, emergency & instant loans are a viable solution. Here’s how to get started:

- Research Lenders: Find reputable online lenders that offer cash advances for disability payments.

- Check Eligibility: Ensure you qualify, typically by having a steady income from disability benefits.

Application Steps

- Fill Out an Application: Most lenders provide a simple online form for personal and income details.

- Submit Documentation: You may need to upload proof of your disability payments.

- Receive Approval: Many lenders approve applications within minutes, providing peace of mind.

Once approved, funds can often be deposited directly into your bank account within a day, allowing you to address urgent expenses promptly. Always read the terms to understand any associated fees or interest rates.

Eligibility Criteria for Instant Cash Advances on Disability

If you’re on disability payments, financial challenges can arise unexpectedly. Knowing how to secure an instant cash advance on disability payments online can be crucial. This option enables quick access to funds, easing the burden of sudden expenses without the hassle of traditional loans.

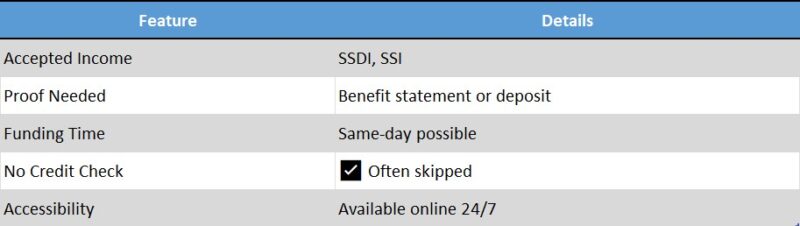

To qualify for an emergency & instant loan linked to your disability payments, you must meet certain criteria:

- Proof of Income: You need to demonstrate that you receive regular disability payments.

- Age Requirement: Applicants must typically be at least 18 years old.

- Bank Account: A valid bank account is required for direct deposit of funds.

- Residency: You should reside in the state where you are applying for the loan.

By meeting these criteria, you can gain quick access to cash when needed. However, it’s important to borrow responsibly and fully understand the loan terms before proceeding.

How to Apply for an Instant Cash Advance on Disability Payments

When unexpected expenses arise, many people ask, “Can I get an instant cash advance on disability online?” This is an important question for those relying on disability payments, as quick access to funds can ease financial stress during emergencies.

Applying for an instant cash advance on disability payments online is straightforward. Here’s a simple guide to help you:

Steps to Apply:

- Research Lenders: Find reputable lenders offering emergency & instant loans for disability recipients.

- Check Eligibility: Confirm you meet the requirements, like having a steady income from disability payments.

- Gather Documents: Collect necessary documents such as proof of income and ID.

- Fill Out the Application: Complete the online form with accurate information.

- Review Terms: Read the loan terms carefully before submitting.

- Receive Funds: If approved, funds can be deposited into your bank account, often within a day!

By following these steps, you can access the funds you need quickly. Remember to borrow responsibly to avoid future financial issues.

What to Expect After Applying for an Instant Cash Advance

When you apply for an instant cash advance on disability payments online, it can feel like a lifeline. Many people rely on disability benefits, and sometimes unexpected expenses arise. Knowing what to expect after applying can ease your worries and help you plan ahead.

Quick Approval Process

Once you submit your application, lenders typically review it quickly. Many companies offer emergency & instant loans, meaning you could get a decision within minutes. This speed is crucial when you need cash fast!

Funds Disbursement

If approved, the funds are often deposited directly into your bank account. This means you can access your money without delay. Just remember, each lender has different policies, so check their terms for specifics.

Understanding Repayment

Before accepting the loan, understand the repayment terms. Instant cash advances can come with high interest rates. Make sure you’re comfortable with how and when you’ll pay it back to avoid future stress.

Exploring the Benefits of Instant Cash Advances for Disability Recipients

When you’re living on disability payments, unexpected expenses can feel overwhelming. That’s where the idea of getting an instant cash advance on disability payments online comes into play. It’s a quick solution that can help you manage those surprise costs without the stress of waiting for traditional loans.

Benefits of Instant Cash Advances for Disability Recipients

- Quick Access to Funds: With Emergency & Instant Loans, you can receive cash almost immediately. This is crucial when bills pile up unexpectedly.

- Easy Application Process: Most online lenders offer simple applications that can be completed in minutes. You don’t need to visit a bank or fill out complicated forms.

- Flexible Use: Whether it’s for medical bills, car repairs, or groceries, you can use the cash for whatever you need most.

In conclusion, exploring the option of an instant cash advance can provide peace of mind for disability recipients. It’s a practical way to handle financial emergencies without the long wait times associated with traditional loans. Remember, always read the terms carefully before applying!

Potential Risks and Considerations of Cash Advances on Disability

When facing unexpected expenses, many people wonder, “Can I get an instant cash advance on disability online?” This question is crucial for those relying on disability payments. Understanding the potential risks and considerations can help you make informed decisions about emergency & instant loans.

High Interest Rates

- Cash advances often come with steep interest rates. This can lead to a cycle of debt if not managed carefully.

Impact on Benefits

- Taking an instant cash advance on disability payments online might affect your eligibility for certain benefits. Always check the rules before proceeding.

Repayment Challenges

- If you struggle to repay the loan, it can create financial stress. Make sure you have a plan in place to avoid falling behind.

Scams and Fraud

- Be cautious! The online world has its share of scams. Always choose reputable lenders to protect your personal information.

How ASAPPayday.com Can Help You Secure an Instant Cash Advance

When unexpected expenses arise, many people wonder, “Can I get an instant cash advance on disability online?” This question is crucial for those relying on disability payments. Knowing your options can provide peace of mind during tough times.

At ASAPPayday.com, we understand the urgency of financial needs. Our platform offers a straightforward way to access instant cash advances on disability payments online. With just a few clicks, you can apply for Emergency & Instant Loans tailored to your situation.

Why Choose Us?

- Quick Approval: Our process is designed for speed, ensuring you get the funds when you need them most.

- User-Friendly Application: Our online application is simple and easy to navigate, making it accessible for everyone.

- Flexible Terms: We offer various repayment options to fit your budget, so you can focus on what matters most.

Frequently Asked Questions About Instant Cash Advances on Disability Payments

1. Can I get an instant cash advance if I receive disability benefits?

Yes, many lenders and cash advance services accept disability benefits as a valid source of income.Tremplo County Loans

2. Are there online lenders that offer cash advances to individuals on disability?

Yes, several online platforms provide cash advances to those receiving disability payments.

3. What are the typical requirements to qualify for an online cash advance on disability payments?

Generally, you need to be at least 18 years old, have a steady income (such as disability benefits), a valid ID, and an active checking account.

4. How quickly can I receive funds after approval?

If approved, funds are typically deposited into your bank account within one business day, sometimes even the same day.

5. Are there risks associated with cash advances on disability payments?

Yes, these advances often come with high interest rates and fees. It’s crucial to ensure you can repay the loan on time to avoid additional charges.

Quick Cash Before You Go with ASAPPayday!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.

Find a Payday Loan!

"*" indicates required fields