Are There Payday Loans for Gig Workers and Freelancers?

Understanding payday loans for gig workers and freelancers is crucial in today’s economy. Many people are turning to gig work and freelancing for flexibility and independence. However, this often comes with unpredictable income, making financial stability a challenge. So, can gig workers and freelancers access payday loans? Let’s find out!

What Are Payday Loans?

Payday loans are short-term loans designed to help people cover urgent expenses until their next paycheck. They are typically easy to obtain, but they come with high interest rates. For gig workers and freelancers, these loans can be a quick solution during lean times.

Are They Available for Gig Workers?

Yes, payday loans for gig workers and freelancers do exist! Many lenders understand the unique financial situations of these workers. Here are some key points to consider:

- Flexible Income Verification: Lenders may accept alternative income sources like freelance contracts.

- Quick Approval: The application process is often fast, allowing you to access funds quickly.

- Consider Your Needs: Make sure to assess if a payday loan is the best option for your situation.

In conclusion, payday loans for specific groups, including gig workers and freelancers, can provide much-needed financial relief. However, it’s essential to weigh the pros and cons before diving in. Always explore other options and choose what’s best for your financial health!

Fast Approval with ASAPPayday – Start Here!

Are Payday Loans a Viable Option for Freelancers?

Freelancers and gig workers often face unpredictable income, making financial planning tricky. This uncertainty raises the question: Are payday loans a viable option for freelancers? Understanding this can help you make informed decisions when cash flow gets tight.

Payday loans for gig workers and freelancers can be tempting, especially when bills are due. However, they come with high-interest rates and short repayment terms. Before diving in, consider these important points:

Key Considerations:

- High Costs: Payday loans often have fees that can add up quickly. If you’re not careful, you might end up in a cycle of debt.

- Quick Access: They provide fast cash, which can be helpful in emergencies. Just ensure you have a plan to pay it back.

- Credit Impact: Missing payments can hurt your credit score, making future borrowing harder.

In conclusion, while payday loans for specific groups like freelancers can offer quick relief, they should be approached with caution. Always explore other options, like personal loans or credit unions, which might be more affordable in the long run.

Alternatives to Consider:

- Personal Loans: These often have lower interest rates and longer repayment terms, making them a safer choice.

- Credit Unions: They may offer special loans for gig workers with better terms than payday loans.

- Emergency Funds: Building a savings cushion can help avoid the need for loans altogether.

In summary, while payday loans can provide quick cash for freelancers, it’s crucial to weigh the risks and explore better alternatives.

Personalized Loan Options at ASAPPayday! – Apply Now!

The Unique Financial Challenges Faced by Gig Workers

Gig workers and freelancers often face unique financial challenges that traditional employees might not understand. With fluctuating incomes and irregular pay schedules, it can be tough to manage expenses. This raises the question: Are there payday loans for gig workers and freelancers? Knowing the answer can help these workers navigate their financial needs more effectively.

Gig workers often juggle multiple jobs, leading to inconsistent income. This unpredictability can make budgeting a nightmare. Here are some common challenges they face:

- Irregular Income: Payments can vary greatly from week to week.

- Delayed Payments: Clients may take time to pay invoices, leaving workers in a tight spot.

- Lack of Benefits: Unlike traditional jobs, gig work often doesn’t come with health insurance or retirement plans.

Fortunately, payday loans for gig workers and freelancers can provide a quick financial solution. These loans are designed to help those with non-traditional income sources. However, it’s essential to consider the terms carefully. Here are some benefits of payday loans for specific groups:

- Quick Access to Cash: Funds can be available within a day.

- Flexible Requirements: Many lenders understand the gig economy and adjust their criteria accordingly.

- Short-Term Relief: Ideal for covering unexpected expenses until the next paycheck arrives.

How to Qualify for Payday Loans as a Freelancer

As a freelancer or gig worker, you might wonder if payday loans are available for your unique situation. Understanding this can be crucial, especially when unexpected expenses arise. Many freelancers face irregular income, making it challenging to secure traditional loans. So, are there payday loans for gig workers and freelancers? Let’s explore how you can qualify for these loans and what you need to know.

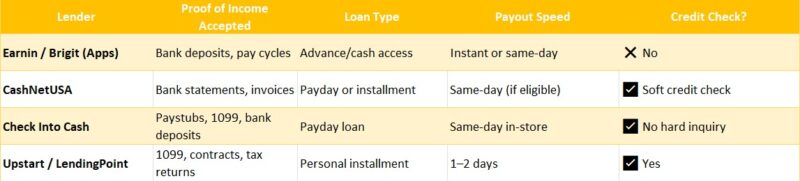

To qualify for payday loans as a freelancer, lenders typically look for a few key factors. First, you need to demonstrate a steady income, even if it fluctuates. Here are some essential points to consider:

- Proof of Income: Provide bank statements or invoices showing your earnings.

- Employment Status: Some lenders may require you to have been freelancing for a certain period.

