Payday Loans in NC: Online & In-Store Options

Understanding payday loans in NC is crucial for anyone facing unexpected expenses. These loans offer quick cash, but it’s important to know your options. You can choose between online applications or visiting a store, each with its own benefits.

Online vs. In-Store Payday Loans

When considering payday loans in NC, you have two main options:

- Convenience: Apply online anytime, anywhere.

- Speed: In-store loans often provide immediate cash after approval.

- Personal Interaction: In-store options allow for direct questions and instant feedback.

Important Considerations

Before applying, keep these points in mind:

- Interest Rates: Rates vary, so shop around.

- Repayment Terms: Know when and how to repay.

- State Regulations: Familiarize yourself with NC’s specific laws.

Pros and Cons of Payday Loans

Payday loans in NC can be beneficial but come with risks:

- Pros: Quick cash access and easy application.

- Cons: High-interest rates and short repayment periods can lead to stress.

How to Apply for a Payday Loan

Applying is straightforward:

- Choose Your Lender: Research options.

- Gather Documents: Proof of income and ID.

- Complete the Application: Fill out the form.

- Receive Your Funds: Get cash quickly after approval!

Alternatives to Payday Loans

If payday loans seem risky, consider alternatives:

- Credit Unions: Often offer lower rates.

- Personal Loans: Provide larger amounts with better terms.

- Payment Plans: Discuss flexible options with service providers.

Fast Approval with ASAPPayday – Start Here!

Online vs. In-Store Payday Loans in NC: Which is Right for You?

When you find yourself in a tight financial spot, payday loans in NC can be a quick solution. But did you know you have options? You can choose between online payday loans or visiting a store in person. Understanding these choices can help you make the best decision for your needs.

Convenience of Online Loans

Online payday loans in NC are super convenient. You can apply from the comfort of your home, anytime you want. Just fill out an application on your phone or computer, and you could get approved in minutes! Plus, you can compare different lenders easily, which is a big plus.

Benefits of In-Store Loans

On the other hand, in-store payday loans offer a personal touch. You can talk to someone face-to-face, which can be comforting. If you have questions, you can get immediate answers. Plus, you might walk out with cash in hand, which is great if you need money fast!

Making Your Choice

So, which option is right for you? Here are some things to consider:

- Speed: Online loans are usually faster to process.

- Personal Interaction: In-store loans give you a chance to speak with someone directly.

- Comfort Level: Think about whether you prefer online applications or face-to-face meetings.

Personalized Loan Options at ASAPPayday! – Apply Now!

The Application Process for Payday Loans in NC: A Step-by-Step Guide

When unexpected expenses arise, many people in North Carolina turn to payday loans for quick financial relief. Understanding the application process for payday loans in NC—whether online or in-store—can help you make informed decisions and avoid potential pitfalls. Let’s break it down step-by-step!

Step 1: Research Your Options

Before applying, explore different payday loans by state to find the best terms. Compare interest rates, fees, and repayment schedules from various lenders. This will help you choose the right option for your needs.

Step 2: Gather Required Documents

Most lenders will ask for some basic documents. Be prepared with:

- A valid ID (like a driver’s license)

- Proof of income (like pay stubs)

- A bank account statement

Having these ready can speed up your application process!

Step 3: Apply Online or In-Store

You can apply for payday loans in NC either online or in-store. Online applications are usually quicker and can be done from the comfort of your home. If you prefer face-to-face interaction, visit a local lender. Either way, fill out the application accurately to avoid delays.

Step 4: Review the Terms

Once approved, carefully review the loan terms. Look for the interest rate, repayment period, and any fees. Understanding these details is crucial to ensure you can manage the loan responsibly. Remember, payday loans can be a helpful tool when used wisely!

Also Read: Payday Loans by State: Online Options & Local Availability

Key Benefits of Choosing Payday Loans in NC: Quick Access to Cash

When unexpected expenses pop up, having quick access to cash can be a lifesaver. That’s where payday loans in NC come into play. Whether you need to cover a medical bill, fix your car, or pay for an emergency, these loans offer a fast solution. Plus, you can choose between online and in-store options, making it super convenient!

Fast Approval Process

One of the biggest advantages of payday loans in NC is the speedy approval process. Many lenders can approve your application within minutes, allowing you to get cash in hand quickly. This is especially helpful when you need money urgently.

Flexible Options

You can choose between online and in-store payday loans. Online applications are often straightforward and can be done from the comfort of your home. In-store options allow you to speak directly with a lender, which can be reassuring if you have questions.

No Credit Checks

Most payday loans don’t require a credit check, making them accessible to more people. This means even if you have a less-than-perfect credit score, you can still get the cash you need. It’s a great way to bridge the gap until your next paycheck! In summary, payday loans in NC provide quick access to cash with flexible options and minimal requirements. They can be a helpful tool when you find yourself in a financial pinch, ensuring you can tackle those unexpected expenses head-on.

Are Payday Loans in NC Safe? Debunking Common Myths

When it comes to managing finances, many people in North Carolina wonder about the safety of payday loans. With options available both online and in-store, it’s essential to understand the facts. Are payday loans in NC a reliable solution, or are they just a trap? Let’s debunk some common myths surrounding these loans.

