Online Payday Loans Louisiana: Fast Cash Guide

When unexpected expenses arise, many people turn to online payday loans Louisiana for quick financial relief. This Fast Cash Guide is designed to help you understand how these loans work and what you need to consider before applying. Knowing the ins and outs can make a big difference in your financial journey.

What Are Online Payday Loans?

Online payday loans are short-term loans that provide quick cash, usually due on your next payday. They are convenient and can be applied for from the comfort of your home. However, they come with high interest rates, so it’s essential to use them wisely.

Key Benefits of Online Payday Loans

- Fast Approval: Most lenders offer quick approval, sometimes within minutes.

- Easy Application Process: You can apply online without complicated paperwork.

- Access to Cash: Funds can be deposited directly into your bank account, often on the same day.

Important Considerations

Before diving into payday loans by state, especially in Louisiana, keep these points in mind:

- High Interest Rates: Be aware of the costs involved.

- Repayment Terms: Understand when and how you need to repay the loan.

- Alternatives: Explore other options like personal loans or credit cards if possible.

Fast Approval with ASAPPayday – Start Here!

How to Apply for Online Payday Loans in Louisiana: A Step-by-Step Guide

When unexpected expenses arise, knowing how to access quick cash can be a lifesaver. That’s where Online Payday Loans Louisiana come into play. This Fast Cash Guide will help you navigate the application process smoothly, ensuring you get the funds you need without unnecessary stress.

Applying for online payday loans in Louisiana is straightforward. Here’s how you can do it:

- Research Lenders: Start by looking for reputable lenders that offer online payday loans in Louisiana. Check reviews and ensure they are licensed to operate in your state.

- Gather Your Information: You’ll need to provide personal details like your name, address, income, and bank account information. Having these ready makes the process faster.

- Fill Out the Application: Visit the lender’s website and complete the online application form. Be honest and accurate to avoid delays.

- Submit Your Application: After filling out the form, submit it and wait for approval. Most lenders will respond quickly, often within minutes!

- Receive Your Funds: If approved, the money will be deposited directly into your bank account, usually by the next business day. This is the beauty of payday loans by state—they’re designed for quick access!

Personalized Loan Options at ASAPPayday! – Apply Now!

The Benefits of Choosing Online Payday Loans in Louisiana

When unexpected expenses arise, finding quick cash can be daunting. Online Payday Loans Louisiana provide a solution, offering a Fast Cash Guide to help you navigate financial challenges with ease.

Quick Access to Funds

One major advantage is speed. You can apply from home and often receive funds within a day, which is crucial for urgent needs like car repairs or medical bills.

Easy Application Process

The application process is simple. Fill out a form, and many lenders offer instant approval, reducing wait times and allowing you to address financial issues promptly.

Flexible Loan Amounts

These loans come in various amounts, catering to both small and larger needs. This flexibility helps you manage your budget effectively.

No Credit Check Required

Many online payday loans skip the credit check, making them accessible for those with less-than-perfect credit. This opens doors for more individuals to secure funds without fear of rejection.

Convenience of Online Applications

You can apply anytime and anywhere, eliminating the need for physical visits or long lines. Just a few clicks can get you cash fast!

Transparency in Terms

Reputable lenders provide clear terms, ensuring you understand fees and repayment schedules. This transparency allows for informed decision-making without hidden surprises.

Support for Emergencies

Online payday loans serve as a safety net during unpredictable emergencies, giving you access to cash when you need it most, providing invaluable peace of mind.

Also Read: Payday Loans by State: Online Options & Local Availability

What Are the Risks Associated with Online Payday Loans in Louisiana?

When considering Online Payday Loans Louisiana, it’s essential to understand the potential risks involved. These loans can provide quick cash, but they come with their own set of challenges that borrowers should be aware of. Knowing these risks can help you make informed decisions and avoid financial pitfalls.

High-Interest Rates

One of the biggest risks of online payday loans in Louisiana is the high-interest rates. These loans often have APRs that can skyrocket, making it difficult to pay back the borrowed amount. If you’re not careful, you could end up in a cycle of debt that’s hard to escape.

