Payday Loans Jacksonville NC: Quick Online Loans

When unexpected expenses arise, many people in Jacksonville, NC, turn to payday loans for quick financial relief. These loans are designed to help you bridge the gap between paychecks, making them a popular choice for those in need of immediate cash. Understanding payday loans Jacksonville NC can empower you to make informed decisions about your finances.

What Are Payday Loans?

Payday loans are short-term loans that are typically due on your next payday. They are easy to apply for and can often be accessed online, making them a convenient option for many. However, it’s essential to understand the terms and conditions before borrowing.

Key Benefits of Payday Loans

- Quick Access to Cash: Funds can be available within hours.

- Minimal Requirements: Usually, you just need proof of income and identification.

- Flexible Use: You can use the money for any urgent expense, like bills or car repairs.

While payday loans by state can vary in terms and regulations, knowing how they work in Jacksonville, NC, can help you navigate your options effectively. Always read the fine print and consider your ability to repay the loan on time.

Fast Approval with ASAPPayday – Start Here!

How to Apply for Quick Online Loans in Jacksonville NC

Quick online loans in Jacksonville, NC, can be a lifesaver for unexpected expenses like car repairs or medical bills. Payday loans Jacksonville NC provide a fast solution to bridge the gap until your next paycheck, making them a popular choice for many.

Steps to Apply for Quick Online Loans

- Research Lenders: Look for reputable lenders offering payday loans by state. Check reviews and ensure they are licensed in North Carolina.

- Gather Your Information: Prepare your ID, proof of income, and bank account details to speed up the process.

- Fill Out the Application: Most lenders have simple online forms. Provide the required information and submit.

- Review Loan Terms: After approval, read the loan terms carefully, including interest rates and repayment schedules.

- Receive Your Funds: If everything is in order, expect to receive your funds quickly, often within one business day!

Benefits of Quick Online Loans

- Fast Approval: Applications are processed quickly, minimizing wait times.

- Convenience: Apply from home without visiting a physical location.

- Flexibility: Use the funds for any urgent expenses you may have.

Personalized Loan Options at ASAPPayday! – Apply Now!

The Benefits of Choosing Payday Loans in Jacksonville NC

When unexpected expenses arise, many people in Jacksonville, NC, turn to payday loans. These quick online loans can provide the financial relief you need, often within a single day. Understanding the benefits of payday loans Jacksonville NC can help you make informed decisions during tough times.

Fast Access to Cash

- Quick Approval: Many lenders offer instant approval, so you can get cash when you need it most.

- Same-Day Funding: Once approved, funds can be deposited directly into your bank account, often on the same day.

Easy Application Process

- Simple Online Forms: Completing an application is straightforward and can be done from the comfort of your home.

- Minimal Documentation: Most lenders require only basic information, making it easy for anyone to apply.

Flexibility in Repayment

- Short-Term Solutions: Payday loans are designed to be repaid quickly, usually by your next paycheck, helping you avoid long-term debt.

- Customizable Terms: Some lenders may offer flexible repayment options to suit your financial situation.

Also Read: Payday Loans by State: Online Options & Local Availability

Are Payday Loans in Jacksonville NC Right for You?

When unexpected expenses hit, many people turn to payday loans. In Jacksonville, NC, these quick online loans can provide the financial relief you need. But are payday loans Jacksonville NC the right choice for you? Let’s explore this together!

Understanding Payday Loans in Jacksonville NC

Payday loans are short-term loans designed to help you cover urgent expenses until your next paycheck. They’re often easy to apply for and can be accessed online, making them a convenient option. However, it’s essential to consider the following:

Key Considerations

- Interest Rates: Payday loans often come with high-interest rates. Make sure you understand the total cost before borrowing.

- Repayment Terms: These loans typically require repayment within a few weeks. Ensure you can pay it back on time to avoid extra fees.

- Alternatives: Explore other options like personal loans or credit unions that may offer better rates.

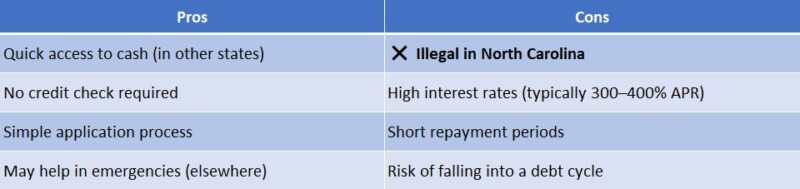

In conclusion, payday loans Jacksonville NC can be a quick fix, but weigh the pros and cons carefully. They might be right for you if you need immediate cash and can repay it quickly.

