Payday Loans Colorado Online: Easy Application

When unexpected expenses arise, many people in Colorado turn to payday loans online for quick relief. Understanding how these loans work can help you make informed decisions. With a simple application process, payday loans Colorado online can be a lifeline when you need cash fast.

What Are Payday Loans?

Payday loans are short-term loans designed to cover urgent expenses until your next paycheck. They are often easy to apply for and can be accessed online, making them a popular choice for many. However, it’s essential to know the terms and conditions before applying.

Benefits of Online Applications

- Convenience: You can apply from the comfort of your home.

- Speed: Most applications are processed quickly, often within minutes.

- Accessibility: Available to those who may not qualify for traditional loans.

- Flexible Amounts: You can borrow what you need, up to a certain limit.

Important Considerations

While payday loans Colorado online can be helpful, they come with high-interest rates. Always read the fine print and ensure you can repay the loan on time to avoid additional fees. Remember, payday loans by state can vary, so check local regulations to stay informed.

Fast Approval with ASAPPayday – Start Here!

How to Apply for Payday Loans Colorado Online: A Step-by-Step Guide

Applying for payday loans Colorado online is a straightforward process that can help you access quick cash when you need it most. Understanding how to navigate this easy application can make a significant difference in your financial situation. Let’s break it down step-by-step!

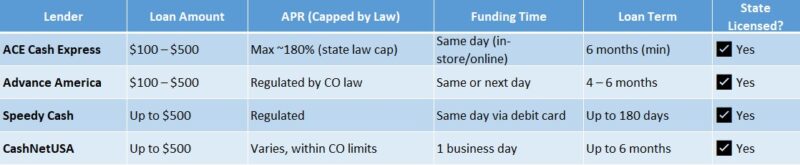

Step 1: Research Lenders

Before you apply, take some time to research different lenders offering payday loans Colorado online. Look for reviews and compare interest rates to find the best option for your needs.

Step 2: Gather Your Information

Make sure you have all the necessary information handy. This typically includes:

- Your ID or driver’s license

- Proof of income

- Bank account details

Having these documents ready will speed up the application process!

Step 3: Fill Out the Application

Visit the lender’s website and fill out the online application form. It’s usually simple and only takes a few minutes. Just follow the prompts and provide accurate information to avoid delays.

Step 4: Review and Submit

Before hitting submit, double-check your application for any mistakes. A clean application increases your chances of approval. Once you’re satisfied, go ahead and submit it!

Step 5: Receive Your Funds

If approved, you’ll typically receive your funds within one business day. This quick turnaround is one of the major benefits of payday loans Colorado online, making them a popular choice for many.

Personalized Loan Options at ASAPPayday! – Apply Now!

The Benefits of Choosing Payday Loans Colorado Online

When unexpected expenses arise, finding a quick solution can feel overwhelming. That’s where payday loans Colorado online come into play. With an easy application process, these loans offer a lifeline for those in need of immediate cash. Let’s explore why choosing payday loans online in Colorado can be a smart choice.

Quick and Easy Application Process

Applying for payday loans Colorado online is a breeze. You can complete the entire process from the comfort of your home. Just fill out a simple form, and you’re on your way to getting the funds you need. No long lines or complicated paperwork!

Fast Approval and Funding

One of the biggest benefits is the speed of approval. Many lenders offer same-day funding, meaning you could have cash in your account within hours. This is especially helpful for emergencies, like car repairs or medical bills.

Flexible Loan Amounts

Payday loans by state, including Colorado, often allow you to choose how much you want to borrow. This flexibility means you can request just what you need, making it easier to manage your finances without taking on unnecessary debt.

Also Read: Payday Loans by State: Online Options & Local Availability

Are Payday Loans Colorado Online Right for You?

When unexpected expenses arise, many in Colorado seek payday loans online for quick relief. These loans provide an easy application process, allowing you to access cash fast. But are payday loans Colorado online right for you? Let’s explore this question together.

Understanding Payday Loans Colorado Online

Payday loans are short-term loans designed to help cover urgent expenses until your next paycheck. Their simple application process makes them appealing, as you can apply from home, which is convenient for those needing cash quickly.

Key Benefits of Payday Loans

- Quick Access to Funds: Receive money often within a day.

- Easy Application: Minimal paperwork is required.

- Flexible Use: Funds can be used for bills, groceries, or emergencies.

However, consider your financial situation. If you can repay the loan on time, it can be helpful. But if unsure, it might lead to more debt. Always weigh your options before deciding!

Are You Eligible for Payday Loans?

To qualify for payday loans Colorado online, you generally need to be at least 18 years old, have a steady income, and possess an active bank account. Meeting these criteria can streamline the application process.

Things to Consider Before Applying

Before applying, think about these factors:

- Interest Rates: They can be high, so know what you’ll owe.

- Repayment Terms: Understand when and how to repay the loan.

- Alternatives: Consider other options like personal loans or credit unions.