Myth 1: All Payday Loans Are Dangerous

Many believe that all payday loans are predatory. While some lenders may charge high fees, not all payday loans in NC operate this way. It’s crucial to research and choose reputable lenders who follow state regulations. This way, you can ensure a safer borrowing experience.

Myth 2: You Can’t Trust Online Lenders

Another common misconception is that online payday loans are less trustworthy than in-store options. In reality, many online lenders are legitimate and regulated. Just like with in-store loans, always check reviews and verify the lender’s credentials before applying.

Key Takeaways:

- Research lenders thoroughly.

- Look for reviews and ratings.

- Understand the terms before borrowing.

By debunking these myths, you can make informed decisions about payday loans in NC, whether you choose to apply online or visit a store. Remember, knowledge is power!

How ASAPPayday.com Can Help You Navigate Payday Loans in NC

Navigating payday loans in NC can be overwhelming, but understanding your options is essential. At ASAPPayday.com, we simplify this process, helping you make informed financial decisions.

Understanding Your Options

You can apply for payday loans in NC either online or in-store, each with its benefits:

- Online Applications: Quick and convenient, allowing you to apply anytime.

- In-Store Applications: Get personal assistance from staff who can answer your questions directly.

Why Choose ASAPPayday.com?

We provide resources to help you understand payday loans by state, including:

- Clear Information: Learn about terms and conditions specific to NC.

- Comparison Tools: Easily compare lenders to find the best rates.

- Expert Advice: Access tips for managing your loan effectively.

The Application Process

Applying is straightforward. You’ll need basic information like income and ID, which helps lenders assess your eligibility quickly. Having your documents ready can speed up the process!

Repayment Plans

Most payday loans require repayment within a few weeks. At ASAPPayday.com, we stress the importance of knowing your repayment schedule to avoid extra fees. Always read the fine print!

Responsible Borrowing

Use payday loans wisely. Only borrow what you can afford to repay, and consider other options to avoid debt cycles.

Local Resources

ASAPPayday.com also connects you with local resources in NC for financial counseling and budgeting assistance, making a significant difference in your financial journey!

Alternatives to Payday Loans in NC: Exploring Your Options

When facing unexpected expenses, many people in North Carolina consider payday loans. These loans offer quick cash but come with high interest rates and fees. Thankfully, there are alternatives to payday loans in NC that can help you manage your finances without falling into a debt trap.

Credit Unions and Community Banks

Local credit unions and community banks often provide small personal loans with lower interest rates. They focus on helping their members, making them a great option for those in need. Plus, they usually have flexible repayment plans that can ease your financial burden.

Installment Loans

Unlike payday loans, installment loans allow you to pay back the borrowed amount in smaller, manageable chunks over time. This can make it easier to budget your payments and avoid the stress of a lump-sum repayment.

Borrowing from Friends or Family

Sometimes, the best option is right in front of you. Asking friends or family for a loan can save you from high-interest rates. Just be sure to discuss repayment terms to keep relationships strong.

Budgeting and Financial Counseling

Before taking any loan, consider budgeting your expenses. Financial counseling services can help you create a plan to manage your money better, reducing the need for payday loans in NC.

FAQs

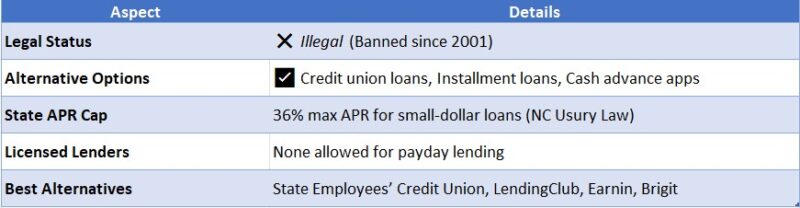

⚖️ Are payday loans legal in North Carolina?

No, payday loans are not legal in North Carolina. The state banned payday lending in 2001 and enforces a 36% APR interest rate cap to protect consumers from predatory practices.

🌐 Can I still get an online payday loan in North Carolina?

While some online lenders may offer payday loans to NC residents, they often operate illegally. The North Carolina Attorney General advises against using these lenders, as they may not comply with state consumer protection laws.

🏦 What are legal alternatives to payday loans in NC?

Safer options include:

-

Credit union Payday Alternative Loans (PALs)

-

Personal loans from banks or online lenders with proper licenses

-

Payment plans from utility companies or creditors

🧾 Why were payday loans banned in NC?

They were banned due to high fees, aggressive collection tactics, and repeat borrowing traps. Lawmakers decided that the risks outweighed any short-term benefits, and enacted laws to prevent financial exploitation.

🔍 How can I find a safe loan option in NC?

Look for:

-

Licensed credit unions or banks

-

Lenders offering transparent APRs and repayment terms

-

Programs from local nonprofits or churches that provide emergency assistance

Quick Cash Before You Go with ASAPPayday!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.

Find a Payday Loan!

"*" indicates required fields