Short Repayment Terms

Another concern is the short repayment terms. Most payday loans require repayment within a few weeks, which can be tough if you’re already struggling financially. If you miss a payment, you might face additional fees, leading to even more financial stress.

Potential for Debt Cycle

Lastly, many borrowers find themselves in a debt cycle. If you take out a new loan to pay off an old one, it can quickly spiral out of control. This is why understanding the risks associated with payday loans by state, especially in Louisiana, is crucial before you borrow.

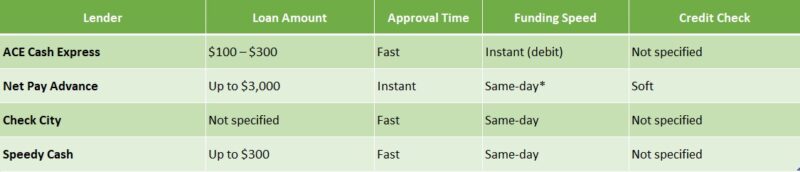

How Much Can You Borrow with Online Payday Loans in Louisiana?

When unexpected expenses arise, knowing how much you can borrow with online payday loans in Louisiana can be a lifesaver. This Fast Cash Guide helps you navigate the world of payday loans, ensuring you make informed decisions when you need quick cash.

In Louisiana, online payday loans typically allow you to borrow between $100 and $1,000. However, the exact amount can vary based on your income and the lender’s policies. It’s essential to understand these limits to avoid borrowing more than you can repay.

Key Factors Influencing Your Loan Amount:

- Income Level: Lenders often assess your monthly income to determine how much you can borrow. Higher income usually means a larger loan amount.

- Repayment Ability: Lenders want to ensure you can repay the loan on time. They may consider your existing debts and expenses.

- State Regulations: Payday loans by state can have different rules. In Louisiana, the maximum loan amount is capped to protect borrowers from excessive debt.

By understanding these factors, you can better navigate your options and find a loan that fits your needs. Remember, it’s always wise to borrow responsibly and only what you can afford to repay.

Why Choose ASAPPayday.com for Your Online Payday Loan Needs?

When life throws unexpected expenses your way, finding quick financial help can feel overwhelming. That’s where Online Payday Loans Louisiana: Fast Cash Guide comes in. It’s designed to help you navigate the world of payday loans, ensuring you make informed choices when you need cash fast.

Trusted Resource

At ASAPPayday.com, we understand that searching for online payday loans Louisiana can be daunting. Our platform offers reliable information and resources, making your journey smoother. We provide insights tailored to your needs, ensuring you find the best options available.

Quick and Easy Process

Applying for payday loans by state can often be complicated. However, with ASAPPayday.com, the process is simple and straightforward. You can apply online in just a few minutes, and our user-friendly interface guides you every step of the way. No more confusion or long waits!

Competitive Rates and Terms

We believe in transparency. At ASAPPayday.com, we showcase competitive rates and terms for online payday loans Louisiana. This way, you can compare different lenders and choose what works best for you. Our goal is to empower you with the knowledge to make the right financial decisions.

Frequently Asked Questions About Online Payday Loans in Louisiana

💬 Are online payday loans legal in Louisiana?

Yes, online payday loans are legal in Louisiana, but lenders must be licensed and follow state regulations on loan amounts, terms, and fees.

📋 What do I need to qualify for an online payday loan in Louisiana?

You typically need to be at least 18 years old, have a valid government-issued ID, proof of income, and an active checking account.

💰 How much can I borrow with an online payday loan in Louisiana?

In Louisiana, payday loan amounts are usually capped at $350, depending on the lender and your ability to repay.

📈 What fees and interest rates apply to online payday loans in Louisiana?

Lenders can charge up to 16.75% of the loan amount, plus a $10 documentation fee, according to Louisiana law.

🔄 Can I extend or renew my payday loan in Louisiana?

Loan rollovers are restricted; lenders must offer an extended payment plan if you are unable to repay the loan when due.

Quick Cash Before You Go with ASAPPayday!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.

Find a Payday Loan!

"*" indicates required fields