Final Thoughts

Payday loans Colorado online can be a quick fix for emergencies, but they come with risks. Assess your situation carefully. If you’re confident in your ability to repay, they might be the solution you need!

Common Misconceptions About Payday Loans in Colorado

Payday loans Colorado online are often misunderstood, leading to misconceptions that can hinder informed financial decisions. It’s essential to clarify these myths, especially since the application process is designed to be straightforward and accessible.

1. Payday Loans Are Always Bad

While payday loans can be risky, they also provide quick cash for emergencies. When used wisely, they can help bridge the gap until your next paycheck.

2. You Need Perfect Credit

Many think only those with excellent credit qualify. In reality, payday loans Colorado online often have flexible requirements, making them accessible to more borrowers.

3. They Are Only for the Desperate

Some believe payday loans are only for emergencies. However, many use them for planned expenses like car repairs, showing they can be practical financial tools when used responsibly.

4. High Fees Are Unavoidable

While payday loans may have higher fees than traditional loans, not all lenders charge the same. Shopping around can help find competitive rates.

5. You Can’t Pay Them Back

Many fear they can’t repay payday loans. However, with proper budgeting, borrowers can manage repayments effectively without falling into debt.

6. All States Have the Same Regulations

Payday loans by state differ significantly. Colorado has regulations that protect borrowers, including limits on fees and interest rates.

7. Applying is Complicated

Some think applying for payday loans Colorado online is lengthy. In fact, many lenders offer simple applications that can be completed quickly.

How ASAPPayday.com Simplifies Your Payday Loan Application Process

When unexpected expenses arise, knowing how to access payday loans Colorado online can be a lifesaver. Many people find themselves in a pinch, needing quick cash for bills or emergencies. Thankfully, with the right platform, the application process can be simple and stress-free.

Quick and Easy Application

At ASAPPayday.com, we understand that time is of the essence. Our online application for payday loans Colorado online is designed to be straightforward. You can complete it in just a few minutes from the comfort of your home. No long lines or complicated paperwork!

24/7 Access

Need help at midnight? No problem! Our online platform is available 24/7, allowing you to apply whenever it suits you. This flexibility means you can tackle your financial needs without the stress of traditional banking hours. Just fill out the form, and you’re on your way!

Fast Approval and Funding

Once you submit your application, our team works quickly to review it. Many applicants receive approval within hours, and funds can be deposited directly into your account as soon as the next business day. This speed is crucial when you need cash fast! In summary, ASAPPayday.com makes it easy to navigate the world of payday loans by state, especially in Colorado. With our user-friendly application process, you can focus on what matters most—getting back on track financially.

Tips for Responsible Borrowing with Payday Loans Colorado Online

When considering payday loans Colorado online, it’s essential to borrow responsibly. These loans can provide quick cash for emergencies, but they come with responsibilities. Understanding how to borrow wisely can help you avoid pitfalls and ensure a smoother financial journey.

Know Your Needs

Before applying, ask yourself if you truly need the loan. Ensure it’s for an unexpected expense, not just a want. This clarity aids in making better financial decisions.

Understand the Terms

Read the fine print! Payday loans by state have different terms and conditions. Knowing the interest rates and repayment schedules prepares you for what’s ahead, helping you avoid surprises later on.

Create a Repayment Plan

Plan how you will repay the loan. Ensure you have enough income to cover the payment when due. Setting aside a portion of your paycheck can help you avoid additional fees and stress.

Borrow Only What You Need

Resist the urge to borrow more than necessary. Only take out what you can comfortably repay, minimizing your financial burden and keeping your budget in check.

Seek Alternatives

Before opting for payday loans Colorado online, explore other options. Can you borrow from friends or family? Consider personal loans with lower interest rates to save money in the long run.

Stay Informed

Educate yourself about payday loans by state regulations. Each state has different rules, and knowing them helps you make informed choices and avoid potential debt traps.

FAQs

🏛️ Are payday loans legal in Colorado?

Yes, payday loans are legal in Colorado but regulated. The maximum loan amount is $500, and terms must be at least 6 months. The state caps fees and interest to protect borrowers.

💻 Can I get a payday loan online in Colorado?

Yes, many licensed lenders in Colorado offer online payday loans. You can apply from your phone or computer and get funded within 24 hours if approved.

📄 What do I need to qualify for an online payday loan in Colorado?

You’ll typically need a valid ID, proof of income (like a pay stub), a bank account, and be at least 18 years old with Colorado residency.

💳 Do online payday lenders in Colorado check credit?

Many online lenders do not require a traditional credit check. Instead, they focus on your income and ability to repay the loan.

⚠️ What should I watch out for with online payday loans in Colorado?

Watch for unlicensed lenders and always read the loan terms carefully. Even with legal limits, payday loans can be expensive if not repaid on time.

Quick Cash Before You Go with ASAPPayday!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.

Find a Payday Loan!

"*" indicates required fields