- Credit Score: While payday loans often have lenient credit requirements, a better score can improve your chances.

Additionally, payday loans for gig workers and freelancers can be a lifeline during tough times. However, it’s essential to borrow responsibly.

Here are some benefits and tips:

- Quick Access to Cash: These loans are designed for fast approval, helping you cover urgent expenses.

- Flexible Amounts: You can often borrow smaller amounts, which is ideal for freelancers with varying needs.

- Research Lenders: Not all lenders cater to freelancers, so look for those who specialize in payday loans for specific groups. This can increase your chances of approval and ensure you get the best terms.

Exploring Alternatives to Payday Loans for Gig Workers

Gig workers and freelancers often face unique financial challenges. With irregular income and fluctuating workloads, they may find themselves in need of quick cash. This raises the question: Are there payday loans for gig workers and freelancers? Understanding the options available can help these workers make informed financial decisions.

When traditional payday loans may not be the best fit, gig workers can explore several alternatives. Here are some options to consider:

Personal Loans

- Flexible Terms: Unlike payday loans, personal loans often have longer repayment periods and lower interest rates.

- Credit Score Impact: These loans can help build credit if repaid on time, which is beneficial for future financial needs.

Peer-to-Peer Lending

- Community Support: Platforms connect borrowers with individual lenders, often with more favorable terms than payday loans.

- Quick Access: Funds can be available quickly, making it a viable option for urgent needs.

Credit Unions

- Lower Rates: Many credit unions offer small loans with lower interest rates compared to payday lenders.

- Member Benefits: Being a member can provide access to financial education and support, helping gig workers manage their finances better.

The Role of ASAPPayDay.com in Supporting Gig Workers with Financial Solutions

Gig workers and freelancers play a vital role in today’s economy, but they often face unique financial challenges. Many of them have irregular income, making it tough to manage expenses. This raises the question: Are there payday loans for gig workers and freelancers? Understanding this can help them find the financial support they need during tough times.

At ASAPPayDay.com, we recognize the struggles of gig workers. That’s why we offer payday loans tailored specifically for them. These loans are designed to provide quick cash when unexpected expenses arise, ensuring that freelancers can focus on their work without financial stress.

Why Choose Payday Loans for Gig Workers?

- Quick Access to Funds: Gig workers often need money fast, and payday loans can provide that.

- Flexible Terms: These loans can be adjusted to fit the unique income patterns of freelancers.

- No Need for Traditional Employment Proof: Unlike traditional loans, gig workers don’t need to show a steady paycheck to qualify.

By offering payday loans for gig workers and freelancers, ASAPPayDay.com ensures that financial solutions are accessible to everyone, regardless of their employment status. This support can make a significant difference in managing day-to-day expenses and achieving financial stability.

Tips for Responsible Borrowing: Making Payday Loans Work for You

When it comes to managing finances, gig workers and freelancers often face unique challenges. Many of them have irregular income, making it tough to predict when they’ll have cash flow. This is where payday loans for gig workers and freelancers can come into play. But before diving in, it’s essential to understand how to use these loans responsibly.

Understand Your Needs

Before applying for a payday loan, ask yourself if it’s truly necessary. Are you facing an unexpected expense? If so, a payday loan might help bridge the gap until your next paycheck. However, always consider other options first, like savings or borrowing from friends.

Know the Terms

Payday loans for specific groups, including gig workers, often come with high-interest rates. Make sure to read the fine print. Understand how much you’ll owe and when. This knowledge will help you avoid falling into a cycle of debt, which can be hard to escape.

Create a Repayment Plan

Once you secure a payday loan, plan how you’ll repay it. Set aside a portion of your income to ensure you can pay it back on time. This strategy will help you maintain your financial health and avoid additional fees. Remember, responsible borrowing is key to making payday loans work for you.

FAQs

🧾 Can gig workers or freelancers get payday loans?

Yes! Many payday lenders accept applications from self-employed individuals, including freelancers, contractors, and gig workers. Instead of a pay stub, you’ll typically need to show proof of consistent income.

📱 What proof of income is needed if I’m a freelancer?

You can provide:

-

Bank statements showing deposits

-

Invoices or 1099 forms

-

Payment screenshots from platforms like Uber, DoorDash, Fiverr, etc.

Lenders mainly want to see that you regularly earn money.

📉 Will my fluctuating income affect my loan approval?

It can. If your income varies a lot, some lenders may offer a smaller loan amount or shorter term. Others may require you to show 3–6 months of consistent earnings to qualify.

💼 Are payday loans the best option for gig workers?

They can be a quick fix for emergencies, but because of high fees, it’s smart to compare them with installment loans or credit union alternatives if available.

⚠️ What should freelancers watch out for with payday loans?

Watch for:

-

High interest rates

-

Tight repayment schedules

-

Lenders not transparent about fees

Always choose a licensed lender and borrow only what you can comfortably repay.

Quick Cash Before You Go with ASAPPayday!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.

Find a Payday Loan!

"*" indicates required fields