Exploring the Risks of Payday Loans in Jacksonville NC

Payday loans in Jacksonville NC can seem like a quick fix for urgent cash needs. However, it’s essential to understand the risks involved. These loans promise fast access to money, but they can lead to a cycle of debt if not managed wisely. Let’s dive into the potential pitfalls of these quick online loans.

Understanding the Risks

- High Interest Rates: Payday loans often come with steep interest rates, making repayment challenging.

- Short Repayment Terms: Borrowers usually have just a few weeks to repay, which can be tough if unexpected expenses arise.

- Debt Cycle: Many people find themselves borrowing again to pay off the previous loan, leading to a cycle of debt.

Making Informed Decisions

Before opting for payday loans in Jacksonville NC, consider alternatives. Look into local assistance programs or credit unions that may offer better terms. Always read the fine print and understand the total cost of borrowing. Remember, payday loans by state can vary, so research your options carefully.

Alternatives to Payday Loans in Jacksonville NC: What Are Your Options?

When facing unexpected expenses, many people in Jacksonville, NC, consider payday loans. These quick online loans can provide immediate cash but often come with high fees. Thankfully, there are alternatives to payday loans Jacksonville NC residents can explore to avoid falling into a debt cycle.

Credit Unions and Local Banks

Local credit unions and banks often offer small personal loans with lower interest rates than payday loans. They may also have flexible repayment terms, making it easier to manage your finances without the stress of high fees.

Payment Plans

If you’re struggling to pay a bill, consider asking for a payment plan. Many service providers, like utility companies, are willing to work with you to create a manageable payment schedule. This can help you avoid the need for payday loans by spreading out your payments.

Borrowing from Friends or Family

Sometimes, the best option is to reach out to friends or family for a loan. They may be more understanding and willing to help without charging interest. Just be sure to communicate clearly about repayment to keep your relationships strong.

How ASAPPayday.com Can Help You Secure a Payday Loan in Jacksonville NC

Payday loans in Jacksonville, NC, can be a lifesaver when unexpected expenses arise. Whether it’s a medical bill or car repair, these quick online loans provide a fast solution. At ASAPPayday.com, we understand the urgency and are here to help you navigate the process smoothly.

Our platform simplifies the application process for payday loans Jacksonville NC. With just a few clicks, you can access a variety of lenders, ensuring you find the best fit for your needs. Here’s how we make it easy:

- Fast Applications: Complete your application online in minutes.

- Multiple Lenders: Compare offers from different lenders to find the best rates.

- Quick Decisions: Get approved quickly, often within the same day!

By choosing ASAPPayday.com, you’re not just applying for a loan; you’re gaining access to a network of trusted lenders. This means you can focus on what matters most—getting the funds you need without the hassle. Remember, payday loans by state can vary, but we’re here to guide you through the specifics in Jacksonville.

Tips for Managing Your Payday Loan Responsibly

Managing a payday loan responsibly is essential, particularly with payday loans Jacksonville NC. These quick online loans can help in emergencies but come with significant responsibilities. Understanding how to manage them wisely can prevent financial stress.

Understand Your Loan Terms

Before signing, read the terms of your payday loan carefully. Know the interest rates, repayment dates, and any fees. This understanding will help you budget effectively and avoid unexpected costs.

Create a Repayment Plan

After securing your payday loan, establish a repayment plan. Set aside a portion of your income specifically for this loan to ensure timely payments and avoid extra fees.

Avoid Taking Multiple Loans

Resist the temptation to take out multiple payday loans, as this can lead to a debt cycle. Stick to one loan to keep your finances manageable.

Communicate with Your Lender

If you’re struggling with payments, contact your lender. Many payday loans Jacksonville NC providers can offer solutions like extending your repayment period.

Explore Alternatives

Before choosing payday loans by state, consider other options like personal loans or credit unions, which may provide better terms and lower rates.

Frequently Asked Questions About Payday Loans in Jacksonville NC

🚫 Are payday loans legal in Jacksonville, North Carolina?

No, payday loans are illegal in Jacksonville and throughout North Carolina due to strict consumer protection laws.

💡 What are the alternatives to payday loans in Jacksonville?

Residents can consider installment loans, personal loans from credit unions, or seek help from local community assistance programs.

🏦 Can I still borrow money quickly in Jacksonville without payday loans?

Yes, licensed lenders offer short-term installment loans that are repaid over time with regulated interest rates.

⚠️ What risks are involved in using illegal payday lenders online?

Using unlicensed lenders can lead to extremely high fees, aggressive collection tactics, and lack of legal protection.

📞 Where can I get help with emergency expenses in Jacksonville?

You can reach out to local credit unions, nonprofit financial organizations, or state-supported emergency relief programs.

Quick Cash Before You Go with ASAPPayday!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.

Find a Payday Loan!

"*" indicates required fields